Answered step by step

Verified Expert Solution

Question

1 Approved Answer

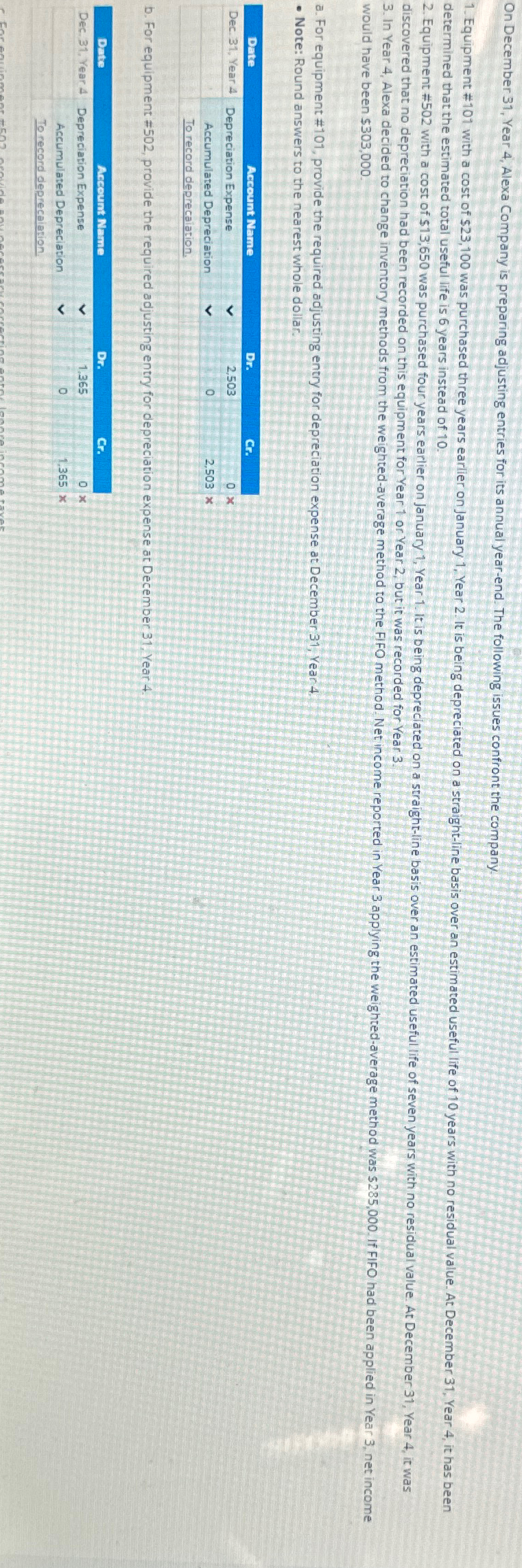

On December 3 1 , Year 4 , Alexa Company is preparing adjusting entries for its annual year - end. The following issues confront the

On December Year Alexa Company is preparing adjusting entries for its annual yearend. The following issues confront the company. determined that the estimated total useful life is years instead of discovered that no depreciation had been recorded on this equipment for Year or Year but it was recorded for Year would have been $

a For equipment # provide the required adjusting entry for depreciation expense at December Year

Note: Round answers to the nearest whole dollar.

tableDateAccount Name,,DrCrDec Year Depreciation Expense,Accumulated Depreciation,To record deprecaiation.,,,

b For equipment $ provide the required adjusting entry for depreciation expense at December Year

tableDateAccount Name,,DrCrDec Year Depreciation Expense,Accumulated Depreciation,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started