Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a

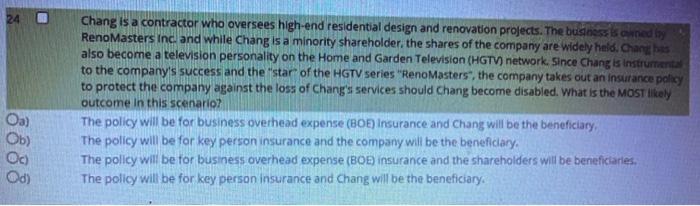

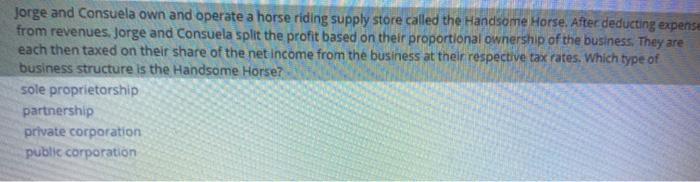

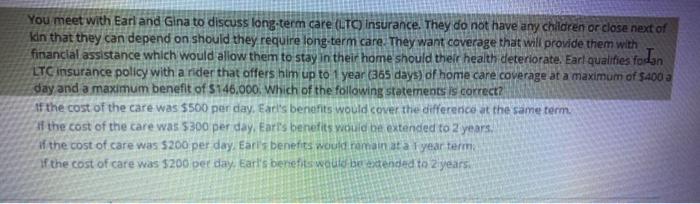

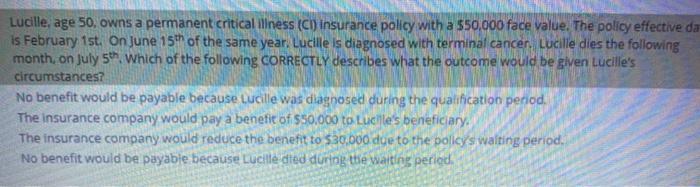

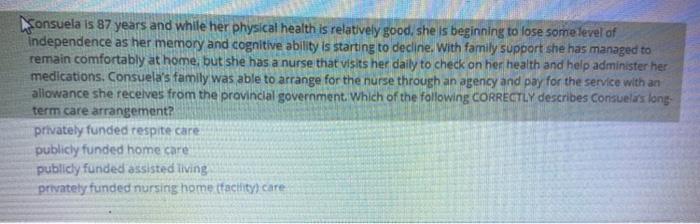

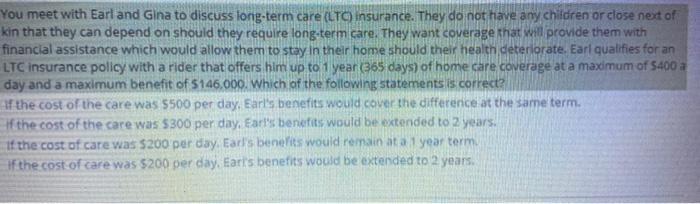

Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a minority shareholder, the shares of the company are widely held. Chang has also become a television personality on the Home and Garden Television (HGTV) network. Since Chang is Instrumental to the company's success and the "star of the HGTV series "RenoMasters", the company takes out an insurance policy to protect the company against the loss of Chang's services should Chang become disabled. What is the MOST likely outcome in this scenario? 24 The policy will be for business overhead expense (BOE) Insurance and Chang will be the beneficiary, The policy will be for key person insurance and the company wil be the beneficiary. Oa) Ob) The policy will be for business overhead expense (BOE) insurance and the shareholders will be beneficiarles. The policy will be for key person insurance and Chang will be the beneficiary. Od) 8888 Jorge and Consuela own and operate a horse riding supply store called the Handsome Horse. After deducting expense from revenues. Jorge and Consuela split the profit based on their proportional ownership of the business. They are each then taxed on their share of the net income from the business at their respective tax rates. Which type of business structure is the Handsome Horse? sole proprietorship partnership private corporation public corporation You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on should they require long-term care. They want coverage that will provide them with financial assistance which would alow them to stay in their home should their health deteriorate. Earl qualifies fodan LTC insurance policy with a rider that offers him up to1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? If the cost of the care was $500 per day. Ear's benefits would cover the difference at the same term. f the cost of the care was $300 per day, Eart's benefits wouid be extended to 2 years. if the cost of care was $200 per day. Eari's benefits would ramain ata i year term if the cost of care was $200 per day. Earl's benefits weuld be extended to 2iyears lev 8 zoao 8:01PM est-Time Limit: 75 Minutes.30 QuestioDA) elect your answer by clicking on the radio button that corresponds to the letter of your cholce. You may check the box next to the uestion number to mark it for review. Prev - allows you to go back to the previous question. Next-saves your answer and allows you to go to the next question wiew Summary-allows you to view your answer cholces and thos e you marked for review Submit Now - submits your answer choices for grading Close - exits the exam. Connor owns a long term care insurance policy and he bepns to sutter from one of the covered conditons. Which of the following scenarios would qualify Connor for the fong-term cara benefits in his policy? Connor is unable to dress hitself and cook food for himsof Connor suffers trom minor cognitive umpairment Connor is unable to maintain continence 22 10 Oar Ob) Connor is unable to transfer from his bed to his.chair o et to the bat oom Prev Next View Summary Close l8888 One of your clients, Art, is the president of an alumni organizatian which represents 600 active members. The alumni has been shopping their existing group insurance plan ahead of the next renewal and you are providing them with competitor information in response to their request for information (RFI). Which of the following statements concerning coverage for the alumni organization is correct? soliciting membership in the group plan will be the agent's responsibility a pre-determined percentage of members must join in order to establish the group plan plan members will be responsible for paying the insurance premiums the benefits will not be similar to those offered by other group plans Petra meets with Alexandria, an insurance agent to review her need for income replacement insurance. Petra works full-time as a drafting techniclan for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment. Petra also earns commission income from selling cosmetics. Petra recelved an inheritance which is invested in a non-registered account and she receives dividends and interest Income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? 