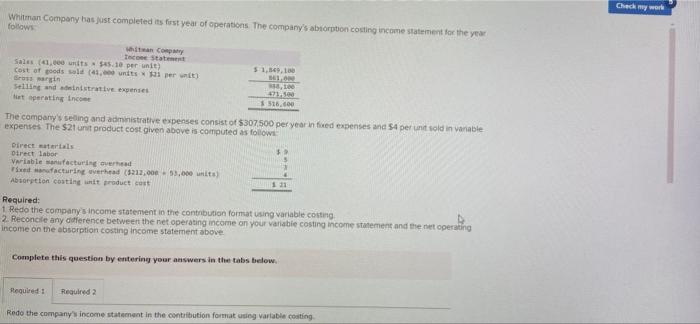

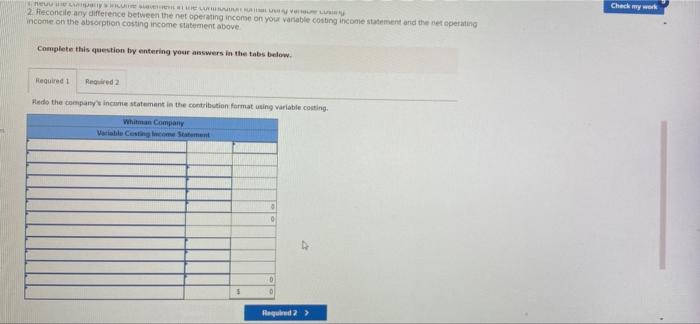

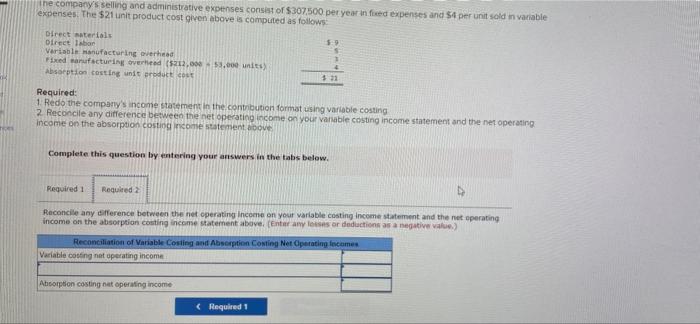

Checimy work Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows when Com Te statement Salus (41,000 units $45.10 per unit) Cost of goods sold (41, per Sorin Selling and ministrative eines et parating Inco 51,549.100 18. 21.10 1515.00 The company selling and administrative expenses consist of $307500 per year in fed expenses and 54 per un sold in variable expenses The $21 unit product cost given above is computed as follow Direct Direct labor Variable facturing over facturing werhead (5212.000 53.000 units) Absorption costing unit product cost 111 Required: 1 Redo the company income statement in the contribution format using variable costing 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing Income statement above Complete this question by entering your answers in the tabs below Required: Required 2 Redo the company's income statement in the contribution format using variable costing Check my werk SEL 2 Reconcile any difference between the net operating income on your variable costing income statement and the net operating Income on the absorption costing income statement above Complete this question by entering your answers in the tabs below. Required Required 2 Hedo the company income statement in the contribution formatting variable costing. Whitman Company Variable Costcomment 0 0 $ Required 2 > the company's selling and administrative expenses consist of $307,500 per year in fed expenses and 54 per unit sold in variable expenses. The $21 unit product cost green above computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overed (5202,000 - $3.000 units) Absorption costing unit productos S 1 4 $ 21 Required: 1 Redo the company's income statement in the contribution format using variable costing 2 Reconcile any difference between the net operating income on your variable costing income statement and the net operating Income on the absorption costing income statement above Complete this question by entering your answers in the tabs below Required 1 Required Reconcile any difference between the net operating Income on your variable costing Income statement and the net operating income on the absorption costing income statement above (Enter any losses or deductions as a negative value) Reconciliation of Variable Costing and Absorption Conting Net Operating comes Variable costing net operating income Absorption costing at operating income (Required 1