Company-wide Contribution Margin Statements Worksheet - Variable Costing Method (no product line allocation needed):

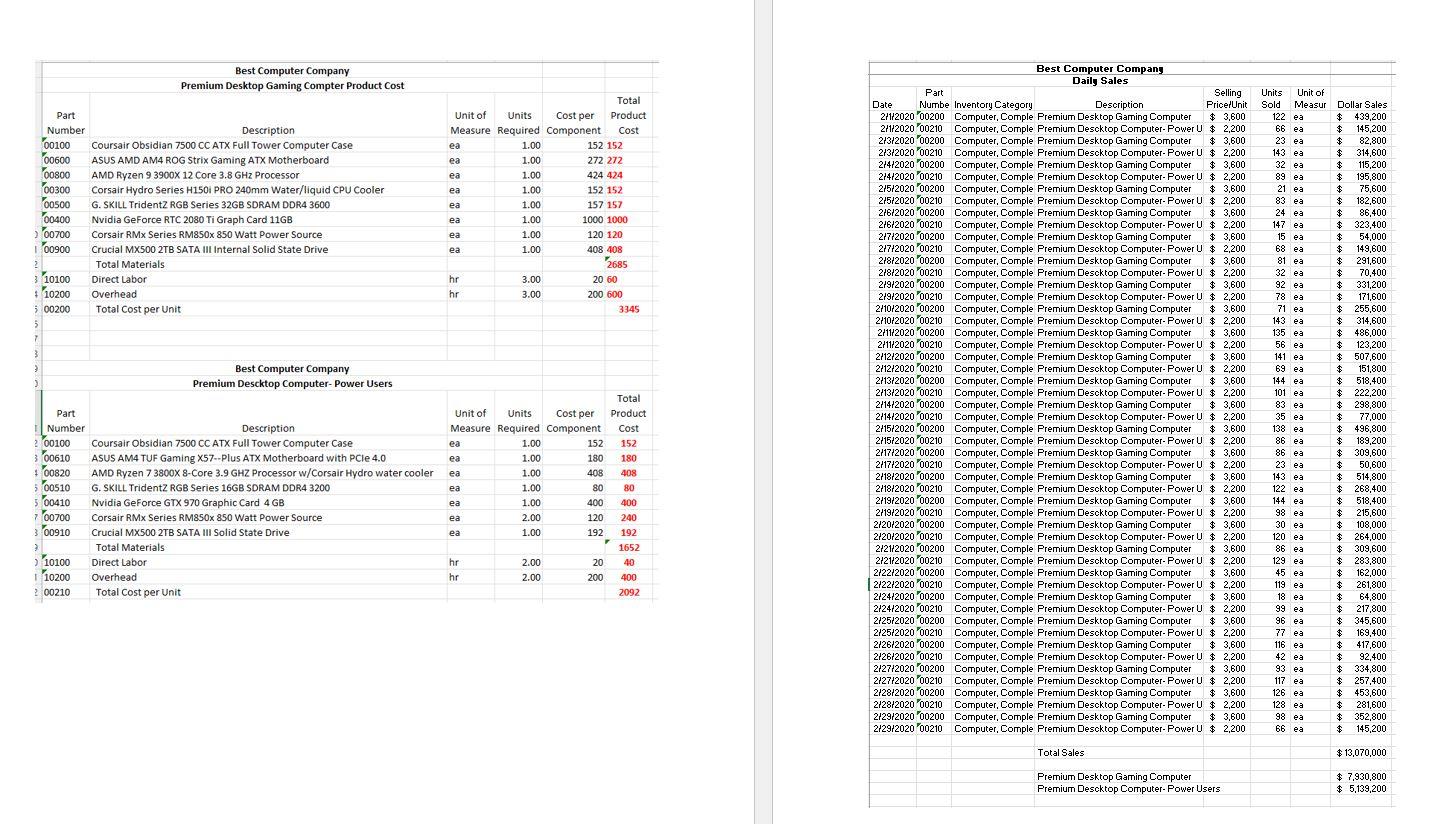