1. spousal support H. bonus paid annually l. commission Income Iv. dividends and interest income 19 Oa) Ob) Tand I s and t and iv and v l8888 Candice and Darlene are partners and co-owners of La Trends hair salon. They have owned the business together for fifteen years and determine that they want to protect each other's ownership interest should the other become disabled and need to leave the business for an extended period of time. Theyapproach you about insurance and they want a policy that will provide a guaranteed lump-sum benefit to fund the buyout by the surviving, able-bodied owner should the other owner become disabled. Which of the following arrangements is the one described in this scenario? share redemption agreement cross-purchase agreement key person agreement entity purchase agreement Oa 8888 Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan, Hope meets with Calile, who works with Hope to solict group quotes from different insurers on behaif of the company. Hope would like the company to pay the entire premlum for the basic coverage provided. After careful deliberation, Hope decides on a plan from Acadian Aliance Life Insurance Company. Which of the following statements is CORRECT Callie is a group broker Disability benefits will be tax tree in the hands of employees On Ou) Or Hope Floats witl adjudicate claims and Acadian Allance wil pay.claims Hope loaty group plan witl be a contrutory plen Lucille, age 50, owns a permanent critical iliness (CI) insurance policy with a 550,000 face value. The policy effective da is February 15st. On June 15 of the same year. Lucille is diagnosed with terminal cancer. Lucille dies the following month, on July 5th, Which of the following CORRECTLY describes what the outcome would be given Lucille's circumstances? No benefit would be payable because Lucille was diagnosed during the qualification period. The insurance company would pay a benefit of $50.000 to Lucile's beneficiary. The insurance company would reduce the benefit to $30.000 due to the policy's walting period. No benefit would be payabie because Lucille died during the waiting peried. Sonsuela is 87 years and while her physical health is relatively good, she is beginning to lose some level of Independence as her memory and cognitive ability is starting to decline. With family support she has managed to remain comfortably at home, but she has a nurse that visits her daily to check on her health and help administer her medications. Consuela's family was able to arrange for the nurse through an agency and pay for the service with an allowance she recelves from the provincial government. Which of the following CORRECTLY describes Consuela's long term care arrangement? privately funded respite care publicly funded home care publicly funded assisted living privately funded nursing home tfactity) care You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on shouid they require long-term care. They want coverage that will provide them with financial assistance which would allow them to stay in their home should their health deteriorate. Earl qualifies for an LTC insurance policy with a rider that offers him up to 1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? f the cost of the care was $500 per day. Earl's benefits would cover the differenice at the same term. if the cost of the care was $300 per day, Earl's benefits would be extended to 2 years. If the cost of care was $200 per day. Earl's benefits would remain at a 1 year term. if the cost of care was $200 per day. Earts benefits would be extended to 2 years. Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a minority shareholder, the shares of the company are widely held. Chang has also become a television personality on the Home and Garden Television (HGTV) network. Since Chang is Instrumental to the company's success and the "star of the HGTV series "RenoMasters", the company takes out an insurance policy to protect the company against the loss of Chang's services should Chang become disabled. What is the MOST likely outcome in this scenario? 24 The policy will be for business overhead expense (BOE) Insurance and Chang will be the beneficiary, The policy will be for key person insurance and the company wil be the beneficiary. Oa) Ob) The policy will be for business overhead expense (BOE) insurance and the shareholders will be beneficiarles. The policy will be for key person insurance and Chang will be the beneficiary. Od) 8888 Jorge and Consuela own and operate a horse riding supply store called the Handsome Horse. After deducting expense from revenues. Jorge and Consuela split the profit based on their proportional ownership of the business. They are each then taxed on their share of the net income from the business at their respective tax rates. Which type of business structure is the Handsome Horse? sole proprietorship partnership private corporation public corporation You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on should they require long-term care. They want coverage that will provide them with financial assistance which would alow them to stay in their home should their health deteriorate. Earl qualifies fodan LTC insurance policy with a rider that offers him up to1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? If the cost of the care was $500 per day. Ear's benefits would cover the difference at the same term. f the cost of the care was $300 per day, Eart's benefits wouid be extended to 2 years. if