Answered step by step

Verified Expert Solution

Question

1 Approved Answer

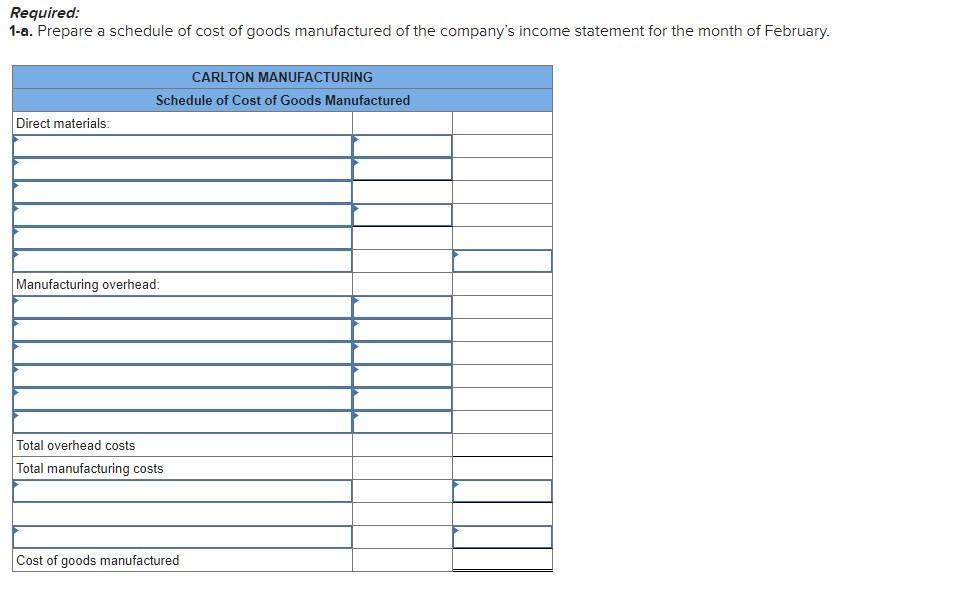

Choose : Administrative expenses Depreciation, factory Depreciation, factory equipment Direct labour Finished goods inventory, beginning Finished goods inventory, ending Indirect materials, factory Insurance, factory Maintenance,

Choose :

Administrative expenses

Depreciation, factory

Depreciation, factory equipment

Direct labour

Finished goods inventory, beginning

Finished goods inventory, ending

Indirect materials, factory

Insurance, factory

Maintenance, factory

Raw materials available for use

Raw materials inventory, beginning

Raw materials inventory, ending

Raw materials used in production

Rent, factory building

Sales

Selling expenses

Supplies, factory

Utilities, factory

Choose :

Add: Purchases of raw materials

Deduct: Purchases of raw materials

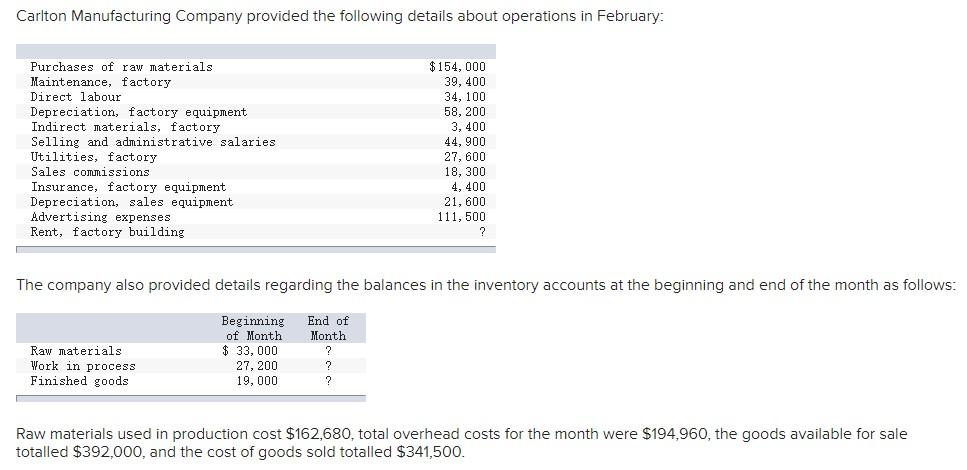

Carlton Manufacturing Company provided the following details about operations in February: The company also provided details regarding the balances in the inventory accounts at the beginning and end of the month as foll Raw materials used in production cost $162,680, total overhead costs for the month were $194,960, the goods available for sale totalled $392,000, and the cost of goods sold totalled $341,500. Required: 1-a. Prebare a schedule of cost of doods manufactured of the combanv's income statement for the month of FebruaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started