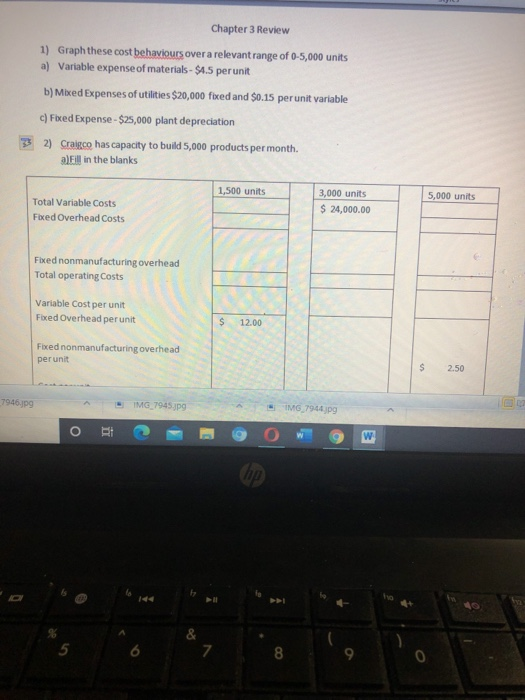

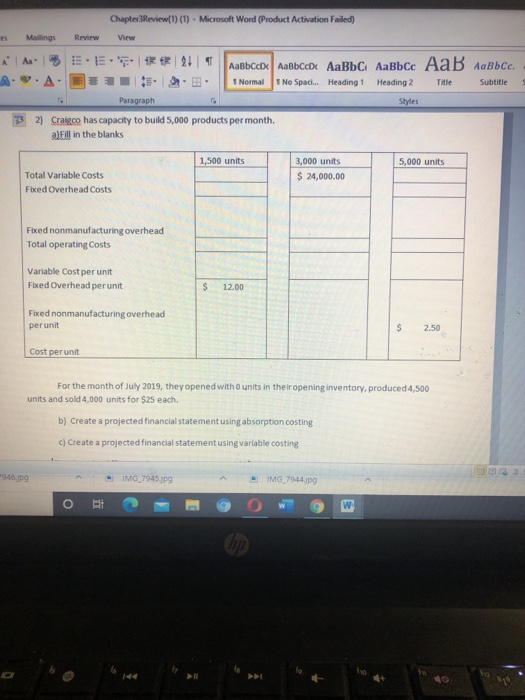

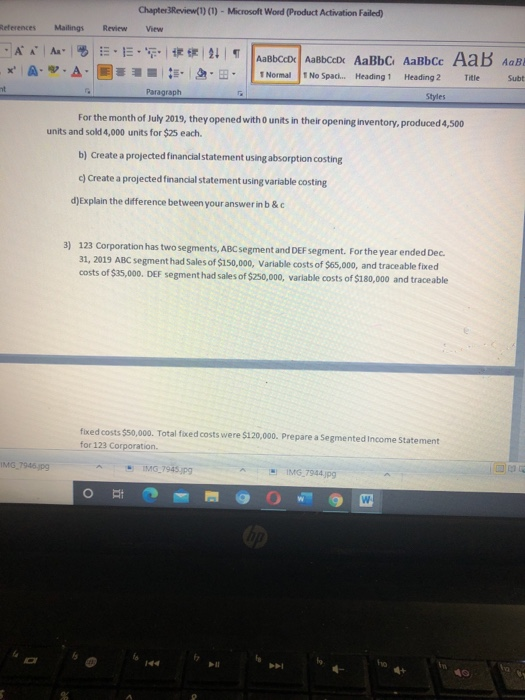

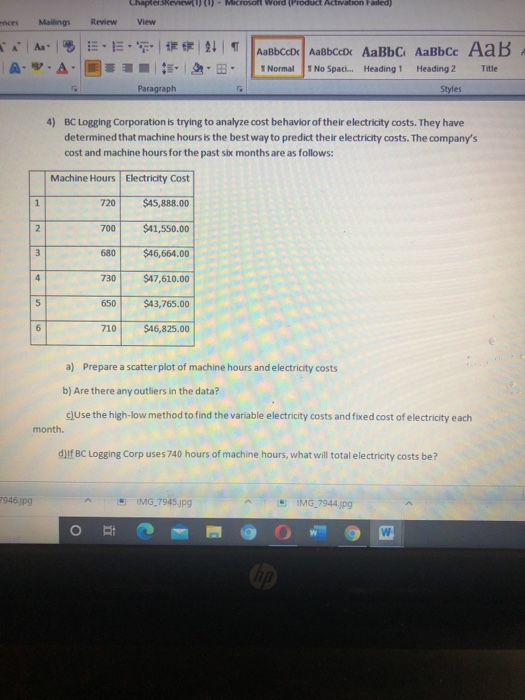

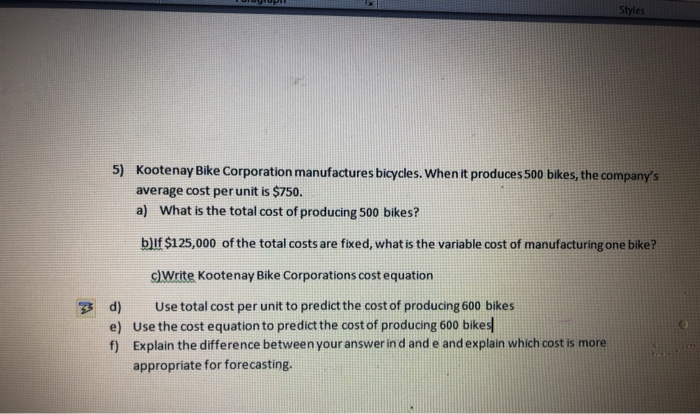

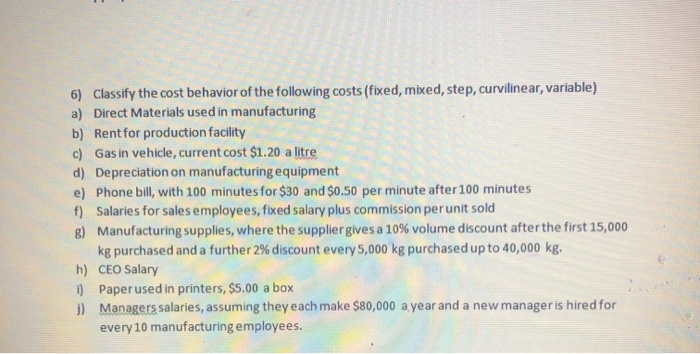

Chapter 3 Review 1) Graph these cost behaviours over a relevant range of 0-5,000 units a) Variable expense of materials - $4.5 per unit b) Mixed Expenses of utilities $20,000 foved and $0.15 per unit variable c) Fixed Expense - $25,000 plant depreciation 32) Craigco has capacity to build 5,000 products per month. a)Fill in the blanks 1,500 units 5,000 units Total Variable Costs Fixed Overhead Costs 3,000 units $ 24,000.00 Fixed nonmanufacturing overhead Total operating costs Variable Cost per unit Fixed Overhead per unit $ 12.00 Fixed nonmanufacturing overhead per unit $ 2.50 1946.jpg IMG_7945.jpg IMG_7944.jpg o & 7 8 0 Chapter3Review(1) (1) - Microsoft Word (Product Activation Failed) View es Mailings Review A E 21 T | . . . T Normal 1 No Spaci... Heading 1 Heading 2 Title Subtitle Paragraph Styles 3 2) Craigco has capacity to build 5,000 products per month. a)Fill in the blanks 1,500 units 5,000 units Total Variable Costs Fixed Overhead Costs 3,000 units $ 24,000.00 Fixed nonmanufacturing overhead Total operating costs Variable Cost per unit Fixed Overhead per unit $ 12.00 Fixed nonmanufacturing overhead per unit $ 2.50 Cost per unit For the month of July 2019, they opened with units in their opening inventory, produced 4,500 units and sold 4,000 units for $25 each. b) Create a projected financial statement using absorption costing c) Create a projected financial statement using variable costing 9:06 09 IMG_7945.jpg IMG_7944.jpg o Chapter3Review(1) (1) - Microsoft Word (Product Activation Failed) References Mailings Review View 21 . T Normal 1 No Spaci... Heading 1 Heading 2 Title Subt nt Paragraph For the month of July 2019, they opened with units in their opening inventory, produced 4,500 units and sold 4,000 units for $25 each. b) Create a projected financial statement using absorption costing Create a projected financial statement using variable costing d)Explain the difference between your answer in b&c 3) 123 Corporation has two segments, ABC segment and DEF segment. For the year ended Dec. 31, 2019 ABC segment had Sales of $150,000, Variable costs of $65,000, and traceable fixed costs of $35,000. DEF segment had sales of $250,000, Variable costs of $180,000 and traceable fixed costs $50,000. Total faced costs were $120,000. Prepare a Segmented Income Statement for 123 Corporation IMG_1945 19 IMG_7945.JPG IMG_7944pg Mirosoft Word (Product Activation Failed) Mailings Review View ARBE 21 T . 