Answered step by step

Verified Expert Solution

Question

1 Approved Answer

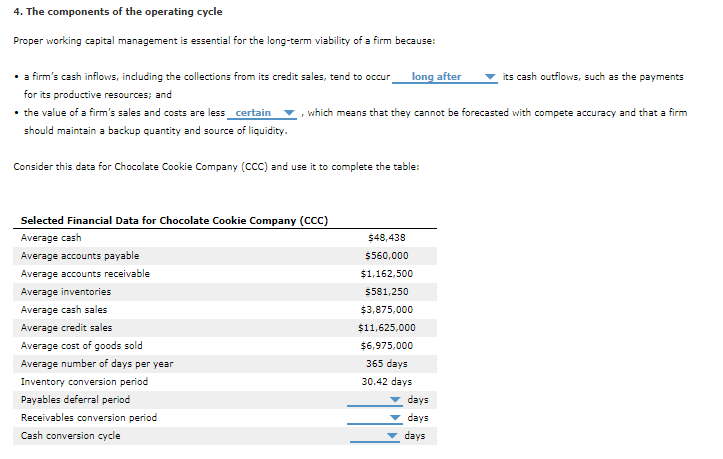

CHAP 14 Q4 DROPDOWN OPTIONS ARE 1- Long after - Long before - at the same time 2- Uncertain - Certain 3- 13.19 days -105.15

CHAP 14 Q4

DROPDOWN OPTIONS ARE

1- Long after - Long before - at the same time

2- Uncertain - Certain

3- 13.19 days -105.15 days - 29.30 days

4- 27.38 days - 36.50 days - 219.00 days

5- 66.92 days - 37.62 days - 59.72 days

4. The components of the operating cycle Proper working capital management is essential for the long-term viability of a firm because: . a firm's cash inflows, including the collections from its credit sales, tend to occur_ long after its cash outflows, such as the payments for its productive resources; and . the value of a firm's sales and costs are less certain which means that they cannot be forecasted with compete accuracy and that a firm should maintain a backup quantity and source of liquidity. Consider this data for Chocolate Cookie Company (CCC) and use it to complete the table: Selected Financial Data for Chocolate Cookie Company (CCC) Average cash Average accounts payable Average accounts receivable Average inventories Average cash sales Average credit sales Average cost of goods sold Average number of days per year Inventory conversion period Payables deferral period Receivables conversion period Cash conversion cycle $48,438 5560,000 $1,162,500 5581,250 $3,875,000 $11,625,000 $6.975,000 365 days 30.42 days days days daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started