Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 7 The accounting record of Sterling Corp. which was organized in 2020 includes only one account for all intangible assets. The following is

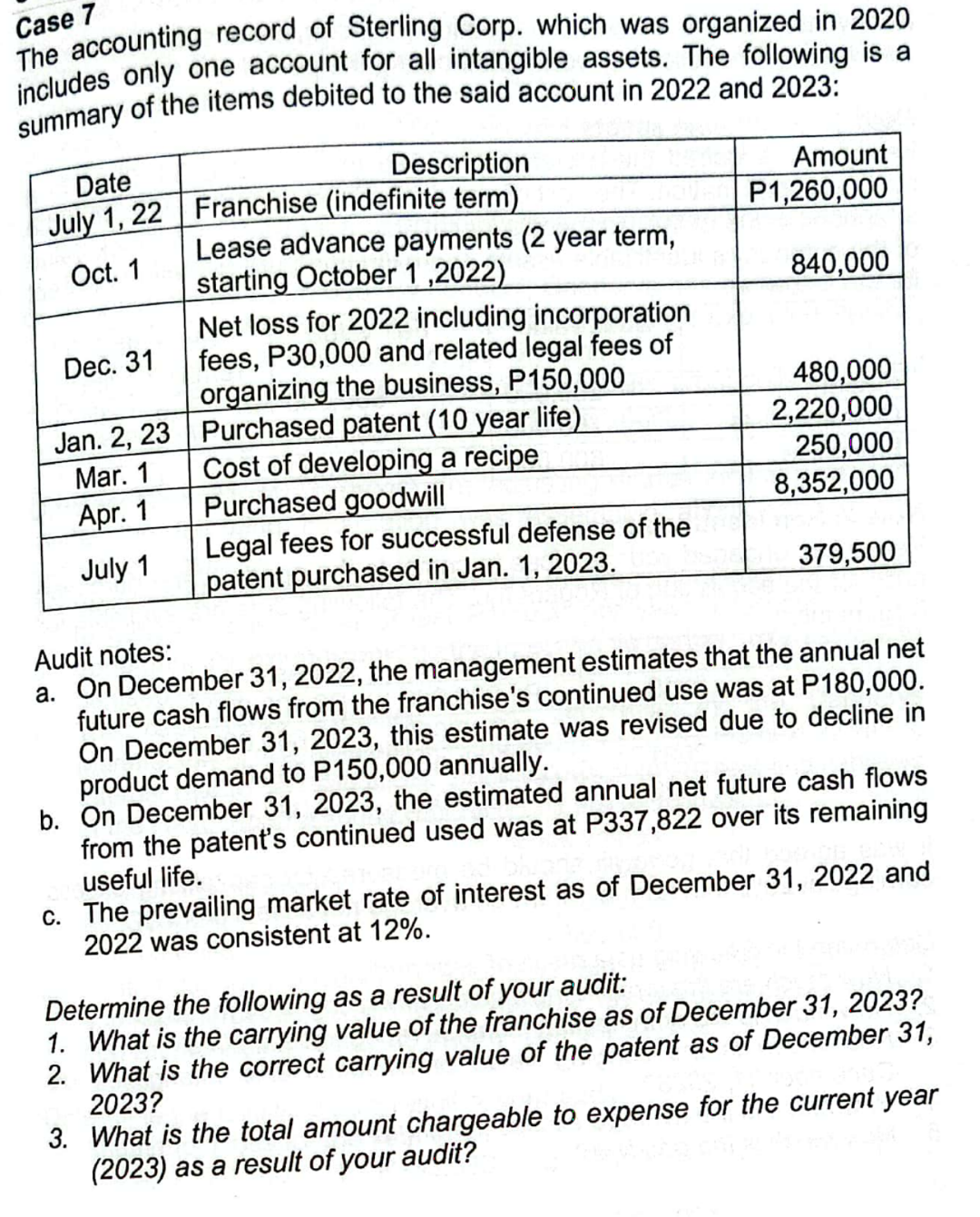

Case 7 The accounting record of Sterling Corp. which was organized in 2020 includes only one account for all intangible assets. The following is a summary of the items debited to the said account in 2022 and 2023: Date Description July 1, 22 Franchise (indefinite term) Oct. 1 Lease advance payments (2 year term, starting October 1,2022) Amount P1,260,000 840,000 Dec. 31 Net loss for 2022 including incorporation fees, P30,000 and related legal fees of organizing the business, P150,000 480,000 Jan. 2, 23 Purchased patent (10 year life) 2,220,000 Mar. 1 Cost of developing a recipe 250,000 Apr. 1 Purchased goodwill 8,352,000 July 1 Legal fees for successful defense of the patent purchased in Jan. 1, 2023. 379,500 Audit notes: a. On December 31, 2022, the management estimates that the annual net future cash flows from the franchise's continued use was at P180,000. On December 31, 2023, this estimate was revised due to decline in product demand to P150,000 annually. b. On December 31, 2023, the estimated annual net future cash flows from the patent's continued used was at P337,822 over its remaining useful life. c. The prevailing market rate of interest as of December 31, 2022 and 2022 was consistent at 12%. Determine the following as a result of your audit: 1. What is the carrying value of the franchise as of December 31, 2023? 2. What is the correct carrying value of the patent as of December 31, 2023? 3. What is the total amount chargeable to expense for the current year (2023) as a result of your audit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 of 3 Here is the solution to this question To determine the carrying values and the total amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started