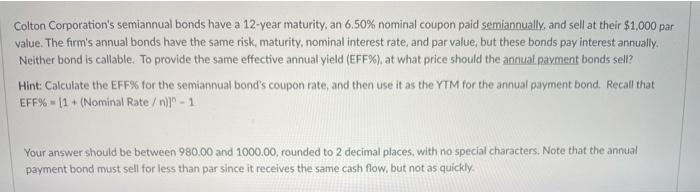

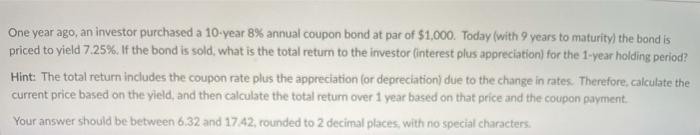

Colton Corporation's semiannual bonds have a 12-year maturity, an 6.50% nominal coupon paid semiannually, and sell at their $1,000 par value. The firm's annual bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. To provide the same effective annual yield (EFF%), at what price should the annual payment bonds sell? Hint: Calculate the EFF% for the semiannual bond's coupon rate, and then use it as the YTM for the annual payment bond. Recall that EFF%- 11 + (Nominal Rate /)" - 1 Your answer should be between 980.00 and 1000.00, rounded to 2 decimal places, with no special characters. Note that the annual payment bond must sell for less than par since it receives the same cash flow, but not as quickly One year ago, an investor purchased a 10-year 8% annual coupon bond at par of $1,000. Today (with 9 years to maturity) the bond is priced to yield 7.25%. If the bond is sold, what is the total return to the investor interest plus appreciation) for the 1-year holding period? Hint: The total return includes the coupon rate plus the appreciation for depreciation) due to the change in rates. Therefore, calculate the current price based on the yield, and then calculate the total return over 1 year based on that price and the coupon payment Your answer should be between 6.32 and 1742, rounded to 2 decimal places, with no special characters PES Colton Corporation's semiannual bonds have a 12-year maturity, an 6.50% nominal coupon paid semiannually, and sell at their $1,000 par value. The firm's annual bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. To provide the same effective annual yield (EFF%), at what price should the annual payment bonds sell? Hint: Calculate the EFF% for the semiannual bond's coupon rate and then use it as the YTM for the annual payment bond. Recall that EFF%= (1 + (Nominal Rate/)- 1 Your answer should be between 980.00 and 1000.00, rounded to 2 decimal places, with no special characters. Note that the annual payment bond must sell for less than par since it receives the same cash flow, but not as quickly