Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check your knowledge! If you complete all parts with a 70% score, you will unlock access to all activities and can proceed to prove your

Check your knowledge! If you complete all parts with a 70% score, you will unlock access to all activities and can proceed to prove your mastery. You can attempt this as many times as you want. Your work will be saved as you work through each part.

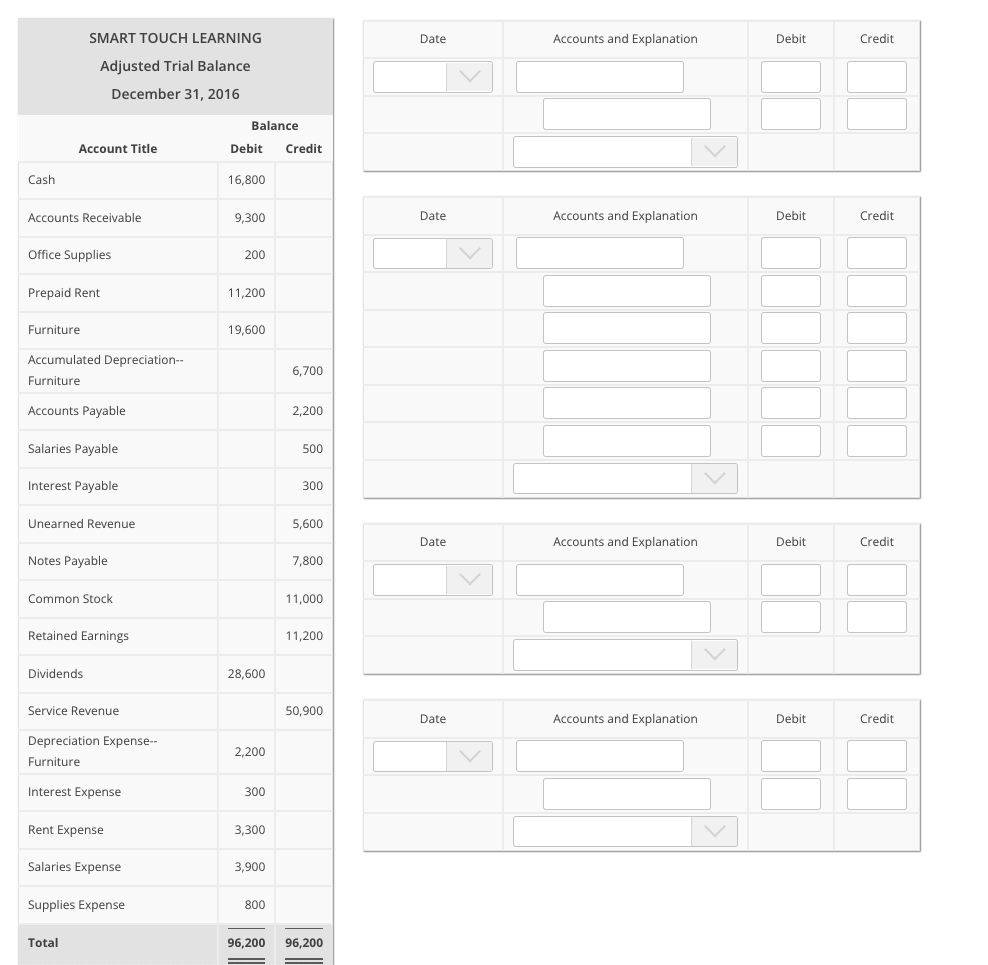

1. Using the information from the Adjusted Trial Balance, journalize the closing entries for the end of the month.

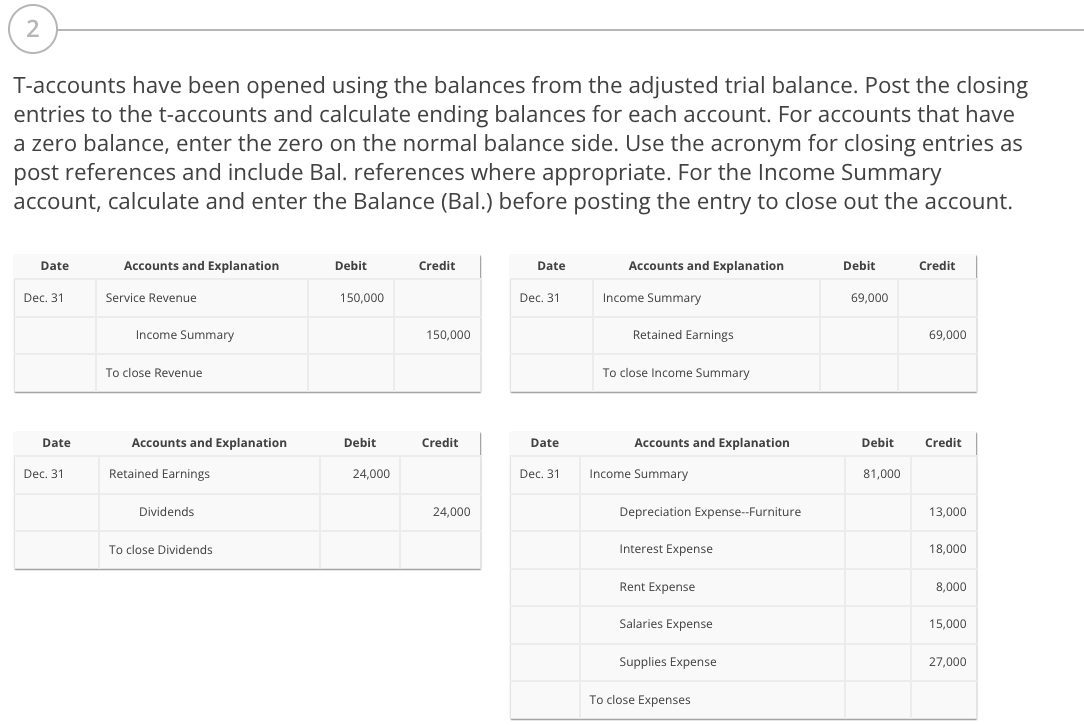

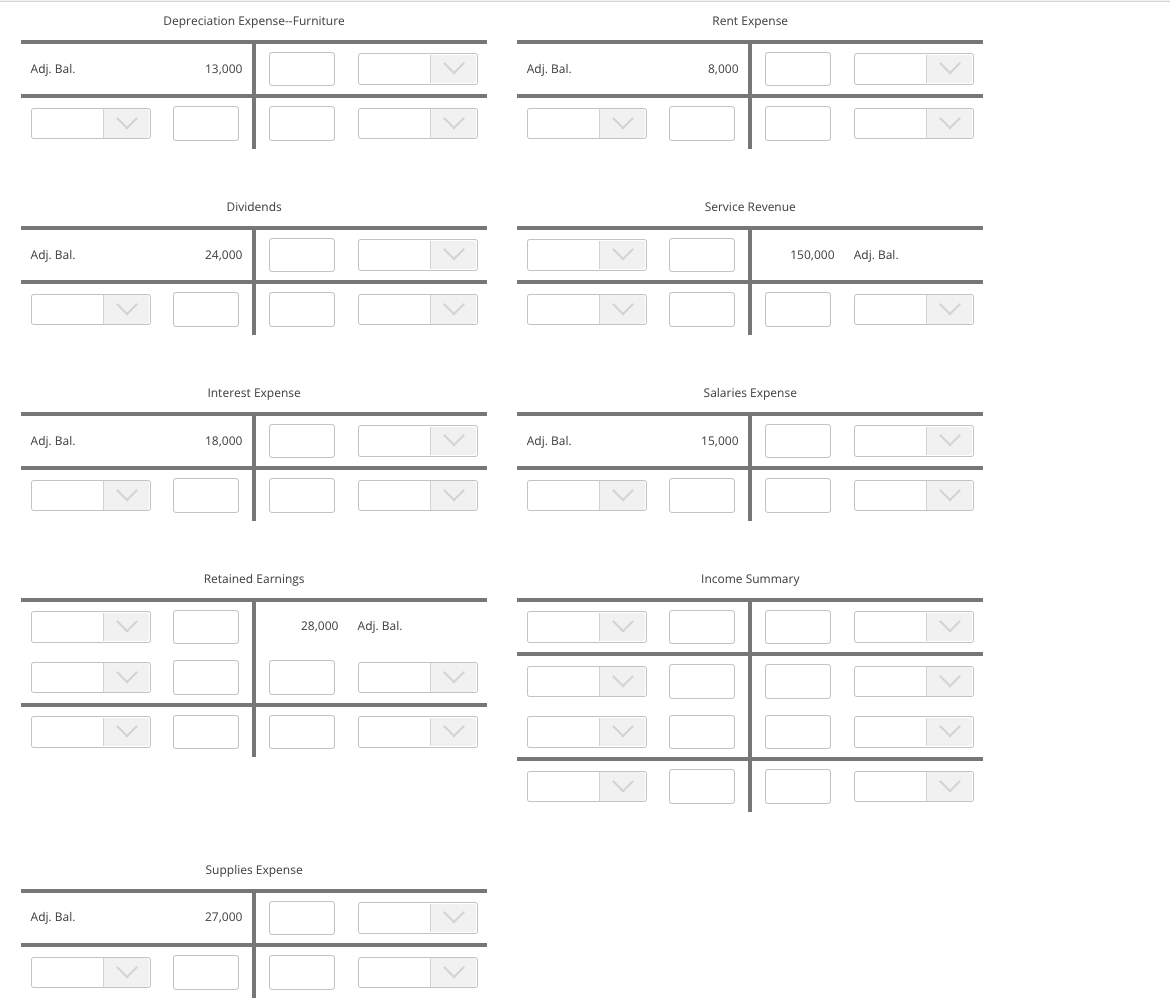

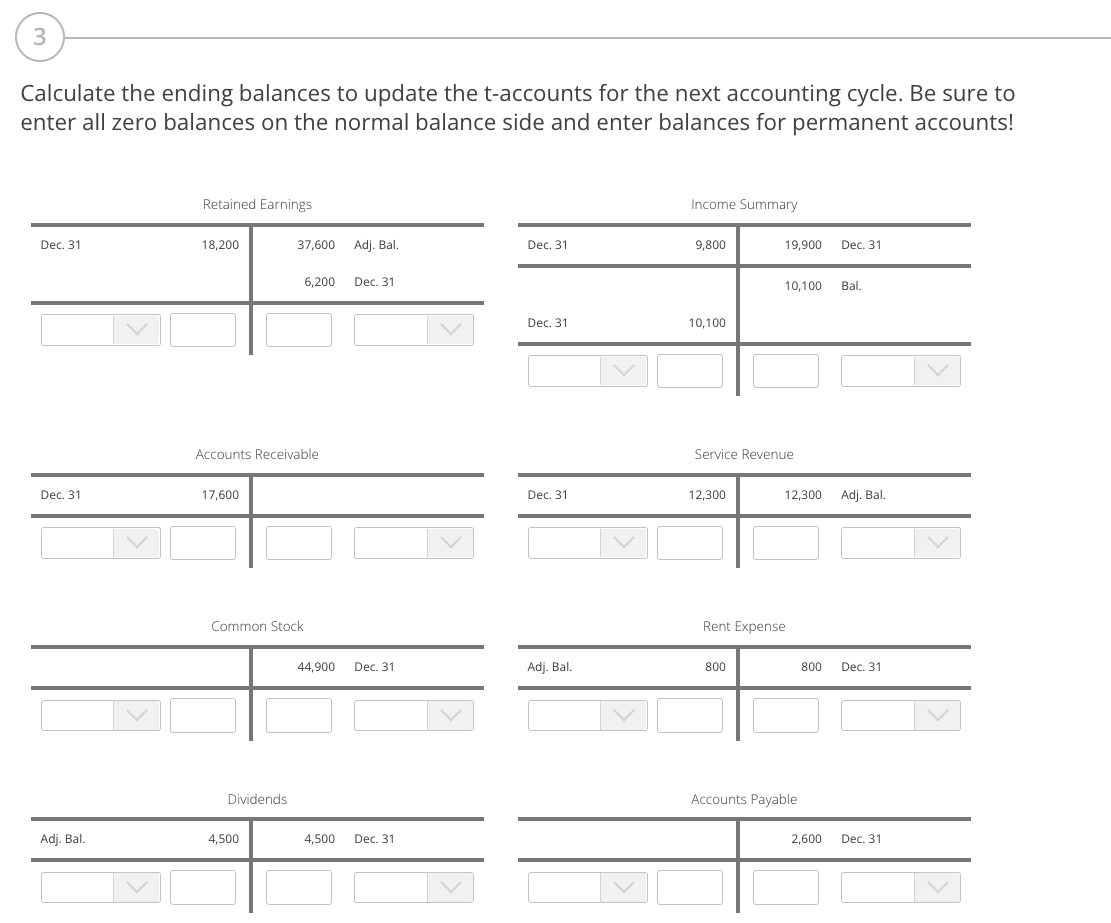