the cost of care was $200 per day. Eari's benefits would ramain ata i year term if the cost of care was $200 per day. Earl's benefits weuld be extended to 2iyears lev 8 zoao 8:01PM est-Time Limit: 75 Minutes.30 QuestioDA) elect your answer by clicking on the radio button that corresponds to the letter of your cholce. You may check the box next to the uestion number to mark it for review. Prev - allows you to go back to the previous question. Next-saves your answer and allows you to go to the next question wiew Summary-allows you to view your answer cholces and thos e you marked for review Submit Now - submits your answer choices for grading Close - exits the exam. Connor owns a long term care insurance policy and he bepns to sutter from one of the covered conditons. Which of the following scenarios would qualify Connor for the fong-term cara benefits in his policy? Connor is unable to dress hitself and cook food for himsof Connor suffers trom minor cognitive umpairment Connor is unable to maintain continence 22 10 Oar Ob) Connor is unable to transfer from his bed to his.chair o et to the bat oom Prev Next View Summary Close l8888 One of your clients, Art, is the president of an alumni organizatian which represents 600 active members. The alumni has been shopping their existing group insurance plan ahead of the next renewal and you are providing them with competitor information in response to their request for information (RFI). Which of the following statements concerning coverage for the alumni organization is correct? soliciting membership in the group plan will be the agent's responsibility a pre-determined percentage of members must join in order to establish the group plan plan members will be responsible for paying the insurance premiums the benefits will not be similar to those offered by other group plans Petra meets with Alexandria, an insurance agent to review her need for income replacement insurance. Petra works full-time as a drafting techniclan for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment. Petra also earns commission income from selling cosmetics. Petra recelved an inheritance which is invested in a non-registered account and she receives dividends and interest Income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? 1. spousal support H. bonus paid annually l. commission Income Iv. dividends and interest income 19 Oa) Ob) Tand I s and t and iv and v l8888 Candice and Darlene are partners and co-owners of La Trends hair salon. They have owned the business together for fifteen years and determine that they want to protect each other's ownership interest should the other become disabled and need to leave the business for an extended period of time. Theyapproach you about insurance and they want a policy that will provide a guaranteed lump-sum benefit to fund the buyout by the surviving, able-bodied owner should the other owner become disabled. Which of the following arrangements is the one described in this scenario? share redemption agreement cross-purchase agreement key person agreement entity purchase agreement Oa 8888 Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan, Hope meets with Calile, who works with Hope to solict group quotes from different insurers on behaif of the company. Hope would like the company to pay the entire premlum for the basic coverage provided. After careful deliberation, Hope decides on a plan from Acadian Aliance Life Insurance Company. Which of the following statements is CORRECT Callie is a group broker Disability benefits will be tax tree in the hands of employees On Ou) Or Hope Floats witl adjudicate claims and Acadian Allance wil pay.claims Hope loaty group plan witl be a contrutory plen Lucille, age 50, owns a permanent critical iliness (CI) insurance policy with a 550,000 face value. The policy effective da is February 15st. On June 15 of the same year. Lucille is diagnosed with terminal cancer. Lucille dies the following month, on July 5th, Which of the following CORRECTLY describes what the outcome would be given Lucille's circumstances? No benefit would be payable because Lucille was diagnosed during the qualification period. The insurance company would pay a benefit of $50.000 to Lucile's beneficiary. The insurance company would reduce the benefit to $30.000 due to the policy's walting period. No benefit would be payabie because Lucille died during the waiting peried. Sonsuela is 87 years and while her physical health is relatively good, she is beginning to lose some level of Independence as her memory and cognitive ability is starting to decline. With family support she has managed to remain comfortably at home, but she has a nurse that visits her daily to check on her health and help administer her medications. Consuela's family was able to arrange for the nurse through an agency and pay for the service with an allowance she recelves from the provincial government. Which of the following CORRECTLY describes Consuela's long term care