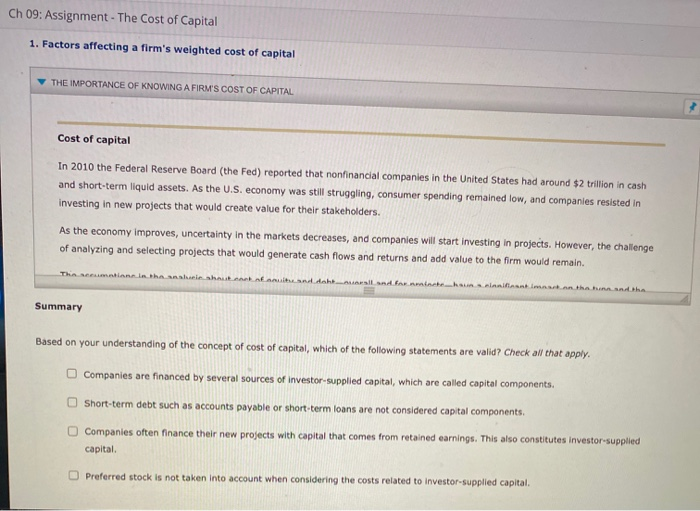

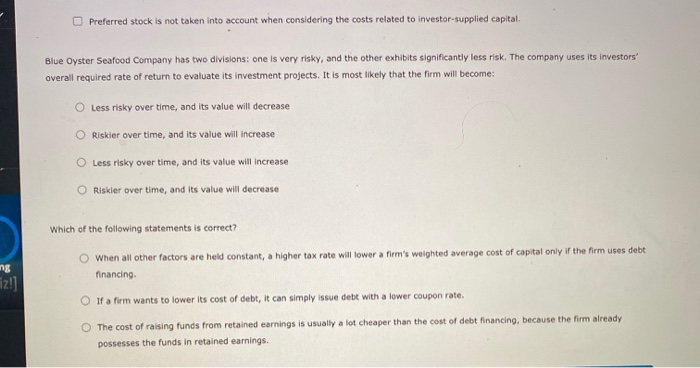

Ch 09: Assignment - The Cost of Capital 1. Factors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cost of capital In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S. economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders. As the economy improves, uncertainty in the markets decreases, and companies will start investing in projects. However, the challenge of analyzing and selecting projects that would generate cash flows and returns and add value to the firm would remain. The mannlatha au hautakuntdohtarsi and farminchulanifiant mean the hand the Summary Based on your understanding of the concept of cost of capital, which of the following statements are valid? Check all that apply. Companies are financed by several sources of investor-supplied capital, which are called capital components. Short-term debt such as accounts payable or short-term loans are not considered capital components O Companies often finance their new projects with capital that comes from retained earnings. This also constitutes investor supplied capital Preferred stock is not taken into account when considering the costs related to investor-supplied capital Preferred stock is not taken into account when considering the costs related to investor-supplied capital. Blue Oyster Seafood Company has two divisions: one is very risky, and the other exhibits significantly less risk. The company uses its investors' overall required rate of return to evaluate its investment projects. It is most likely that the firm will become: Less risky over time, and its value will decrease Riskier over time, and its value will increase Less risky over time, and its value will increase Riskler over time, and its value will decrease Which of the following statements is correct? ng When all other factors are held constant, a higher tax rate will lower a firm's weighted average cost of capital only if the firm uses debt financing iz!] O if a firm wants to lower its cost of debt, it can simply issue debt with a lower coupon rate. The cost of raising funds from retained earnings is usually a lot cheaper than the cost of debt financing, because the firm already possesses the funds in retained earnings