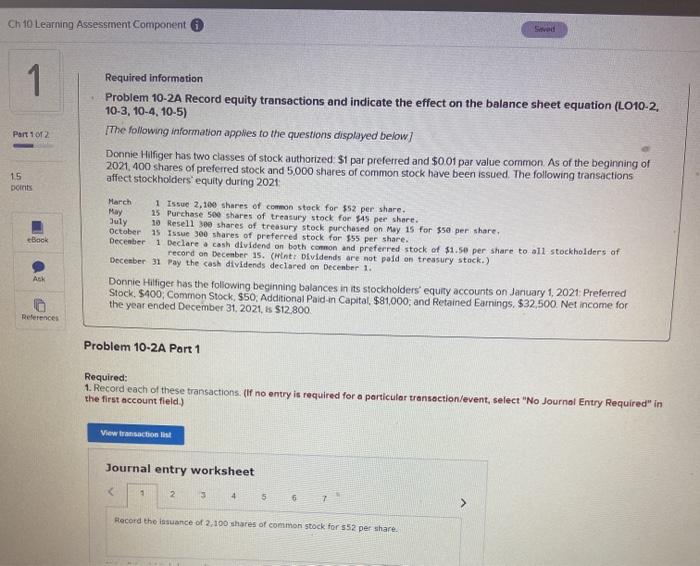

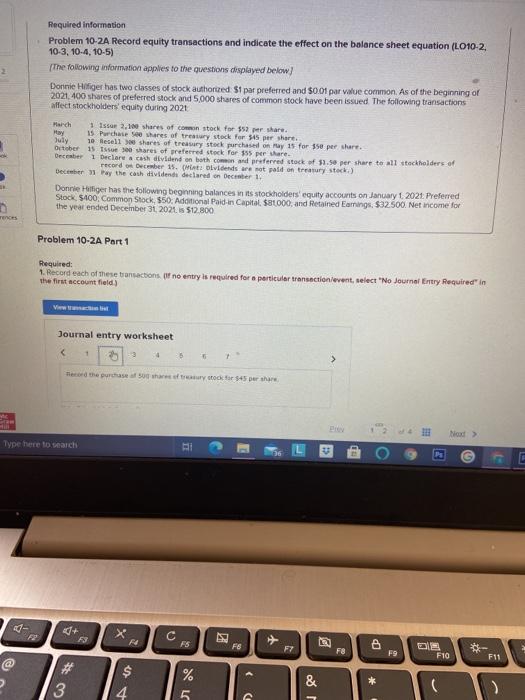

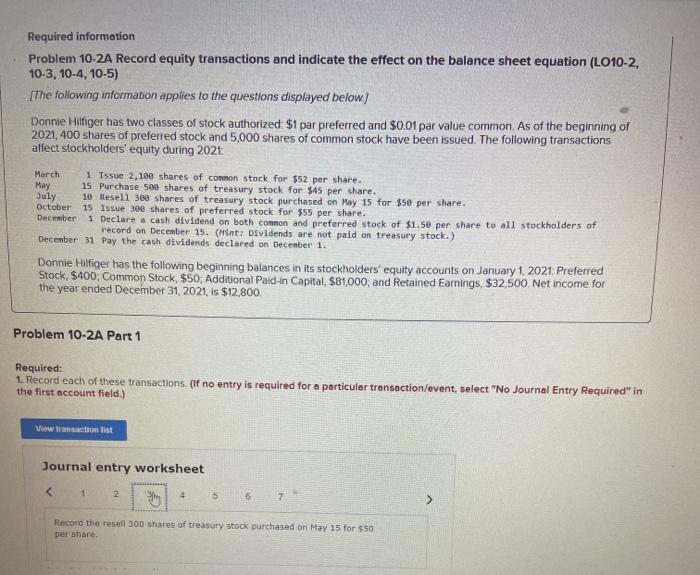

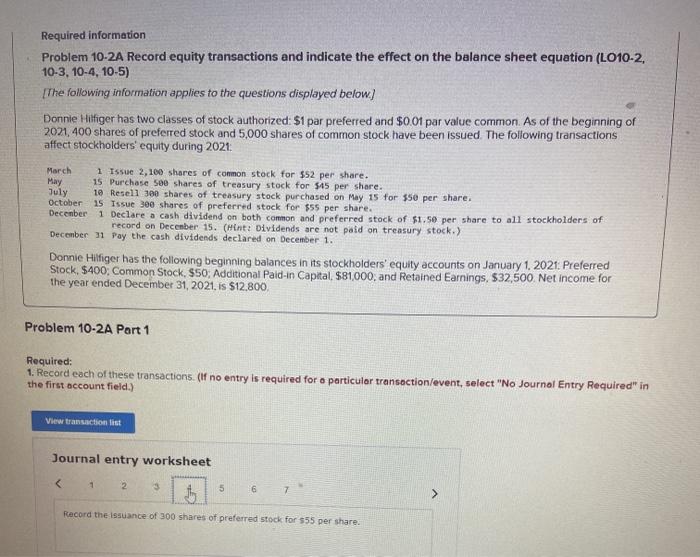

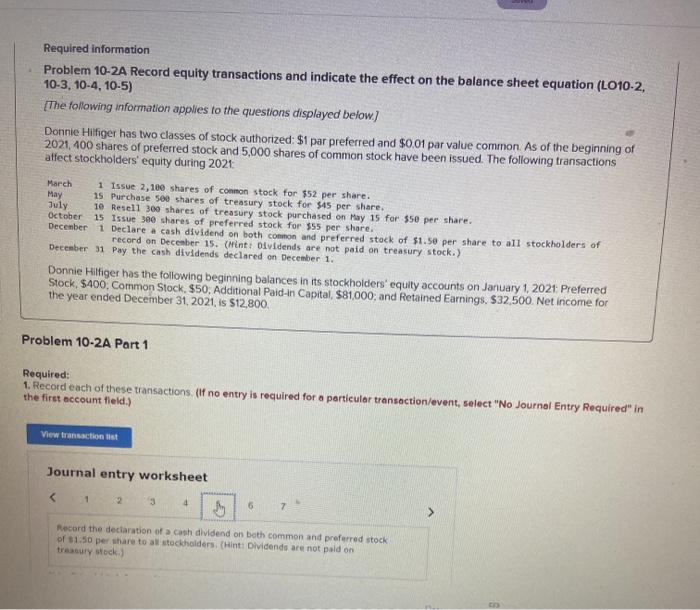

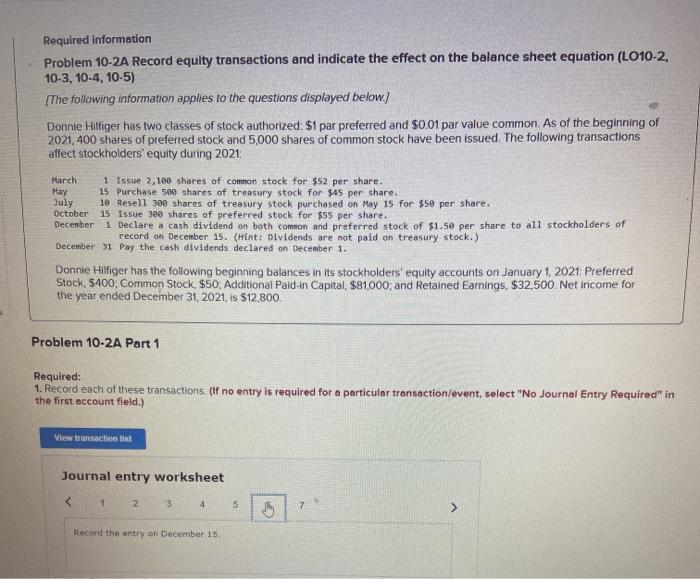

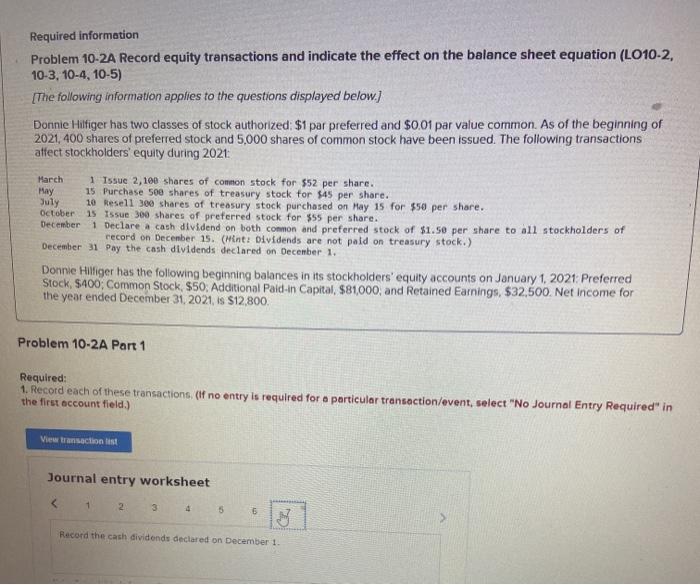

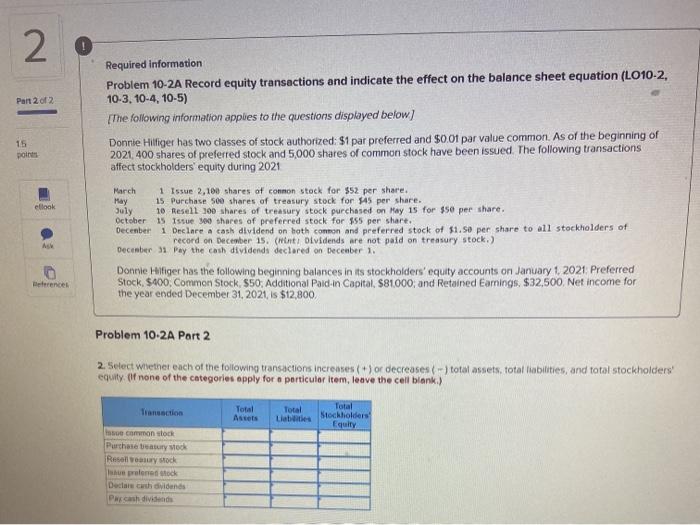

Ch 10 Learning Assessment Component Seved 1 1 Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (L010-2 10-3, 10-4, 10-5) The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized $1 par preferred and $001 par value common As of the beginning of 2021 400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 Part 1 of 2 1.5 points Back March 1 Issue 2,100 shares of common stock for $52 per share. May 15 Purchase 500 shares of treasury stock for $45 per share. July 10 Resell 300 shares of treasury stock purchased on May 15 for $50 per share. October 15 Issue 300 shares of preferred stock for $55 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.50 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021 Preferred Stock $400, Common Stock $50, Additional Paid in Capital, $81,000; and Retained Earnings. $32,500. Net income for the year ended December 31, 2021, is $12.800 AK References Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field) View transactions Journal entry worksheet 3 2 34 5 6 > Record the issuance of 2.100 shares of common stock for 552 per share. Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (L010-2. 10-3, 10-4, 10-5) The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized S1 par preferred and $0.01 par value common. As of the beginning of 2021.400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 2.100 shares of common stock for $52 per share. Hay 15 Purchase shares of treasury stock for 545 per shart. 10 Beseli se shares of treury stock purchased on May 15 for 350 per shart. October 15 to 300 shares of preferred stock for 55 per here December 1 Declare a cash dividend on both common and preferred stack of 33.50 per share to all stockholders of record on December 15. ( Dividends are not paid on tratury stock) Becher 3 Pay the cash dividends declared on December 