arrangement? privately funded respite care publicly funded home care publicly funded assisted living privately funded nursing home tfactity) care You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on shouid they require long-term care. They want coverage that will provide them with financial assistance which would allow them to stay in their home should their health deteriorate. Earl qualifies for an LTC insurance policy with a rider that offers him up to 1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? f the cost of the care was $500 per day. Earl's benefits would cover the differenice at the same term. if the cost of the care was $300 per day, Earl's benefits would be extended to 2 years. If the cost of care was $200 per day. Earl's benefits would remain at a 1 year term. if the cost of care was $200 per day. Earts benefits would be extended to 2 years. Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a minority shareholder, the shares of the company are widely held. Chang has also become a television personality on the Home and Garden Television (HGTV) network. Since Chang is Instrumental to the company's success and the "star of the HGTV series "RenoMasters", the company takes out an insurance policy to protect the company against the loss of Chang's services should Chang become disabled. What is the MOST likely outcome in this scenario? 24 The policy will be for business overhead expense (BOE) Insurance and Chang will be the beneficiary, The policy will be for key person insurance and the company wil be the beneficiary. Oa) Ob) The policy will be for business overhead expense (BOE) insurance and the shareholders will be beneficiarles. The policy will be for key person insurance and Chang will be the beneficiary. Od) 8888 Jorge and Consuela own and operate a horse riding supply store called the Handsome Horse. After deducting expense from revenues. Jorge and Consuela split the profit based on their proportional ownership of the business. They are each then taxed on their share of the net income from the business at their respective tax rates. Which type of business structure is the Handsome Horse? sole proprietorship partnership private corporation public corporation You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on should they require long-term care. They want coverage that will provide them with financial assistance which would alow them to stay in their home should their health deteriorate. Earl qualifies fodan LTC insurance policy with a rider that offers him up to1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? If the cost of the care was $500 per day. Ear's benefits would cover the difference at the same term. f the cost of the care was $300 per day, Eart's benefits wouid be extended to 2 years. if the cost of care was $200 per day. Eari's benefits would ramain ata i year term if the cost of care was $200 per day. Earl's benefits weuld be extended to 2iyears lev 8 zoao 8:01PM est-Time Limit: 75 Minutes.30 QuestioDA) elect your answer by clicking on the radio button that corresponds to the letter of your cholce. You may check the box next to the uestion number to mark it for review. Prev - allows you to go back to the previous question. Next-saves your answer and allows you to go to the next question wiew Summary-allows you to view your answer cholces and thos e you marked for review Submit Now - submits your answer choices for grading Close - exits the exam. Connor owns a long term care insurance policy and he bepns to sutter from one of the covered conditons. Which of the following scenarios would qualify Connor for the fong-term cara benefits in his policy? Connor is unable to dress hitself and cook food for himsof Connor suffers trom minor cognitive umpairment Connor is unable to maintain continence 22 10 Oar Ob) Connor is unable to transfer from his bed to his.chair o et to the bat oom Prev Next View Summary Close l8888 One of your clients, Art, is the president of an alumni organizatian which represents 600 active members. The alumni has been shopping their existing group insurance plan ahead of the next renewal and you are providing them with competitor information in response to their request for information (RFI). Which of the following statements concerning coverage for the alumni organization is correct? soliciting membership in the group plan will be the agent's responsibility a pre-determined percentage of members must join in order to establish the group plan plan members will be responsible for paying the insurance premiums the benefits will not be similar to those offered by other group plans Petra meets with Alexandria, an insurance agent to review her need for income replacement insurance. Petra works full-time as a drafting techniclan for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment. Petra also earns commission income from selling cosmetics. Petra recelved an inheritance which is invested in a non-registered account and she receives dividends and interest Income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? 