Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose out of the 3 options given. a) Sold merchandise to customers on credit. b) Sold merchandise to customers on credit. c) Purchased a two-year

Choose out of the 3 options given.

a) Sold merchandise to customers on credit.

b) Sold merchandise to customers on credit.

c) Purchased a two-year insurance contract.

d) Received cash for services to be performed over the next year.

e) Paid monthly employee salaries.

f) Borrowed money from First Bank by signing a note payable due in five years.

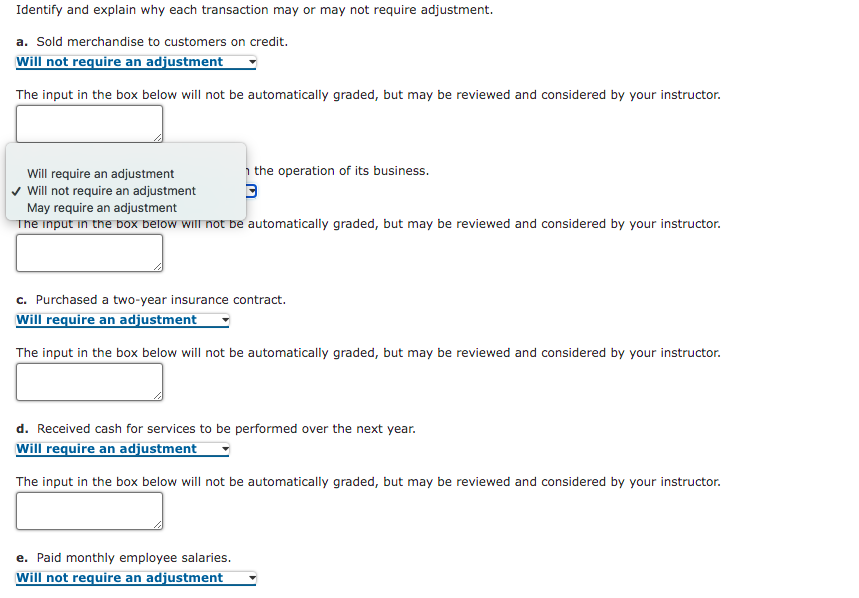

Identify and explain why each transaction may or may not require adjustment. a. Sold merchandise to customers on credit. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. Will require an adjustment Will not require an adjustment May require an adjustment c. Purchased a two-year insurance contract. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. d. Received cash for services to be performed over the next year. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. e. Paid monthly employee salaries. Will not require an adjustment

Identify and explain why each transaction may or may not require adjustment. a. Sold merchandise to customers on credit. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. Will require an adjustment Will not require an adjustment May require an adjustment c. Purchased a two-year insurance contract. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. d. Received cash for services to be performed over the next year. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. e. Paid monthly employee salaries. Will not require an adjustment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started