Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 30 problem 27 How dis you arrived with the answer Ive used the excel but Im getting an error. Kindly help Thanks. A parent

Chapter 30 problem 27

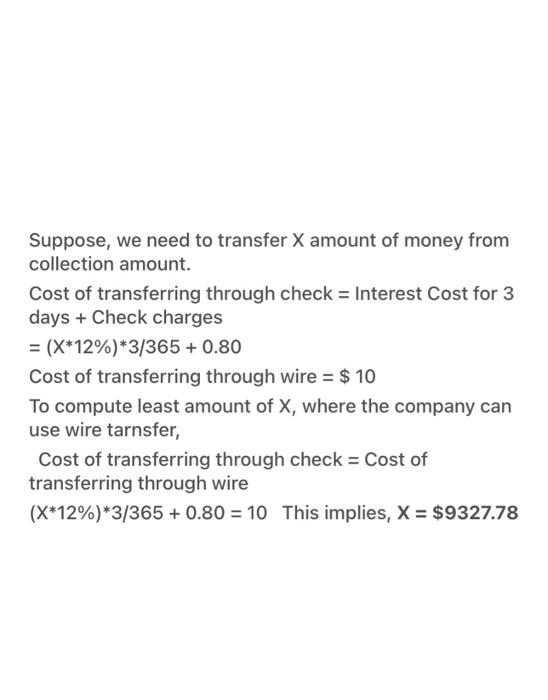

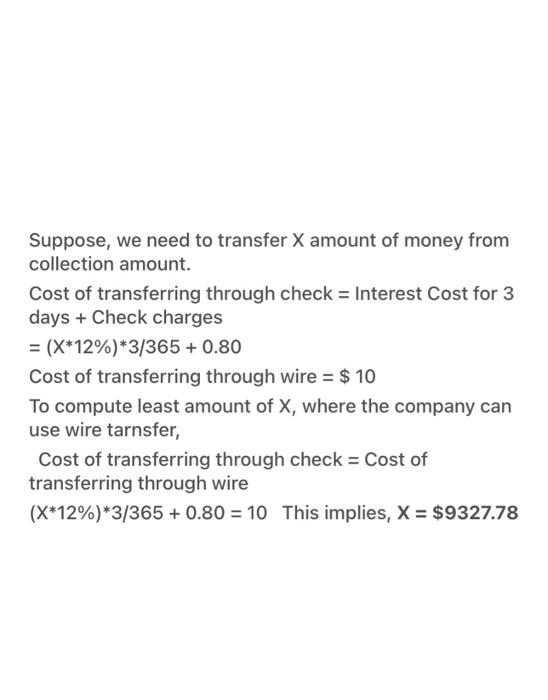

A parent company settles the collection account balances of its subsidiaries once a week. (That is, each week it transfers any balances in the accounts to a central account.) The cost of a wire transfer is $10. A check costs $.80. Cash transferred by wire is available the same day, but the parent must wait three days for checks to clear. Cash can be invested at 12% per year. How much money must be in a collection account before it pays to use a wire transfer? Suppose, we need to transfer X amount of money from collection amount. Cost of transferring through check = Interest Cost for 3 days + Check charges = (X*12%)*3/365 +0.80 Cost of transferring through wire = $ 10 To compute least amount of X, where the company can use wire tarnsfer, Cost of transferring through check = Cost of transferring through wire (X*12%)*3/365 +0.80 = 10 This implies, X = $9327.78 How dis you arrived with the answer Ive used the excel but Im getting an error. Kindly help Thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started