1. spousal support H. bonus paid annually l. commission Income Iv. dividends and interest income 19 Oa) Ob) Tand I s and t and iv and v l8888 Candice and Darlene are partners and co-owners of La Trends hair salon. They have owned the business together for fifteen years and determine that they want to protect each other's ownership interest should the other become disabled and need to leave the business for an extended period of time. Theyapproach you about insurance and they want a policy that will provide a guaranteed lump-sum benefit to fund the buyout by the surviving, able-bodied owner should the other owner become disabled. Which of the following arrangements is the one described in this scenario? share redemption agreement cross-purchase agreement key person agreement entity purchase agreement Oa 8888 Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan, Hope meets with Calile, who works with Hope to solict group quotes from different insurers on behaif of the company. Hope would like the company to pay the entire premlum for the basic coverage provided. After careful deliberation, Hope decides on a plan from Acadian Aliance Life Insurance Company. Which of the following statements is CORRECT Callie is a group broker Disability benefits will be tax tree in the hands of employees On Ou) Or Hope Floats witl adjudicate claims and Acadian Allance wil pay.claims Hope loaty group plan witl be a contrutory plen Lucille, age 50, owns a permanent critical iliness (CI) insurance policy with a 550,000 face value. The policy effective da is February 15st. On June 15 of the same year. Lucille is diagnosed with terminal cancer. Lucille dies the following month, on July 5th, Which of the following CORRECTLY describes what the outcome would be given Lucille's circumstances? No benefit would be payable because Lucille was diagnosed during the qualification period. The insurance company would pay a benefit of $50.000 to Lucile's beneficiary. The insurance company would reduce the benefit to $30.000 due to the policy's walting period. No benefit would be payabie because Lucille died during the waiting peried. Sonsuela is 87 years and while her physical health is relatively good, she is beginning to lose some level of Independence as her memory and cognitive ability is starting to decline. With family support she has managed to remain comfortably at home, but she has a nurse that visits her daily to check on her health and help administer her medications. Consuela's family was able to arrange for the nurse through an agency and pay for the service with an allowance she recelves from the provincial government. Which of the following CORRECTLY describes Consuela's long term care arrangement? privately funded respite care publicly funded home care publicly funded assisted living privately funded nursing home tfactity) care You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on shouid they require long-term care. They want coverage that will provide them with financial assistance which would allow them to stay in their home should their health deteriorate. Earl qualifies for an LTC insurance policy with a rider that offers him up to 1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? f the cost of the care was $500 per day. Earl's benefits would cover the differenice at the same term. if the cost of the care was $300 per day, Earl's benefits would be extended to 2 years. If the cost of care was $200 per day. Earl's benefits would remain at a 1 year term. if the cost of care was $200 per day. Earts benefits would be extended to 2 years. Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a minority shareholder, the shares of the company are widely held. Chang has also become a television personality on the Home and Garden Television (HGTV) network. Since Chang is Instrumental to the company's success and the "star of the HGTV series "RenoMasters", the company takes out an insurance policy to protect the company against the loss of Chang's services should Chang become disabled. What is the MOST likely outcome in this scenario? 24 The policy will be for business overhead expense (BOE) Insurance and Chang will be the beneficiary, The policy will be for key person insurance and the company wil be the beneficiary. Oa) Ob) The policy will be for business overhead expense (BOE) insurance and the shareholders will be beneficiarles. The policy will be for key person insurance and Chang will be the beneficiary. Od) 8888 Jorge and Consuela own and operate a horse riding supply store called the Handsome Horse. After deducting expense from revenues. Jorge and Consuela split the profit based on their proportional ownership of the business. They are each then taxed on their share of the net income from the business at their respective tax rates. Which type of business structure is the Handsome Horse? sole proprietorship partnership private corporation public