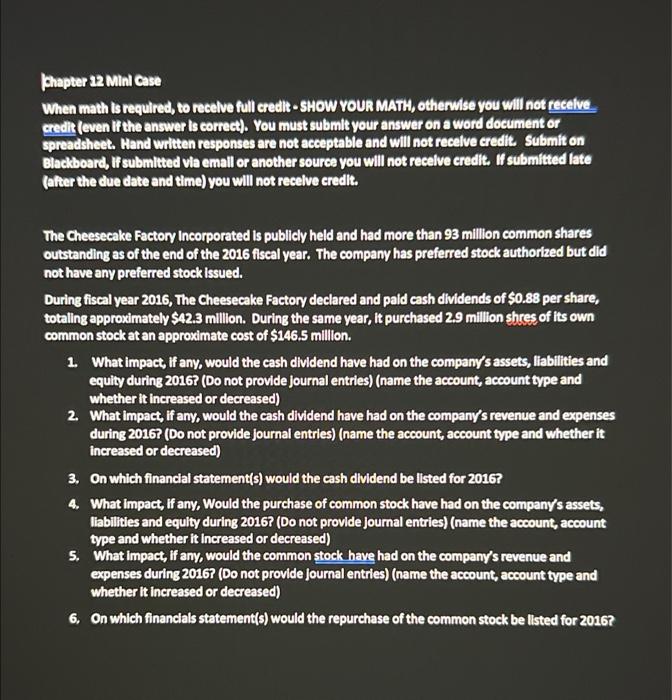

Chapter 12 Minl Case When math is required, to recelve full credit - SHOW YOUR MATH, otherwise you will not receive credit (even if the answer is correct). You must submit your answer on a word document or spreadsheet. Hand written responses are not acceptable and will not receive credit. Submit on Blackboard, If submitted via email or another source you will not receive credit. If submitted late (after the due date and time) you will not receive credit. The Cheesecake Factory Incorporated is publicly held and had more than 93 million common shares outstanding as of the end of the 2016 fiscal year. The company has preferred stock authorized but did not have any preferred stock Issued. During fiscal year 2016, The Cheesecake Factory declared and paid cash dividends of $0.88 per share, totaling approximately $42.3 million. During the same year, It purchased 2.9 million shres of its own common stock at an approximate cost of $146.5 million. 1 What impact, if any, would the cash dividend have had on the company's assets, liabilities and equity during 2016? (Do not provide journal entries) (name the account, account type and whether it increased or decreased) 2. What impact, if any, would the cash dividend have had on the company's revenue and expenses during 20167 (Do not provide journal entries) (name the account, account type and whether it increased or decreased) 3. On which financial statement(s) would the cash dividend be listed for 2016? 4. What Impact, If any, Would the purchase of common stock have had on the company's assets, liabilities and equity during 2016? (Do not provide journal entries) (name the account, account type and whether it increased or decreased) 5. What impact, if any, would the common stock have had on the company's revenue and expenses during 2016? (Do not provide Journal entries) (name the account, account type and whether it increased or decreased) 6, On which financials statement(s) would the repurchase of the common stock be listed for 2016