1 Normal T No Spaci... Heading 1 Heading 2 Title Paragraph Styles 4) BC Logging Corporation is trying to analyze cost behavior of their electricity costs. They have determined that machine hours is the best way to predict their electricity costs. The company's cost and machine hours for the past six months are as follows: Machine Hours Electricity Cost 1 720 $45,888.00 2 700 $41,550.00 680 $46,664.00 4 730 $47,610.00 5 650 $43,765.00 6 710 $46,825.00 a) Prepare a scatter plot of machine hours and electricity costs b) Are there any outliers in the data? JUse the high-low method to find the variable electricity costs and fixed cost of electricity each month. dif BC Logging Corp uses 740 hours of machine hours, what will total electricity costs be? 946.jpg IMG_7945.jpg IMG_7944.jpg o RI w Styles 5) Kootenay Bike Corporation manufactures bicycles. When it produces 500 bikes, the company's average cost per unit is $750. a) What is the total cost of producing 500 bikes? b)lf $125,000 of the total costs are fixed, what is the variable cost of manufacturing one bike? c) Write Kootenay Bike Corporations cost equation 3 d) Use total cost per unit to predict the cost of producing 600 bikes e) Use the cost equation to predict the cost of producing 600 bikes f) Explain the difference between your answer ind and e and explain which cost is more appropriate for forecasting. 6) Classify the cost behavior of the following costs (fixed, mixed, step, curvilinear, variable) a) Direct Materials used in manufacturing b) Rent for production facility c) Gas in vehicle, current cost $1.20 a litre d) Depreciation on manufacturing equipment e) Phone bill, with 100 minutes for $30 and $0.50 per minute after 100 minutes f) Salaries for sales employees, fixed salary plus commission per unit sold g) Manufacturing supplies, where the supplier gives a 10% volume discount after the first 15,000 kg purchased and a further 2% discount every 5,000 kg purchased up to 40,000 kg. h) CEO Salary 1) Paper used in printers, $5.00 a box j) Managers salaries, assuming they each make $80,000 a year and a new manager is hired for every 10 manufacturing employees