1 Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1 2021 Preferred Stock 5400. Common Stock 550. Additional Paid in Capital $1000, and Retained Earnings $32.500. Net income for the year ended December 31, 2021 512.800 Problem 10-2A Part 1 Required: 1. Record each of these transactions. If no entry is required for a particular transaction event, select "No Journal Entry Required in the first account field) View all Journal entry worksheet + 25 3 5 > er the purchase orary rock for $45 per share No > Type here to search i P Ps + F X F + FS F8 FY BB F8 F9 F10 @ F11 $ > % 5 & * 3 CC Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) [The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized $1 par preferred and $0.01 par value common As of the beginning of 2021,400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 2,100 shares of common stock for $52 per share. May 15 Purchase 500 shares of treasury stock for $45 per share. July 10 Resell 300 shares of treasury stock purchased on May 15 for $58 per share. October 15 Issue 300 shares of preferred stock for $55 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.5e per share to all stockholders of record on Decembe 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021. Preferred Stock, $400, Common Stock $50; Additional Paid-in Capital, $81,000, and Retained Earnings, $32,500 Net income for the year ended December 31, 2021, is $12,800 Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the resell 300 shares of treasury stock purchased on May 15 for 350 per share. Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (L010-2, 10-3, 10-4, 10-5) The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021,400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 2,100 shares of common stock for $52 per share. May 15 Purchase 500 shares of treasury stock for $45 per share. July 10 Resell 300 shares of treasury stock purchased on May 15 for $50 per share. October 15 Issue 300 shares of preferred stock for $55 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.50 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on cury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021. Preferred Stock $400. Common Stock. $50; Additional Paid-in Capital, $81,000, and Retained Earnings, $32,500 Net income for the year ended December 31, 2021. is $12.800 Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the issuance of 300 shares of preferred stock for $55 per share. Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) [The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021,400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 2,100 shares of common stock for $52 per share. May 15 Purchase 500 shares of treasury stock for 545 per share. July 10 Resell 300 shares of treasury stock purchased on May 15 for $50 per share. October 15 Issue 300 shares of preferred stock for 555 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.50 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021 Preferred Stock, $400. Common Stock $50, Additional Paid-in Capital, $81,000, and Retained Earnings, $32,500. Net income for the year ended December 31, 2021, is $12,800. Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the declaration of cash dividend on both common and preferred stock of $1.50 per share to all stockholders. (Hint: Dividends are not paid on treasury stock) Required information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (L010-2, 10-3, 10-4, 10-5) The following information applies to the questions displayed below.) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021,400 shares of preferred stock and 5,000 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 2,100 shares of common stock for $S2 per share. May 15 Purchase 500 shares of treasury stock for $45 per share. July 10 Resell 300 shares of treasury stock purchased on May 15 for $50 per share. October 15 Issue 300 shares of preferred stock for $55 per share. December 1 Declare a cash dividend on both common and preferred stock of $1.50 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock, $400, Common Stock $50. Additional Paid-in Capital, $81000, and Retained Earnings, $32,500. Net income for the year ended December 31, 2021, is $12,800, Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction ist Journal entry worksheet