CITIBANK EQUITY-LINKED CD

In the attached newspaper page advertising Citibanks Stock Index Insured Account, the bank promises Stock Market Returns. Zero Risk to Principal. In describing how it works, the advertisement explains that:

- The bank calculates the month-end average of the S&P 500 index average over the next five years, i.e. the average of 60 month-end S&P 500 index values.

- The bank takes the difference of the month-end average S&P 500 price and the value of the S&P 500 at the time of the deposit. If the difference is positive, i.e. the S&P has appreciated; the investor receives double the amount of the appreciation. If the difference is negative, i.e. the S&P has depreciated; the investor gets back the initial amount invested.

To make things simpler, assume that the bank simply offers to give the difference between the S&P 500 value at the end of five years and the initial index value if the S&P 500 appreciates (i.e. no averaging or doubling). If the S&P 500 depreciates, the investor gets back the initial principal.

-

- Draw a picture representing the payoffs to the investor.

-

- What is the cost to the investor for buying this product? For example, consider what the investor loses in comparison to a regular CD? Similarly, what does the investor lose in comparison to an investment in the S&P 500 Index Fund?

-

- Explain why an investor might be interested in this product. Why would Citibank offer such a product?

-

- What is the risk exposure to the bank from offering this product? How might the bank hedge this risk exposure?

-

- Discuss the difference the option that truly underlies the CD and the simplified version of the option that I you have analyzed.

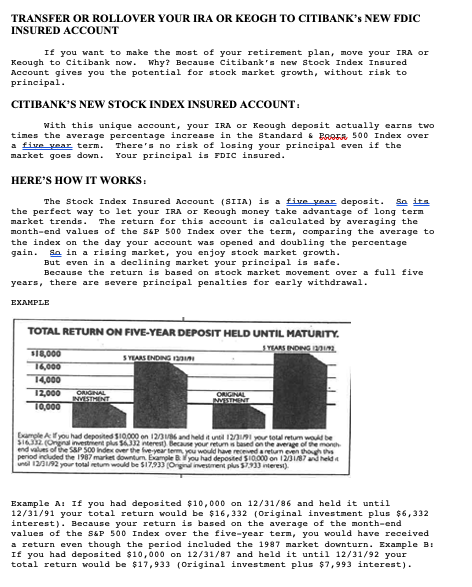

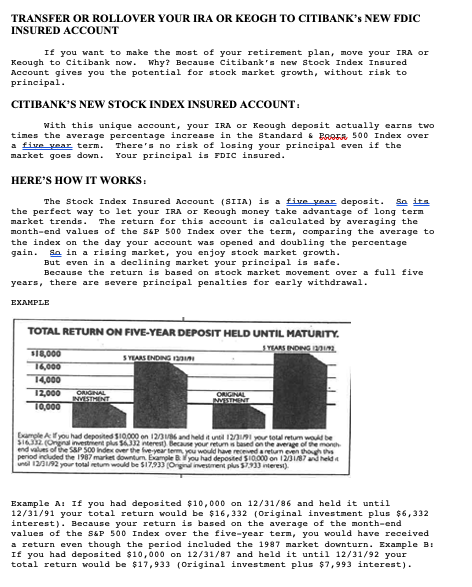

KURSI stock marke returns. Zero Kisk to principal: .: FLESSITATI Rada 17 --22 I! TRA gibt RO 8paraten 11. ube TRANSFER OR ROLLOVER YOUR IRA OR KEOGH Because the return is based on TO CITIBANK'S NEW FDIC INSURED ACCOUNT stock market movement over a five you there are severe principal If you want to make the most of S&P 500 Index over the term.com penalties for carly withdrawal. your retirement plan, move your paring this average to the Index on HERE'S HOW TO START: IRA Keogh to thank now the day your account was opened For more Wormatien Why Because bank's new Stock and doubling the percentage yan Index Immured or to rollover or transfer your So in arising market you enjoy IRA Keogh stopila Accountives stock markt growth EXCLUSIVELY Chunk branch today or call you the potential FOR IRAN But even in a declining market for stock market 1-800-321-CITL ext. 7102 ANO KECGHS your principalis growth without risk to principal TOTAL RETURN ON FIVE-YEAR DEPOSIT HELD UNTIL MATURITY SIMIL CITIBANK'S NEW STOCK INDEX INSURED ACCOUNT With this unique account your IRA or Keogh deposit actually BE TE two times the average percentage Increase in the Sundard & Poor's 500 index or a five year term. vad biu Yetis 100syle. Theresnarik of Si 4-losing your principal even if the TORB market goes down your principal is FDIC insured The Stock Index Insured You can call any day of the 199 HERE'S HOW IT WOKS. Account is only wwwble at Chibank week. crenon weekend The Stock Index 1-800-321-CITI Account is a five year deposit Sok's THE CITI NEVER SLEEPS- And unments with a 16 the perfect way to your IRA Keogh money take advantage of broker or in some mutual funch, TINO long-term market trends. The return there are no management fees or for the count is calculated by aver sales charges. And there no risk to IS Propol The minimum depositis azing the month-end values of the only $10.000 obo 19-282-42LES LEPEL LLLLL L...12- ---- CITIBANCO TRANSFER OR ROLLOVER YOUR IRA OR KEOGH TO CITIBANK's NEW FDIC INSURED ACCOUNT If you want to make the most of your retirement plan, nove your IRA OF Keough to Citibank now. Why? Because Citibank's new Stock Index Insured Account gives you the potential for stock market growth, without risk to principal. CITIBANK'S NEW STOCK INDEX INSURED ACCOUNT: With this unique account, your IRA or Keough deposit actually earns two times the average percentage increase in the standard & Porr 500 Index over a five year term. There's no risk of losing your principal even if the market goes down. Your principal is PDIC insured. HERE'S HOW IT WORKS: The Stock Index Insured Account (SIIA) is a five year deposit. So its the perfect way to let your IRA Or Keough money take advantage of long term market trends. The return for this account is calculated by averaging the month-end values of the sa 500 Index over the term, comparing the average to the index on the day your account was opened and doubling the percentage gain. So in a rising market, you enjoy stock market growth. But even in a declining market your principal is safe. Because the return is based on stock market movement over a full five years, there are severe principal penalties for early withdrawal. EXAMPLE TOTAL RETURN ON FIVE-YEAR DEPOSIT HELD UNTIL MATURITY. YEARS INONG 110,000 SYEARS ENDING 16000 14,000 12,000 ORIGINAL ORIGINAL INVESTMENT MESINENT 10,000 Example All you had deposited $10,000 on 12/6wdedit 12 you to return wul be 31632 Onester plus 5632 nerest) because your return is based on the average of the month and values of the S&P 500 index over the five-year term you would have received a return even though period ncluded the 1987 market downtun bample B you had deposted 510.000 on 12/31/87 and held until 121/92 your total retum would be 517,933 [ord verer plus 5793) interest) Example A: If you had deposited $10,000 on 12/31/86 and held it until 12/31/91 your total return would be $16,332 (Original investment plus $6,332 interest). Because your return is based on the average of the month-end values of the S&P 500 Index over the five-year term, you would have received a return even though the period included the 1987 market downturn. Example B: If you had deposited $10,000 on 12/31/87 and held it until 12/31/92 your total return would be $17,933 (Original investment plus $7,993 interest)