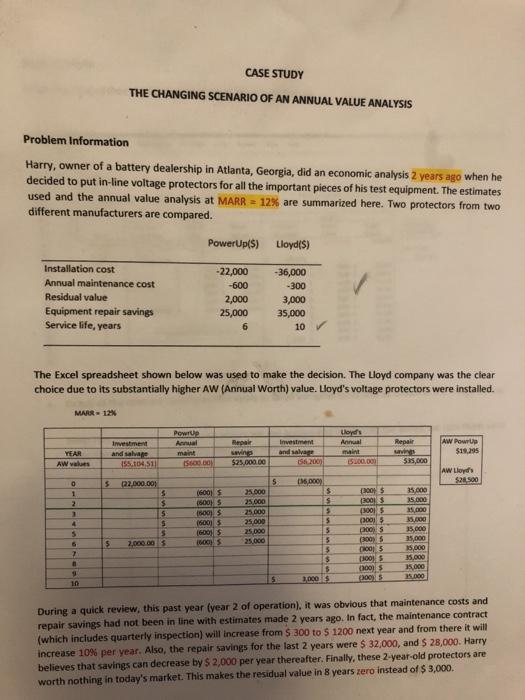

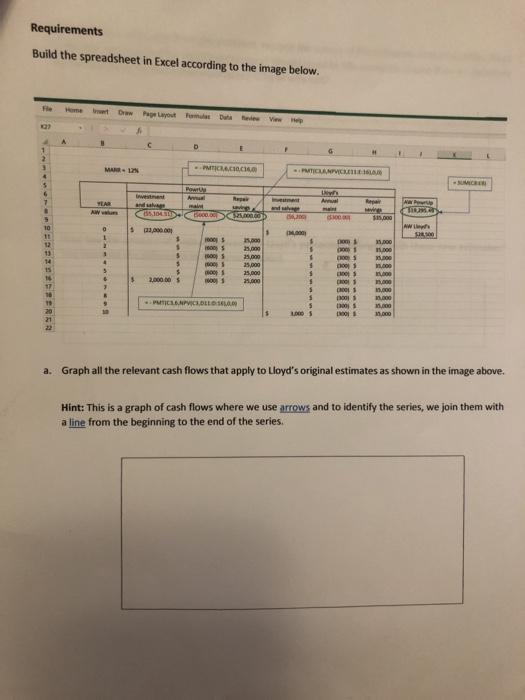

CASE STUDY THE CHANGING SCENARIO OF AN ANNUAL VALUE ANALYSIS Problem Information Harry, owner of a battery dealership in Atlanta, Georgia, did an economic analysis 2 years ago when he decided to put in-line voltage protectors for all the important pieces of his test equipment. The estimates used and the annual value analysis at MARR = 12% are summarized here. Two protectors from two different manufacturers are compared. PowerUp(s) Lloyd(s) Installation cost Annual maintenance cost Residual value Equipment repair savings Service life, years -22,000 -600 2,000 25,000 6 - 36,000 -300 3,000 35,000 10 The Excel spreadsheet shown below was used to make the decision. The Lloyd company was the clear choice due to its substantially higher AW (Annual Worth) value. Lloyd's voltage protectors were installed. MARR - 12% Powrup Repair Repair Lloyd Annual maint 5.100.000 Investment and salvar 1.104511 AW PowUp $19.95 YEAR AW values Investment and sale 156 2009 maint 15.600.00 $25,000.00 $35,000 AW Lloyd $2.500 5 5 35.000 0 1 2 3 4 5 22.000.00) 5 $ 5 S 5 2.000.00 (600) 5 500 5 00015 16001 ( 60) 100 25.000 25.000 25.000 25.000 25.000 25.000 16.DOO $ S $ $ 5 5 5 $ $ 3.000 1300 (3001 (300 (30015 OS 3001 003 100 5 (2001 2005 15.000 35.000 25,000 25,000 5 2 9 in 35.000 1.000 During a quick review, this past year (year 2 of operation), it was obvious that maintenance costs and repair savings had not been in line with estimates made 2 years ago. In fact, the maintenance contract (which includes quarterly inspection) will increase from $ 300 to $ 1200 next year and from there it will increase 10% per year. Also, the repair savings for the last 2 years were $ 32,000, and $ 28,000. Harry believes that savings can decrease by $ 2,000 per year thereafter. Finally, these 2-year-old protectors are worth nothing in today's market. This makes the residual value in 8 years zero instead of $3,000. Requirements Build the spreadsheet in Excel according to the image below. 02 V D 1 2 MARUN MICHACCIA PMTICLANCE 5 -NUR A A YEAR AWW wetent an 104 unde E. CH BMC 115.000 0 5 01.03 AW IMO Sloool Soos loosi $ 1 . 25,000 35.000 25.000 25,000 21.000 100 3.000 . he os loom 3 2,000.00 $ $ food 1.00 11.00 1.200 11.000 .. PICS DELS food ERS LOS a. Graph all the relevant cash flows that apply to Lloyd's original estimates as shown in the image above. Hint: This is a graph of cash flows where we use arrows and to identify the series, we join them with a line from the beginning to the end of the series. b. With the new estimates from the problem, replace the values of the estimates in the Excel file. What is the AW recalculated for Lloyd's protectors? Would Lloyd be the economic choice if we let ourselves be carried away by these new estimates? Why or why not? C. How has the amount of capital recovery for Lloyd's protectors changed with these new estimates? You must