Answered step by step

Verified Expert Solution

Question

1 Approved Answer

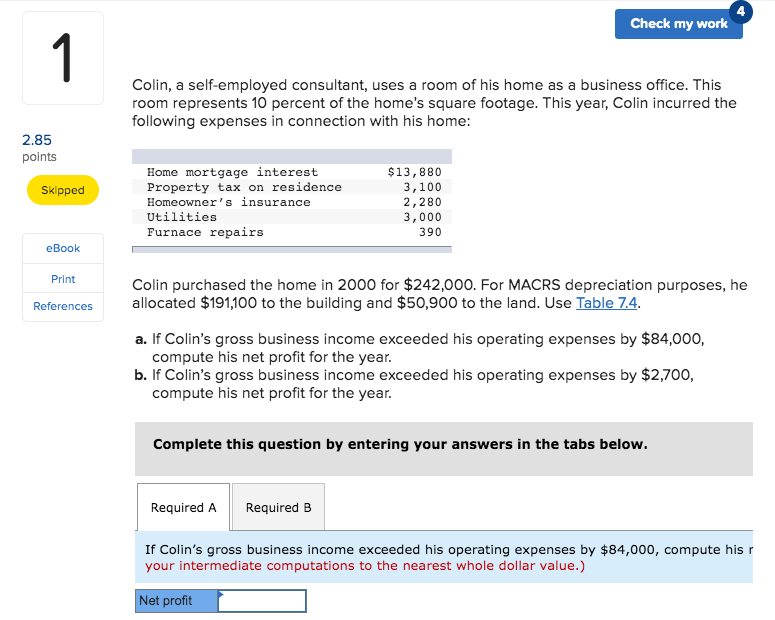

Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the homes square footage. This

Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the homes square footage. This year, Colin incurred the following expenses in connection with his home:

| Home mortgage interest | $ | 13,880 | |

| Property tax on residence | 3,100 | ||

| Homeowners insurance | 2,280 | ||

| Utilities | 3,000 | ||

| Furnace repairs | 390 | ||

Colin purchased the home in 2000 for $242,000. For MACRS depreciation purposes, he allocated $191,100 to the building and $50,900 to the land. Use Table 7.4.

- If Colins gross business income exceeded his operating expenses by $84,000, compute his net profit for the year.

- If Colins gross business income exceeded his operating expenses by $2,700, compute his net profit for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started