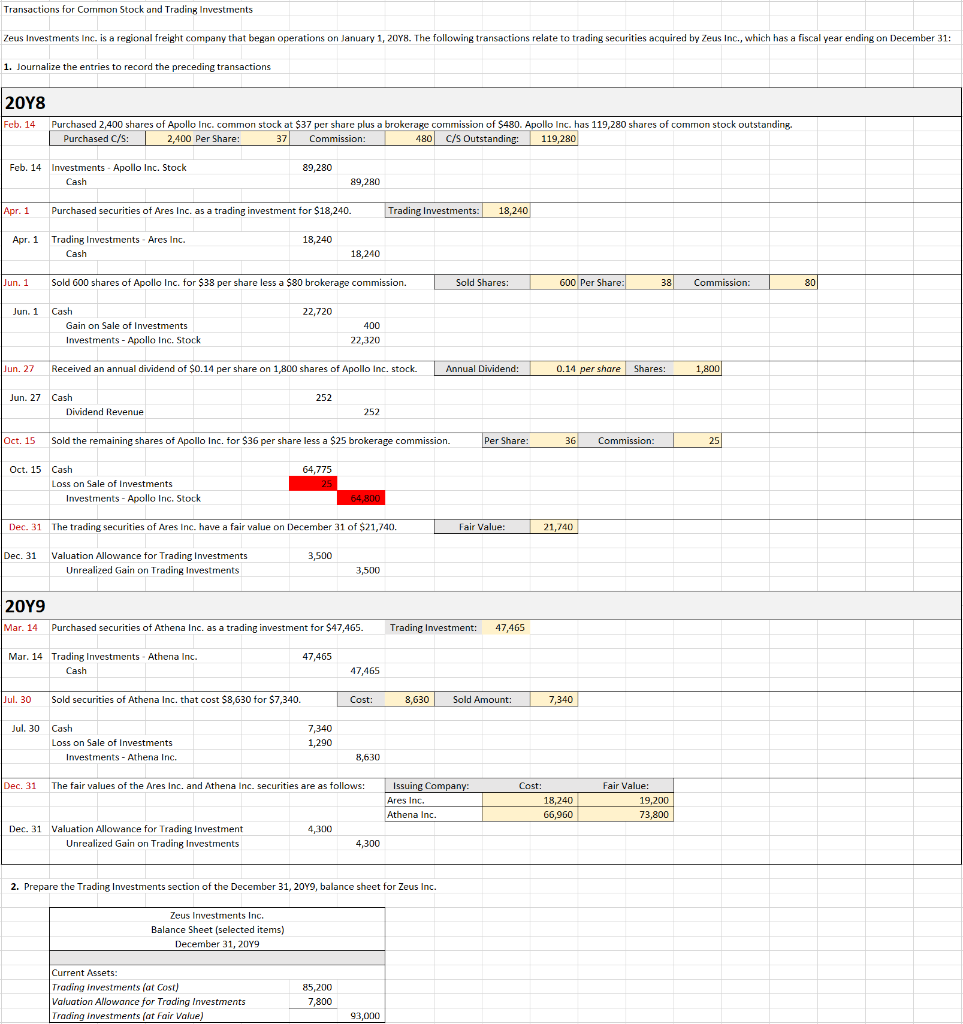

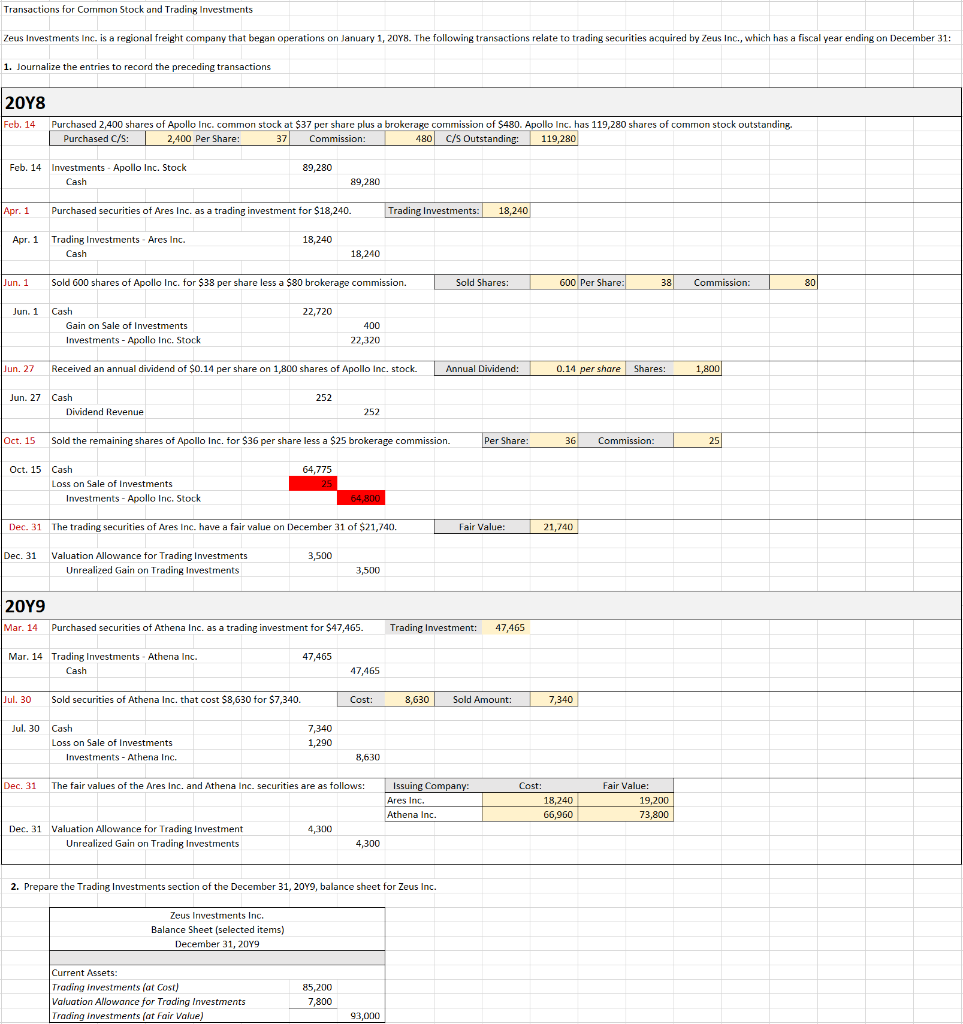

Ch. 15 PR.15.01 Transactions for Common Stock and Trading Investments

Please help solve for red and include formulas to show work.

Transactions for Common Stock and Trading Investments Zeus Investments Inc. is a regional freight company that began operations on January 1, 2048. The following transactions relate to trading securities acquired by Zeus Inc., which has a fiscal year ending on December 31: 1. Journalize the entries to record the preceding transactions 2018 Feb. 14 Purchased 2,400 shares of Apollo Inc. common stock at $37 per share plus a brokerage commission of $480. Apollo Inc. has 119,280 shares of common stock outstanding, Purchased C/S: 2,400 Per Share: 37 Commission: 480 C/S Outstanding: 119,280 Feb. 14 Investments - Apollo Inc. Stock Cash 89,280 89,280 Apr. 1 1 Purchased securities of Ares Inc. as a trading investment for $18,240. Trading Investments: 18,240 Apr. 1 18,240 Trading Investments Ares Inc. Cash 18,240 Jun. 1 Sold 600 shares of Apollo Inc. for $38 per share less a $80 brokerage commission. Sold Shares: 600 Per Share: 38 Commission: 801 Jun. 1 22,720 Cash Gain on Sale of Investments Investments - Apollo Inc. Stock 400 22,320 Jun. 27 Received an annual dividend of $0.14 per share on 1,800 shares of Apollo Inc. stock. Annual Dividend: 0.14 per share Shares: 1,800 252 