corporation You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on should they require long-term care. They want coverage that will provide them with financial assistance which would alow them to stay in their home should their health deteriorate. Earl qualifies fodan LTC insurance policy with a rider that offers him up to1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? If the cost of the care was $500 per day. Ear's benefits would cover the difference at the same term. f the cost of the care was $300 per day, Eart's benefits wouid be extended to 2 years. if the cost of care was $200 per day. Eari's benefits would ramain ata i year term if the cost of care was $200 per day. Earl's benefits weuld be extended to 2iyears lev 8 zoao 8:01PM est-Time Limit: 75 Minutes.30 QuestioDA) elect your answer by clicking on the radio button that corresponds to the letter of your cholce. You may check the box next to the uestion number to mark it for review. Prev - allows you to go back to the previous question. Next-saves your answer and allows you to go to the next question wiew Summary-allows you to view your answer cholces and thos e you marked for review Submit Now - submits your answer choices for grading Close - exits the exam. Connor owns a long term care insurance policy and he bepns to sutter from one of the covered conditons. Which of the following scenarios would qualify Connor for the fong-term cara benefits in his policy? Connor is unable to dress hitself and cook food for himsof Connor suffers trom minor cognitive umpairment Connor is unable to maintain continence 22 10 Oar Ob) Connor is unable to transfer from his bed to his.chair o et to the bat oom Prev Next View Summary Close l8888 One of your clients, Art, is the president of an alumni organizatian which represents 600 active members. The alumni has been shopping their existing group insurance plan ahead of the next renewal and you are providing them with competitor information in response to their request for information (RFI). Which of the following statements concerning coverage for the alumni organization is correct? soliciting membership in the group plan will be the agent's responsibility a pre-determined percentage of members must join in order to establish the group plan plan members will be responsible for paying the insurance premiums the benefits will not be similar to those offered by other group plans Petra meets with Alexandria, an insurance agent to review her need for income replacement insurance. Petra works full-time as a drafting techniclan for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment. Petra also earns commission income from selling cosmetics. Petra recelved an inheritance which is invested in a non-registered account and she receives dividends and interest Income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? 1. spousal support H. bonus paid annually l. commission Income Iv. dividends and interest income 19 Oa) Ob) Tand I s and t and iv and v l8888 Candice and Darlene are partners and co-owners of La Trends hair salon. They have owned the business together for fifteen years and determine that they want to protect each other's ownership interest should the other become disabled and need to leave the business for an extended period of time. Theyapproach you about insurance and they want a policy that will provide a guaranteed lump-sum benefit to fund the buyout by the surviving, able-bodied owner should the other owner become disabled. Which of the following arrangements is the one described in this scenario? share redemption agreement cross-purchase agreement key person agreement entity purchase agreement Oa 8888 Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan, Hope meets with Calile, who works with Hope to solict group quotes from different insurers on behaif of the company. Hope would like the company to pay the entire premlum for the basic coverage provided. After careful deliberation, Hope decides on a plan from Acadian Aliance Life Insurance Company. Which of the following statements is CORRECT Callie is a group broker Disability benefits will be tax tree in the hands of employees On Ou) Or Hope Floats witl adjudicate claims and Acadian Allance wil pay.claims Hope loaty group plan witl be a contrutory plen Lucille, age 50, owns a permanent critical iliness (CI) insurance policy with a 550,000 face value. The policy effective da is February 15st. On June 15 of the same year. Lucille is diagnosed with terminal cancer. Lucille dies the following month, on July 5th, Which of the following CORRECTLY describes what the outcome would be given Lucille's circumstances? No benefit would be payable because Lucille was diagnosed during the qualification period. The insurance company would pay a benefit of $50.000 to Lucile's beneficiary. The insurance company would reduce the benefit to $30.000 due to the policy's walting period. No benefit would be payabie because Lucille died during the waiting peried. Sonsuela