set the difference in AW (annual value). CASE STUDY THE CHANGING SCENARIO OF AN ANNUAL VALUE ANALYSIS Problem Information Harry, owner of a battery dealership in Atlanta, Georgia, did an economic analysis 2 years ago when he decided to put in-line voltage protectors for all the important pieces of his test equipment. The estimates used and the annual value analysis at MARR = 12% are summarized here. Two protectors from two different manufacturers are compared. PowerUp(s) Lloyd(s) Installation cost Annual maintenance cost Residual value Equipment repair savings Service life, years -22,000 -600 2,000 25,000 6 - 36,000 -300 3,000 35,000 10 The Excel spreadsheet shown below was used to make the decision. The Lloyd company was the clear choice due to its substantially higher AW (Annual Worth) value. Lloyd's voltage protectors were installed. MARR - 12% Powrup Repair Repair Lloyd Annual maint 5.100.000 Investment and salvar 1.104511 AW PowUp $19.95 YEAR AW values Investment and sale 156 2009 maint 15.600.00 $25,000.00 $35,000 AW Lloyd $2.500 5 5 35.000 0 1 2 3 4 5 22.000.00) 5 $ 5 S 5 2.000.00 (600) 5 500 5 00015 16001 ( 60) 100 25.000 25.000 25.000 25.000 25.000 25.000 16.DOO $ S $ $ 5 5 5 $ $ 3.000 1300 (3001 (300 (30015 OS 3001 003 100 5 (2001 2005 15.000 35.000 25,000 25,000 5 2 9 in 35.000 1.000 During a quick review, this past year (year 2 of operation), it was obvious that maintenance costs and repair savings had not been in line with estimates made 2 years ago. In fact, the maintenance contract (which includes quarterly inspection) will increase from $ 300 to $ 1200 next year and from there it will increase 10% per year. Also, the repair savings for the last 2 years were $ 32,000, and $ 28,000. Harry believes that savings can decrease by $ 2,000 per year thereafter. Finally, these 2-year-old protectors are worth nothing in today's market. This makes the residual value in 8 years zero instead of $3,000. Requirements Build the spreadsheet in Excel according to the image below. 02 V D 1 2 MARUN MICHACCIA PMTICLANCE 5 -NUR A A YEAR AWW wetent an 104 unde E. CH BMC 115.000 0 5 01.03 AW IMO Sloool Soos loosi $ 1 . 25,000 35.000 25.000 25,000 21.000 100 3.000 . he os loom 3 2,000.00 $ $ food 1.00 11.00 1.200 11.000 .. PICS DELS food ERS LOS a. Graph all the relevant cash flows that apply to Lloyd's original estimates as shown in the image above. Hint: This is a graph of cash flows where we use arrows and to identify the series, we join them with a line from the beginning to the end of the series. b. With the new estimates from the problem, replace the values of the estimates in the Excel file. What is the AW recalculated for Lloyd's protectors? Would Lloyd be the economic choice if we let ourselves be carried away by these new estimates? Why or why not? C. How has the amount of capital recovery for Lloyd's protectors changed with these new estimates? You must set the difference in AW (annual value)