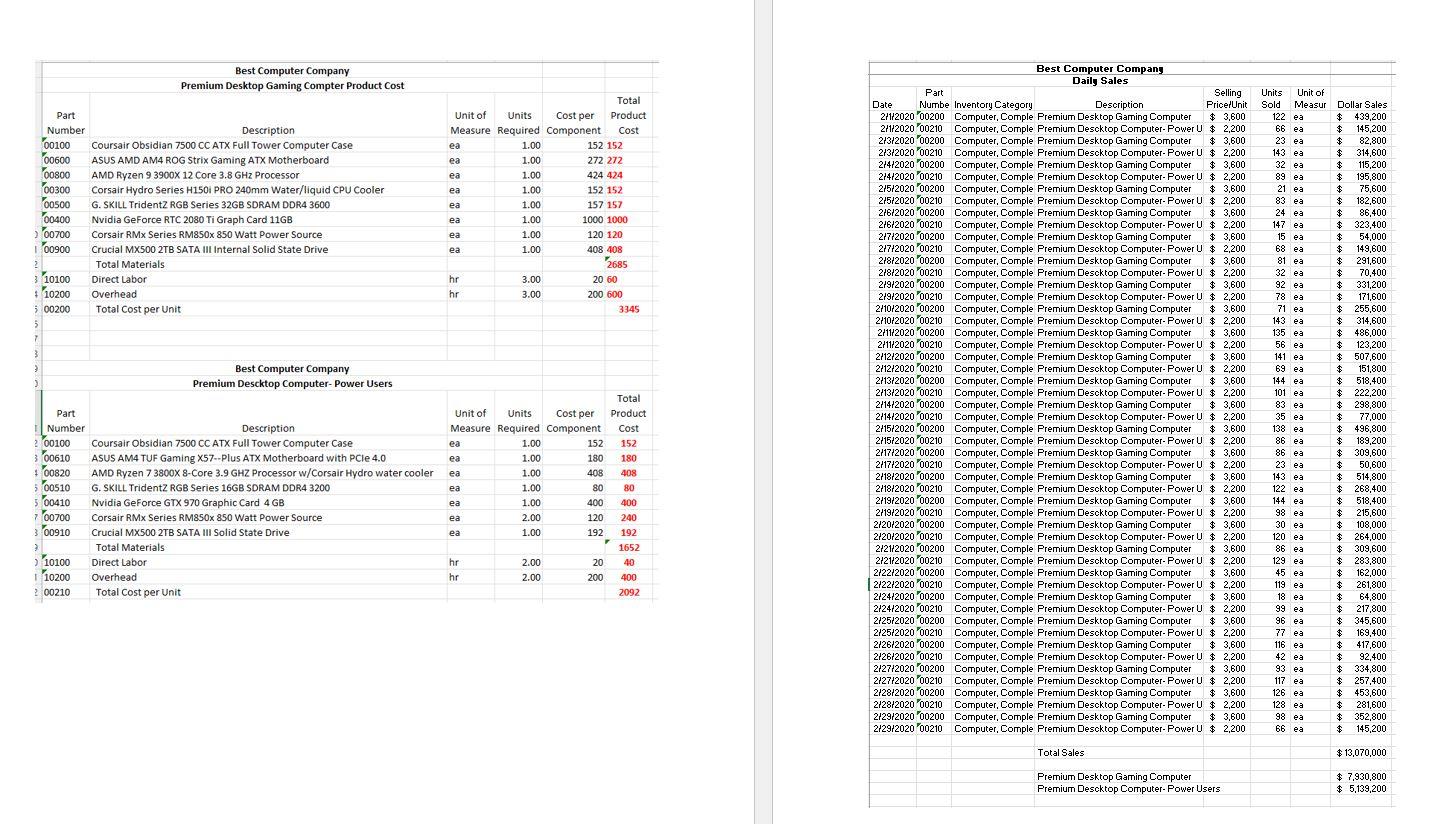

Calculate the total product material variable cost referencing the "product cost" worksheet, and "daily sales" worksheet.

