Answered step by step

Verified Expert Solution

Question

1 Approved Answer

choose the best answers 1. Which of the following statement(s) is false? I. A valuation model is an objective search for true value. II. A

choose the best answers

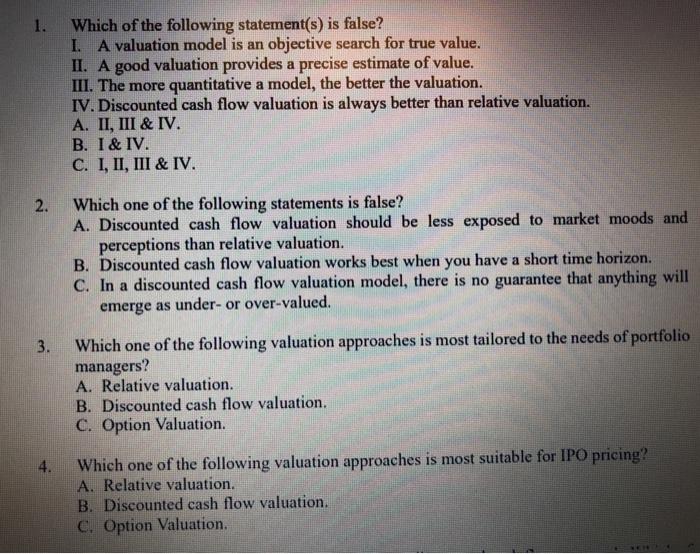

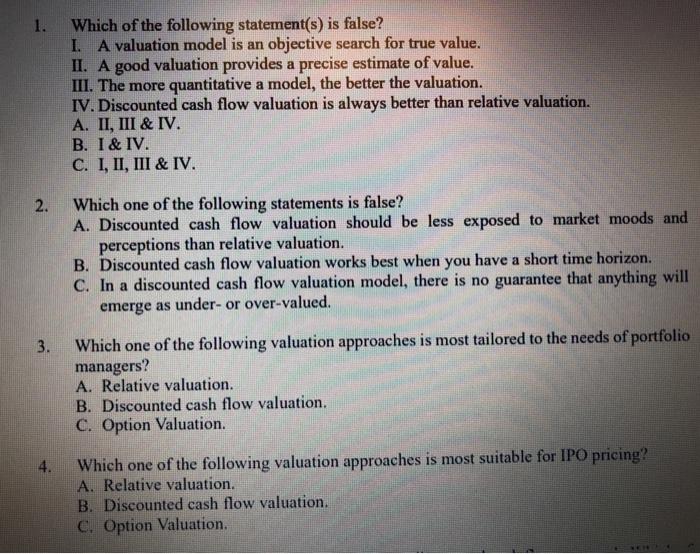

1. Which of the following statement(s) is false? I. A valuation model is an objective search for true value. II. A good valuation provides a precise estimate of value. III. The more quantitative a model, the better the valuation. IV. Discounted cash flow valuation is always better than relative valuation. A. II, III & IV. B. I & IV. C. I, II, III & IV. 2. Which one of the following statements is false? A. Discounted cash flow valuation should be less exposed to market moods and perceptions than relative valuation. B. Discounted cash flow valuation works best when you have a short time horizon. C. In a discounted cash flow valuation model, there is no guarantee that anything will emerge as under- or over-valued. 3. Which one of the following valuation approaches is most tailored to the needs of portfolio managers? A. Relative valuation. B. Discounted cash flow valuation. C. Option Valuation. 4. Which one of the following valuation approaches is most suitable for IPO pricing? A. Relative valuation. B. Discounted cash flow valuation. C. Option Valuation. +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started