Question

Case Study: Smoothing and Compensating Losses in Investments Returns IFIs are exposed to the rate of return risk in the context of their overall statement

Case Study: Smoothing and Compensating Losses in Investments Returns

IFIs are exposed to the rate of return risk in the context of their overall statement of financial position exposures. An increase in benchmark rates may result in Investment Accounts Holders (IAHs) having expectations of a higher rate of return. The rate of return risk differs from the interest rate risk in that the Islamic Financial Institutions (IFIs) are concerned with the result of their investment activities as this cannot be precisely pre-determined before the end of the investment period.

A consequence of the rate of return risk is the displaced commercial risk, which derives from competitive pressures on IFIs to attract and retain investors (that is, the fund providers). The IFls can be under market pressure to pay a return that exceeds the actual return earned from assets financed by IAHs, especially when the assets are under-performing as compared to the assets of the competitors. In such a case, the IFls may decide to partly or entirely waive their rights over their share of the profit as mudarib in order to satisfy and retain the fund providers, namely, the IAHs, and dissuade them from withdrawing their funds. The decision of an IFI to waive their rights over their profit share in favour of the IAHs is a commercial decision, the basis of which needs to be dictated by clear and well-defined policies and procedures approved by the Shariah supervisory board and the board of directors of the respective IFIs.

Maintaining a PER is another technique used by the IFIs for smoothing and compensating losses in investment returns. According to the AAOIFI Financial Accounting Standard No. 11, the PER is the amount appropriated by the IFIs out of the mudarabah income, before allocating the mudaribs share, in order to maintain a certain level of return on investment for the IAHs and to avoid deflating the owners equity.

The basis for computing the amounts to be appropriated should be pre-defined and applied in accordance with the contractual conditions accepted by the IAHs, and after a formal review and approval by the Shariah supervisory board and board of directors of the IFls. In certain jurisdictions, the central supervisory or regulatory authority lays down the requirements relating to maintenance of the PER.

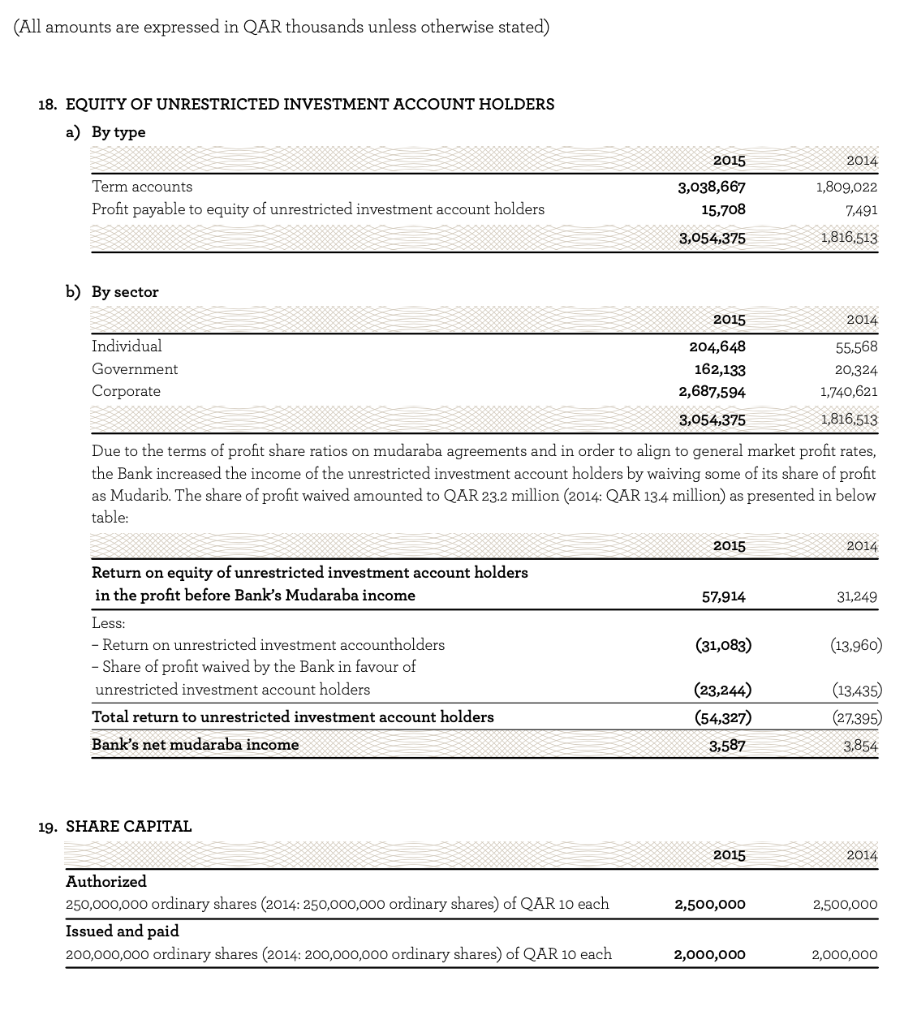

In 2015 Qatar First Bank waived some of its share of profit as Mudarib to increase the income of its unrestricted investment account holders (IAH) clients and align the return with the general market profit rates.

Supposing that all the IAH are one Rab al Mal and Using its 2015 QFB Annual Report | 20 - Equity of Unrestricted Investment Accounts Holders, p. 55

- Compute the original profit-sharing ratio (before QFB waived its share).

- Find how much of its share in profit (in percent) QFB waived from its profit in favor of its investment Account Holders.

- Find the new profit-sharing ratio after QFB waived some of its shares.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started