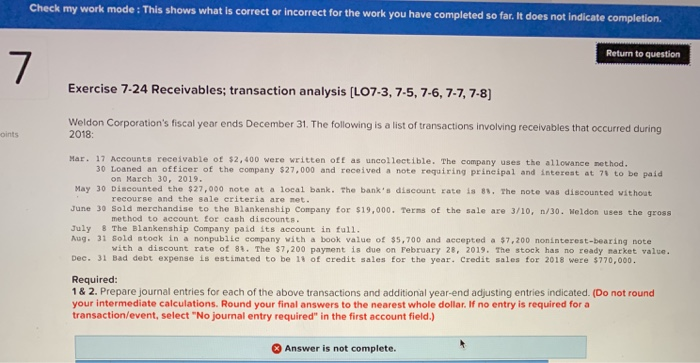

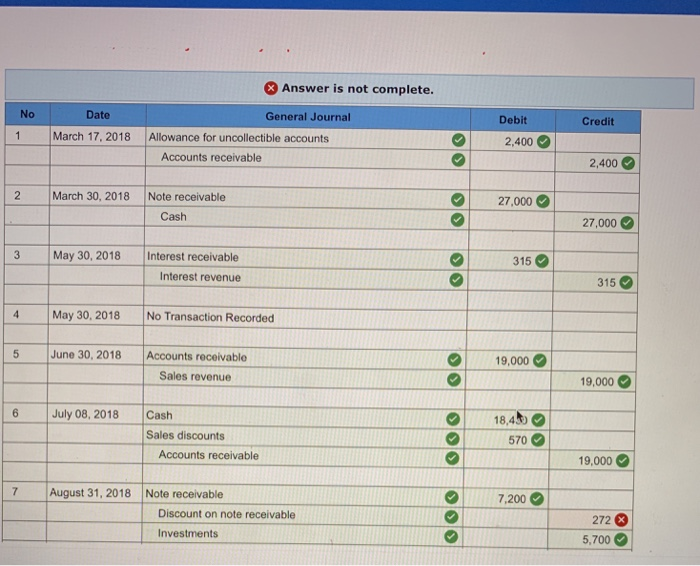

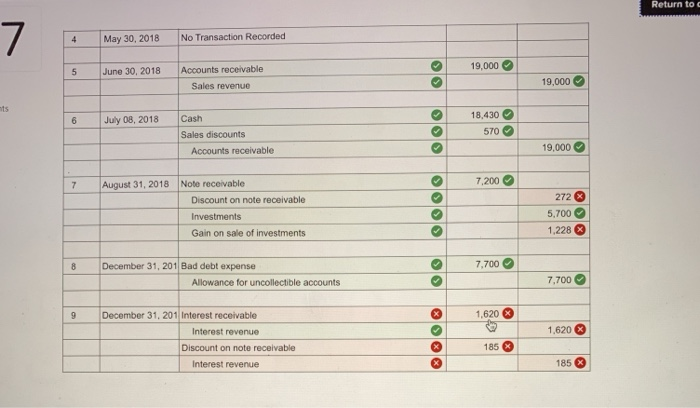

Check my work mode : This shows what is correct or incorrect for the work you have completed so fat. It does not indicate completion. Return to question 7 Exercise 7-24 Receivables; transaction analysis [LO7-3,7-5,7-6, 7-7,7-8 Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2018 oints Mar. 17 Accounts receivable ot $2,400 were written off as uncollectible. The company uses the allowance nethod. 30 Loaned an officer of the company $27,000 and received a note requiring prineipal and interest at 78 to be paid May 30 Discounted the $27,000 note at a local bank. The bank's discount rate is 8,The note vas discounted withoat June 30 Sold merchandise to the Blankenship Company for $19,000. Terms of the sale are 3/10, n/30. Weldon uses the gross on Harch 30, 2019. recourse and the sale eriteria are met method to account for eash discounts July 8 The Blankenship Company paid its account in full Aug. 31 Sold stock in a nonpublie company vith a book value of $5,700 and accepted a $7,200 noninterest-bearing note with a discount rate of 81. The $7,200 payment is due on February 28, 2019. The stock has no ready market value. Dec. 31 Bad debt expense is estimated to be 1t of credit sales for the year. Credit sales for 2018 were $770,000. Required: 1& 2. Prepare journal entries for each of the above transactions and additional year-end adjusting entries indicated. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field) 3 Answer is not complete. Answer is not complete. No Date General Journal Debit Credit March 17, 2018 Allowance for uncollectible accounts 2,400 Accounts receivable 2,400 2 March 30, 2018 Note receivable 27.000 Cash 27,000 3 May 30, 2018 Interest receivable 15 Interest revenue 15 4 May 30, 2018 No Transaction Recorded June 30, 2018 Accounts receivable Sales revenue 19,000 9,000 6 July 08, 2018 Cash 18,4 Sales discounts 570 Accounts receivable 9,000 7August 31, 2018 Note receivable 7,200 Discount on note receivable 272 3 5,700 Investments Return to c 7 4 May 30, 2018No Transaction Recorded 19,000 0 5 June 30, 2018 Accounts receivable 19,000 Sales revenue 18,430 570 ts 6 July 08, 2018 Cash Sales discounts 19,000 Accounts receivable 7.200 7August 31, 2018 Note receivable Discount on note receivable Investments Gain on sale of investments 272 03 5,700 1,228 7.700 8 December 31, 201 Bad debt expense Allowance for uncollectible accounts ,700 1,620 9 December 31, 201 Interest receivable Interest revenue 1,620 1850 Discount on note receivable Interest revenue 185