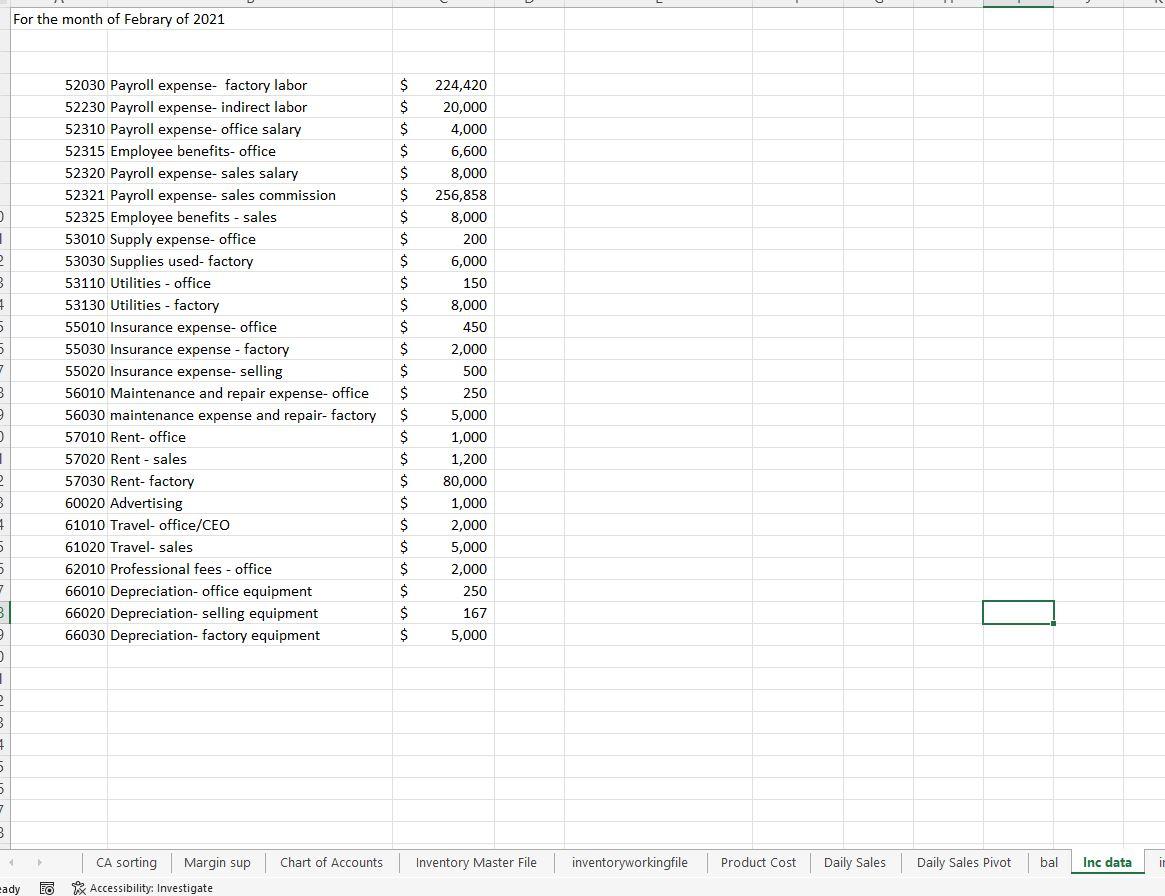

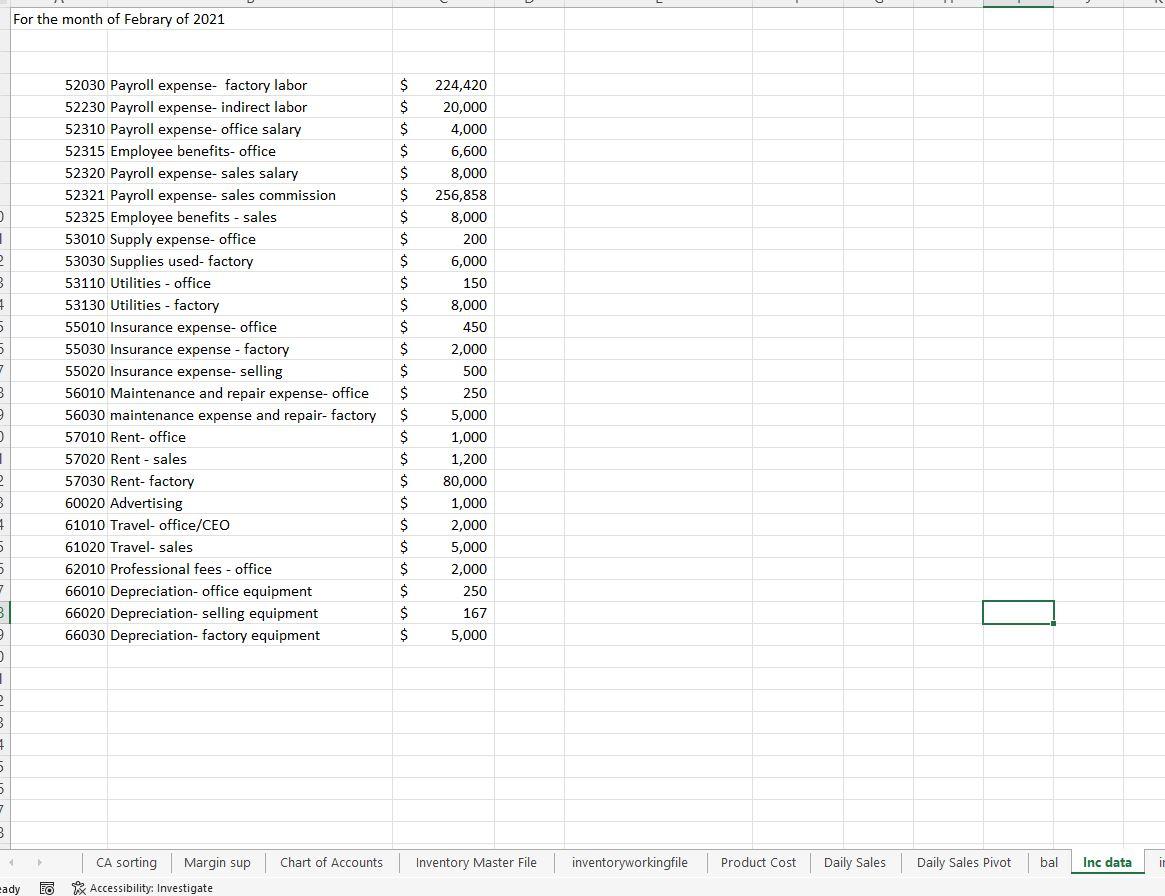

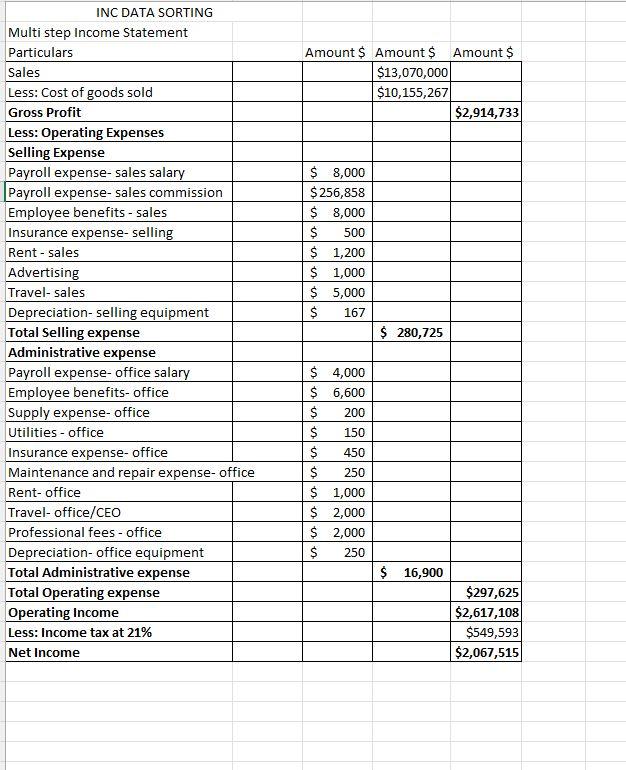

Clean up the worksheet by deleting all balance sheet accounts not needed. You should only use the accounts in income statement sorted by type.

