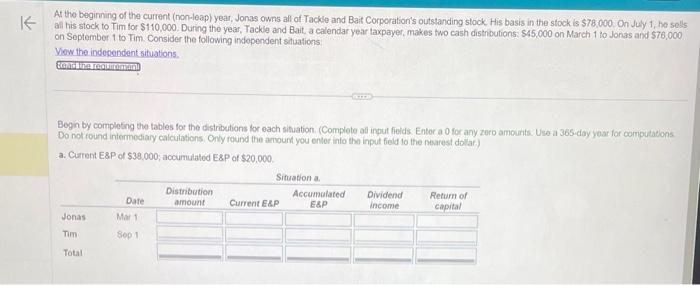

Chapter 4 Question 3

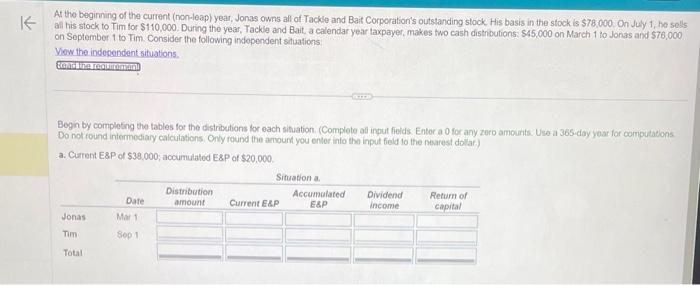

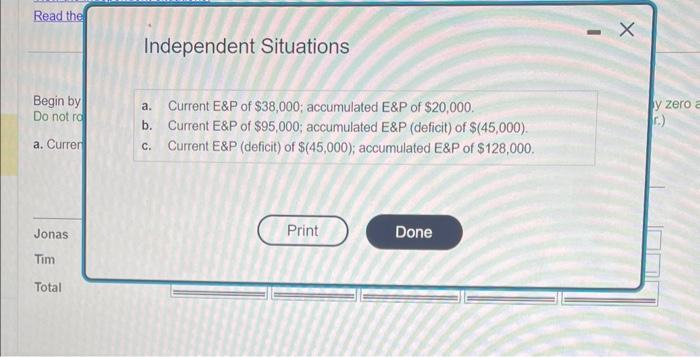

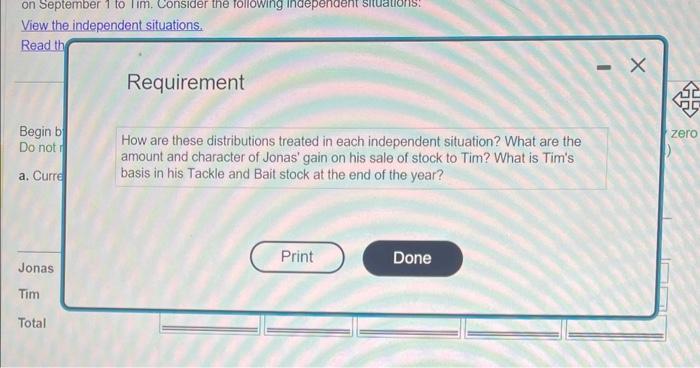

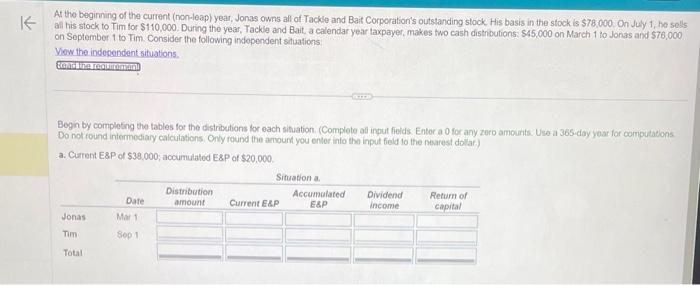

At tho beginning of the current (non-leap) year, Jonas owns all of Tackle and Bat Corporation's outstanding slock His basis in the stock is $78,000. On July 1, he sels al his stock to Tim for $110,000. Durng the year, Tacke and Bait, a calendar year taxpayer, makes two cash distributions; $45,000 on March 1 to Jonas and $76,000 on September 1 to Tim. Consider the following infependent satuations. View the indesendent situations. Begin by completing the tables for the distritutions hor each sitiation. (Complote af input fields. Entor a 0 for any zero amounts. Use a 365 -day yoat for computadons. Do not round intermediary calculations Only reund the amount you entor into the input field to the nearest dolar.) a. Cument E8P of $38,000; accumulated E8P of $20,000. Independent Situations a. Current E\&P of $38,000; accumulated E\&P of $20,000. b. Current E\&P of $95,000; accumulated E\&P (deficit) of $(45,000). c. Current E\&P (deficit) of $(45,000); accumulated E\&P of $128,000. How are these distributions treated in each independent situation? What are the amount and character of Jonas' gain on his sale of stock to Tim? What is Tim's basis in his Tackle and Bait stock at the end of the year? At tho beginning of the current (non-leap) year, Jonas owns all of Tackle and Bat Corporation's outstanding slock His basis in the stock is $78,000. On July 1, he sels al his stock to Tim for $110,000. Durng the year, Tacke and Bait, a calendar year taxpayer, makes two cash distributions; $45,000 on March 1 to Jonas and $76,000 on September 1 to Tim. Consider the following infependent satuations. View the indesendent situations. Begin by completing the tables for the distritutions hor each sitiation. (Complote af input fields. Entor a 0 for any zero amounts. Use a 365 -day yoat for computadons. Do not round intermediary calculations Only reund the amount you entor into the input field to the nearest dolar.) a. Cument E8P of $38,000; accumulated E8P of $20,000. Independent Situations a. Current E\&P of $38,000; accumulated E\&P of $20,000. b. Current E\&P of $95,000; accumulated E\&P (deficit) of $(45,000). c. Current E\&P (deficit) of $(45,000); accumulated E\&P of $128,000. How are these distributions treated in each independent situation? What are the amount and character of Jonas' gain on his sale of stock to Tim? What is Tim's basis in his Tackle and Bait stock at the end of the year