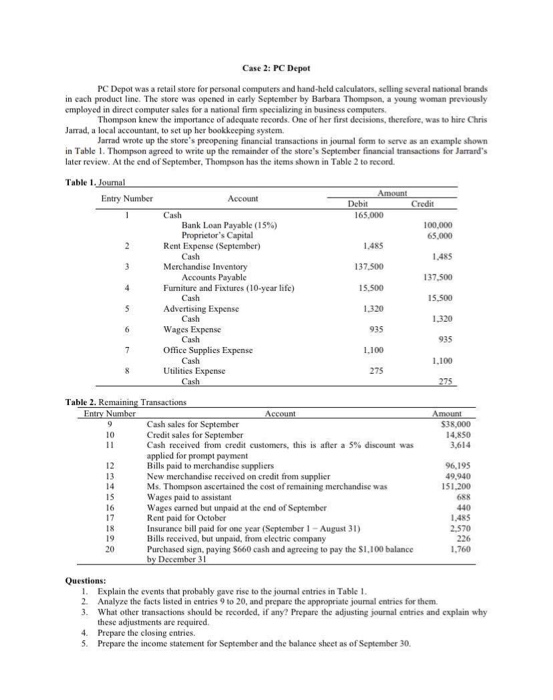

Case 2: PC Depot PC Depot was a retail store for personal computers and hand-held calculatoes, selling several national brands in each product line. The store was opened in carly September by Barbara Thompson, a young woman previously employed in direct computer sales for a national firm specializing in business computers Thompson know the importance of adequate records. One of her first decisions, therefore, was to hire Chris Jarrad, a local accountant, to set up her bookkeeping system Jarrad wrote up the store's preopening financial transactions in journal form o r an ample shown in Table 1. Thompson agreed to write up the remainder of the store's September financial transactions for Jarand's later review. At the end of September, Thompson has the items shown in Table 2 to record Table 1. Journal Entry Number Account Cash Bank Loan Payable (15%) Proprietor's Capital Rent Expense (September) Amunt Debit Credit 165.000 100,000 65,000 14RS 1.45 137.500 137.500 15.500 15.500 Merchandise Inventory Accounts Payable Furniture and Fixtures (10-year life) Cash Advertising Expense Cash Wages Expense Cash Office Supplies Expense 1,320 935 935 Utilities Expense Cash 275 1.100 275 Amount SIK 000 14.50 1614 Table 2. Remaining Transactions Entry Number Cash sales for September Credit sales for September Cash received from credit customers, this is after a 5% discount was applied for prompt payment Bills paid to merchandise suppliers New merchandise received on credit from supplier Ms. Thompson ascertained the cost of remaining merchandise was Wapes paid to assistant Wages carned but unpaid at the end of September Rent paid for October Insurance bill paid for one year (September 1 - August 31) Bills received, but unpaid, from electric company Purchased sign, paying $660 cash and agreeing to pay the 51.100 balance by December 31 96.195 49.900 151 200 63 440 1.45 22520 226 1.760 Questions: 1 Explain the events that probably gave rise to the journal entries in Table 1 2. Analyze the facts listed in entries 9 to 20, and prepare the appropriate joumal entries for them 3. What other transactions should be recorded, if any? Prepare the adjusting journal entries and explain why these adjustments are required 4. Prepare the closing entries. 5. Prepare the income statement for September and the balance sheet as of September 30