is 87 years and while her physical health is relatively good, she is beginning to lose some level of Independence as her memory and cognitive ability is starting to decline. With family support she has managed to remain comfortably at home, but she has a nurse that visits her daily to check on her health and help administer her medications. Consuela's family was able to arrange for the nurse through an agency and pay for the service with an allowance she recelves from the provincial government. Which of the following CORRECTLY describes Consuela's long term care arrangement? privately funded respite care publicly funded home care publicly funded assisted living privately funded nursing home tfactity) care You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on shouid they require long-term care. They want coverage that will provide them with financial assistance which would allow them to stay in their home should their health deteriorate. Earl qualifies for an LTC insurance policy with a rider that offers him up to 1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? f the cost of the care was $500 per day. Earl's benefits would cover the differenice at the same term. if the cost of the care was $300 per day, Earl's benefits would be extended to 2 years. If the cost of care was $200 per day. Earl's benefits would remain at a 1 year term. if the cost of care was $200 per day. Earts benefits would be extended to 2 years. Chang is a contractor who oversees high-end residential design and renovation projects. The bustness is owned by RenoMasters Inc. and while Chang is a minority shareholder, the shares of the company are widely held. Chang has also become a television personality on the Home and Garden Television (HGTV) network. Since Chang is Instrumental to the company's success and the "star of the HGTV series "RenoMasters", the company takes out an insurance policy to protect the company against the loss of Chang's services should Chang become disabled. What is the MOST likely outcome in this scenario? 24 The policy will be for business overhead expense (BOE) Insurance and Chang will be the beneficiary, The policy will be for key person insurance and the company wil be the beneficiary. Oa) Ob) The policy will be for business overhead expense (BOE) insurance and the shareholders will be beneficiarles. The policy will be for key person insurance and Chang will be the beneficiary. Od) 8888 Jorge and Consuela own and operate a horse riding supply store called the Handsome Horse. After deducting expense from revenues. Jorge and Consuela split the profit based on their proportional ownership of the business. They are each then taxed on their share of the net income from the business at their respective tax rates. Which type of business structure is the Handsome Horse? sole proprietorship partnership private corporation public corporation You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on should they require long-term care. They want coverage that will provide them with financial assistance which would alow them to stay in their home should their health deteriorate. Earl qualifies fodan LTC insurance policy with a rider that offers him up to1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? If the cost of the care was $500 per day. Ear's benefits would cover the difference at the same term. f the cost of the care was $300 per day, Eart's benefits wouid be extended to 2 years. if the cost of care was $200 per day. Eari's benefits would ramain ata i year term if the cost of care was $200 per day. Earl's benefits weuld be extended to 2iyears lev 8 zoao 8:01PM est-Time Limit: 75 Minutes.30 QuestioDA) elect your answer by clicking on the radio button that corresponds to the letter of your cholce. You may check the box next to the uestion number to mark it for review. Prev - allows you to go back to the previous question. Next-saves your answer and allows you to go to the next question wiew Summary-allows you to view your answer cholces and thos e you marked for review Submit Now - submits your answer choices for grading Close - exits the exam. Connor owns a long term care insurance policy and he bepns to sutter from one of the covered conditons. Which of the following scenarios would qualify Connor for the fong-term cara benefits in his policy? Connor is unable to dress hitself and cook food for himsof Connor suffers trom minor cognitive umpairment Connor is unable to maintain continence 22 10 Oar Ob) Connor is unable to transfer from his bed to his.chair o et to the bat oom Prev Next View Summary Close l8888 One of your clients, Art, is the president of an alumni organizatian which represents 600 active members. The alumni has been shopping their existing group insurance plan ahead of the next renewal and you are providing them with competitor information in response to their request for information (RFI). Which of the following statements concerning coverage for the alumni organization is