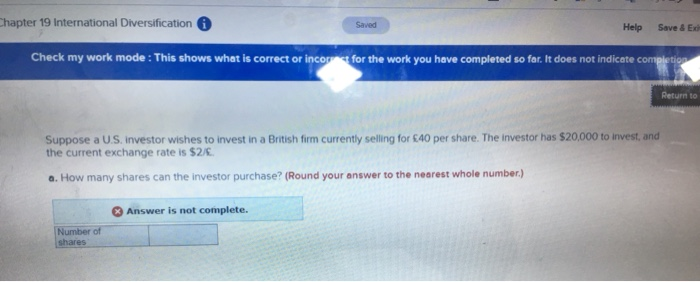

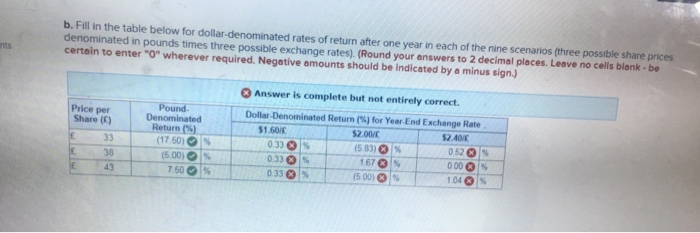

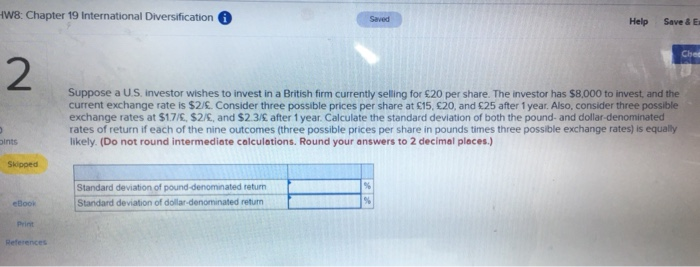

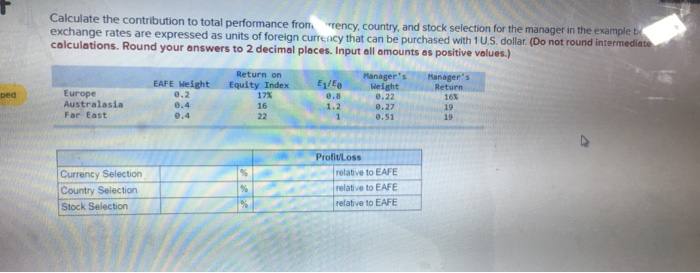

Chapter 19 International Diversification Saved Help Save Check my work mode: This shows what is correct or incor for the work you have completed so far. It does not indicate com Return to Suppose a U.S. investor wishes to invest in a British firm currently selling for $40 per share. The investor has $20,000 to invest, and the current exchange rate is $2/C a. How many shares can the investor purchase? (Round your answer to the nearest whole number) Answer is not complete. Number of b. Fill in the table below for dollar-denominated rates of return after one year in each of the nine scenarios (three possible share prices denominated in pounds times three possible exchange rates). (Round your answers to 2 decimal places. Leave no cells blank.be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. Price per Share Pound Denominated Return (1750) (5.00) 7505 Dollar Denominated Return (%) for Year End Exchange Rate 51.601 $2.00 52.40 033 0526 033 IS 033 15 0013 43 -IW8: Chapter 19 International Diversification Help Seve Suppose a US investor wishes to invest in a British firm currently selling for 620 per share. The investor has $8,000 to invest and the current exchange rate is $2/6. Consider three possible prices per share at 615.620 and 25 after 1 year. Also, consider three possible exchange rates at $17/6, $2/, and $2.3/after 1 year. Calculate the standard deviation of both the pound and dollar denominated rates of return if each of the nine outcomes (three possible prices per share in pounds times three possible exchange rates) is equally likely. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) sints Skipped Standard deviation of pound-denominated return Standard deviation of dollar-denominated retum Calculate the contribution to total performance fron. ency, country, and stock selection for the manager in the example exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar. (Do not round intermediate calculations. Round your answers to 2 decimal places. Input all amounts as positive values.) Return on Equity Index EAFE Weight 171 Europe Australasia Far East Manager's Manager's E1/ Weight Return 0.8 0.22 163 1.2 0.27 19 10. 5119 Currency Selection Country Selection Stock Selection ProfitLoss relative to EAFE relative to EAFE relate to EAFE