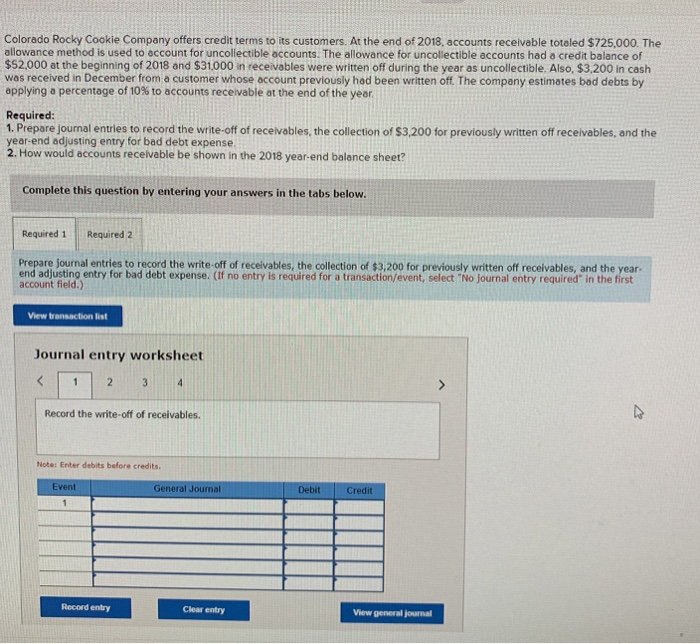

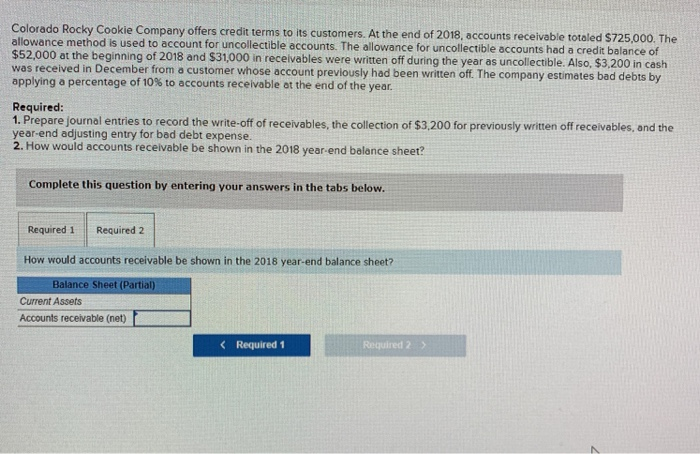

Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totoled $725,000. The allowance method is used to account for uncollectible accounts. The allowance for uncolectible accounts had a credit balance of $52,000 at the beginning of 2018 and $31000 in receivables were written off during the year as uncollectible. Also, $3,200 in cash was received in December from a customer whose account previously had been written off. The company estimates bod debts by applying a percentage of 10% to accounts receivable at the end of the year, Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $3.200 for previously written off receivables, and the year-end adjusting entry for bad debt expense 2. How would accounts recelvable be shown in the 2018 year-end balance sheet? Complete this question by entering your answers in the tabs below Required 1 Required 2 Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously written off receivables, and the year end adjusting entry for bad debt expense. (If no entry is required for a transaction/event, select No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the write-off of receivables Note: Enter debits before credits Event General Journal Debit Record entry Clear entry View general journal Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totaled $725,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of at the beginning of 2018 and $31,000 in receivables were written off during the year as uncollectible. Also, $3,200 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts receivable at the end of the year. Required 1. Prepare journal entries to record the write-off of receivables, the collection of $3.200 for previously wrtten off receivables, and the year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2018 year end belance sheet? Complete this question by entering your answers in the tabs below Required 1 Required 2 How would accounts receivable be shown in the 2018 year-end balance sheet? nce Current Assets Accounts receivable (net) Required 1 Required 2 >