correct? soliciting membership in the group plan will be the agent's responsibility a pre-determined percentage of members must join in order to establish the group plan plan members will be responsible for paying the insurance premiums the benefits will not be similar to those offered by other group plans Petra meets with Alexandria, an insurance agent to review her need for income replacement insurance. Petra works full-time as a drafting techniclan for a large design firm where, in addition to her base salary, she receives a substantial annual bonus. Outside of her normal employment. Petra also earns commission income from selling cosmetics. Petra recelved an inheritance which is invested in a non-registered account and she receives dividends and interest Income which also help support her lifestyle. In addition, Petra receives spousal support payments from a previous marriage. Which of the following sources of Petra's income would be considered earned income? 1. spousal support H. bonus paid annually l. commission Income Iv. dividends and interest income 19 Oa) Ob) Tand I s and t and iv and v l8888 Candice and Darlene are partners and co-owners of La Trends hair salon. They have owned the business together for fifteen years and determine that they want to protect each other's ownership interest should the other become disabled and need to leave the business for an extended period of time. Theyapproach you about insurance and they want a policy that will provide a guaranteed lump-sum benefit to fund the buyout by the surviving, able-bodied owner should the other owner become disabled. Which of the following arrangements is the one described in this scenario? share redemption agreement cross-purchase agreement key person agreement entity purchase agreement Oa 8888 Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan, Hope meets with Calile, who works with Hope to solict group quotes from different insurers on behaif of the company. Hope would like the company to pay the entire premlum for the basic coverage provided. After careful deliberation, Hope decides on a plan from Acadian Aliance Life Insurance Company. Which of the following statements is CORRECT Callie is a group broker Disability benefits will be tax tree in the hands of employees On Ou) Or Hope Floats witl adjudicate claims and Acadian Allance wil pay.claims Hope loaty group plan witl be a contrutory plen Lucille, age 50, owns a permanent critical iliness (CI) insurance policy with a 550,000 face value. The policy effective da is February 15st. On June 15 of the same year. Lucille is diagnosed with terminal cancer. Lucille dies the following month, on July 5th, Which of the following CORRECTLY describes what the outcome would be given Lucille's circumstances? No benefit would be payable because Lucille was diagnosed during the qualification period. The insurance company would pay a benefit of $50.000 to Lucile's beneficiary. The insurance company would reduce the benefit to $30.000 due to the policy's walting period. No benefit would be payabie because Lucille died during the waiting peried. Sonsuela is 87 years and while her physical health is relatively good, she is beginning to lose some level of Independence as her memory and cognitive ability is starting to decline. With family support she has managed to remain comfortably at home, but she has a nurse that visits her daily to check on her health and help administer her medications. Consuela's family was able to arrange for the nurse through an agency and pay for the service with an allowance she recelves from the provincial government. Which of the following CORRECTLY describes Consuela's long term care arrangement? privately funded respite care publicly funded home care publicly funded assisted living privately funded nursing home tfactity) care You meet with Earl and Gina to discuss long-term care (LTC) insurance. They do not have any children or close next of kin that they can depend on shouid they require long-term care. They want coverage that will provide them with financial assistance which would allow them to stay in their home should their health deteriorate. Earl qualifies for an LTC insurance policy with a rider that offers him up to 1 year (365 days) of home care coverage at a maximum of $400 a day and a maximum benefit of $146.000. Which of the following statements is correct? f the cost of the care was $500 per day. Earl's benefits would cover the differenice at the same term. if the cost of the care was $300 per day, Earl's benefits would be extended to 2 years. If the cost of care was $200 per day. Earl's benefits would remain at a 1 year term. if the cost of care was $200 per day. Earts benefits would be extended to 2 years.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Ch ang is a contractor who oversees high end residential design and renovation projects The business is owned by Reno M asters Inc and while Chang is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started