Date Accounts and Explanation Debit Credit SMART TOUCH LEARNING Adjusted Trial Balance December 31, 2016 Balance Debit Credit Account Title Cash 16,800 Accounts Receivable 9,300 Date Accounts and Explanation Debit Credit Office Supplies 200 Prepaid Rent 11,200 Furniture 19,600 Accumulated Depreciation- Furniture 6,700 Accounts Payable 2,200 Salaries Payable 500 Interest Payable 300 Unearned Revenue 5,600 Date Accounts and Explanation Debit Credit Notes Payable 7,800 Common Stock 11,000 Retained Earnings 11,200 Dividends 28,600 Service Revenue 50,900 Date Accounts and Explanation Debit Credit Depreciation Expense- Furniture 2,200 Interest Expense 300 Rent Expense 3,300 Salaries Expense 3,900 Supplies Expense 800 Total 96,200 96,200 T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the t-accounts and calculate ending balances for each account. For accounts that have a zero balance, enter the zero on the normal balance side. Use the acronym for closing entries as post references and include Bal. references where appropriate. For the Income Summary account, calculate and enter the Balance (Bal.) before posting the entry to close out the account. Date Accounts and Explanation Debit Credit Date Accounts and Explanation Debit Credit Dec. 31 Service Revenue 150,000 Dec. 31 Income Summary 69,000 Income Summary 150,000 Retained Earnings 69,000 To close Revenue To close Income Summary Date Accounts and Explanation Debit Credit Date Accounts and explanation Debit Credit Dec. 31 Retained Earnings 24,000 Dec. 31 Income Summary 81,000 Dividends 24,000 Depreciation Expense--Furniture 13,000 To close Dividends Interest Expense 18,000 Rent Expense 8,000 Salaries Expense 15,000 Supplies Expense 27,000 To close Expenses Depreciation Expense--Furniture Rent Expense Adj. Bal. 13,000 Adj. Bal. 8,000 Dividends Service Revenue Adj. Bal. 24,000 150,000 Adj. Bal. Interest Expense Salaries Expense Adj. Bal. 18,000 Adj. Bal. 15,000 Retained Earnings Income Summary 28,000 Adj. Bal. Supplies Expense Adj. Bal. 27,000 3 Calculate the ending balances to update the t-accounts for the next accounting cycle. Be sure to enter all zero balances on the normal balance side and enter balances for permanent accounts! Retained Earnings Income Summary Dec. 31 18,200 37,600 Adj. Bal. Dec. 31 9,800 19,900 Dec. 31 6,200 Dec. 31 10,100 Bal. Dec. 31 10,100 Accounts Receivable Service Revenue Dec. 31 17,600 Dec. 31 12,300 12,300 Adj. Bal. Common Stock Rent Expense 44,900 Dec. 31 Adj. Bal. 800 800 Dec. 31 Dividends Accounts Payable Adj. Bal. 4,500 4,500 Dec. 31 2,600 Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started