Jun. 27 Cash Dividend Revenue 252 Oct. 15 Sold the remaining shares of Apollo Inc. for $36 per share less a $25 brokerage commission Per Share: 36 Commission: 25 64,775 Oct. 15 Cash Loss on Sale of Investments Investments - Apollo Inc. Stock 64,800 Dec. 31 The trading securities of Ares Inc. have a fair value on December 31 of $21,740. Fair Value: 21,740 Dec. 31 Valuation Allowance for Trading Investments Unrealized Gain on Trading Investments 3,500 3,500 2019 Mar. 14 Purchased securities of Athena Inc. as a trading investment for $47,465. Trading Investment: 47,465 47,465 Mar. 14 Trading Investments Athena Inc. Cash 47,465 Jul. 30 Sold securities of Athena Inc. that cost $8,630 for $7,340 Cost: 8,630 Sold Amount: 7,340 Jul. 30 Cash Loss on Sale of Investments Investments - Athena Inc. 7,340 1,290 8,630 Dec. 31 The fair values of the Ares Inc. and Athena Inc. securities are as follows: Issuing Company: Ares Inc. Athena Inc. Cost: 18,240 66,960 Fair Value: 19,200 73,800 4,300 Dec. 31 Valuation Allowance for Trading Investment Unrealized Gain on Trading Investments 4,300 2. Prepare the Trading Investments section of the December 31, 2019, balance sheet for Zeus Inc. Zeus Investments Inc. Balance Sheet (selected items) December 31, 2019 Current Assets: Trading investments (at Cost) Valuation Allowance for Trading Investments Trading investments (at Fair Value) 85,200 7,800 93.000