Using VLookup bring the account balance from the "inc data sheet by referencing account number. Sum the total fixed cost and total variable cost (not including the variable material cost).

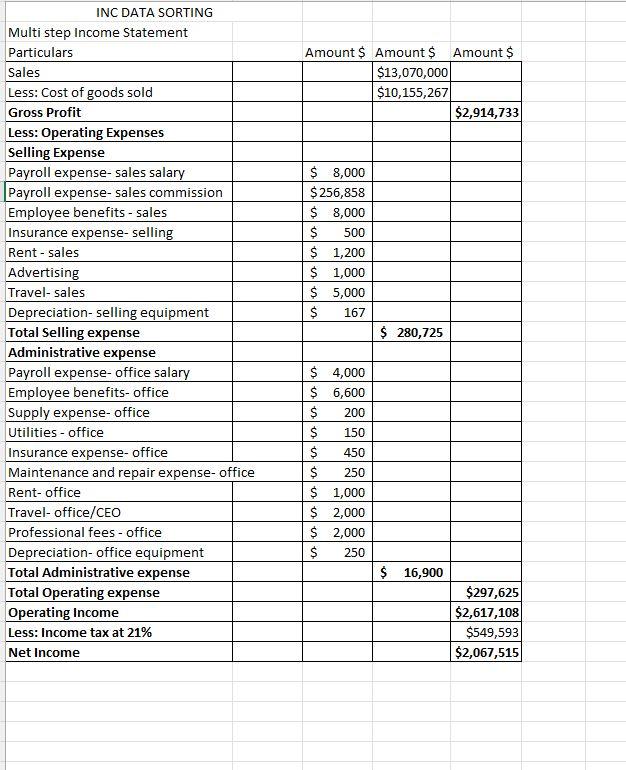

For the month of Febrary of 2021 \begin{tabular}{|l|rr} \hline 52030 Payroll expense- factory labor & $ & 224,420 \\ \hline 52230 Payroll expense- indirect labor & $ & 20,000 \\ \hline 52310 Payroll expense- office salary & $ & 4,000 \\ \hline 52315 Employee benefits- office & $ & 6,600 \\ \hline 52320 Payroll expense- sales salary & $ & 8,000 \\ \hline 52321 Payroll expense- sales commission & $ & 256,858 \\ \hline 52325 Employee benefits - sales & $ & 8,000 \\ \hline 53010 Supply expense- office & $ & 200 \\ \hline 53030 Supplies used- factory & $ & 6,000 \\ \hline 53110 Utilities - office & $ & 150 \\ \hline 53130 Utilities - factory & $ & 8,000 \\ \hline 55010 Insurance expense- office & $ & 450 \\ \hline 55030 Insurance expense - factory & $ & 2,000 \\ \hline 55020 Insurance expense- selling & $ & 500 \\ \hline 56010 Maintenance and repair expense- office & $ & 250 \\ \hline 56030 maintenance expense and repair-factory & $ & 5,000 \\ \hline 57010 Rent- office & $ & 1,000 \\ \hline 57020 Rent - sales & $ & 1,200 \\ \hline 57030 Rent- factory & $ & 80,000 \\ \hline 60020 Advertising & $ & 1,000 \\ \hline 61010 Travel- office/CEO & $ & 2,000 \\ \hline 61020 Travel- sales & $ & 5,000 \\ \hline 62010 Professional fees - office & 2,000 \\ \hline 66010 Depreciation- office equipment & 250 \\ \hline 66020 Depreciation- selling equipment & 167 \\ \hline 66030 Depreciation- factory equipment & $ & \\ \hline \end{tabular} Accounting policies Best Computer Company INC DATA SORTING Multi step Income Statement For the month of Febrary of 2021 \begin{tabular}{|l|rr} \hline 52030 Payroll expense- factory labor & $ & 224,420 \\ \hline 52230 Payroll expense- indirect labor & $ & 20,000 \\ \hline 52310 Payroll expense- office salary & $ & 4,000 \\ \hline 52315 Employee benefits- office & $ & 6,600 \\ \hline 52320 Payroll expense- sales salary & $ & 8,000 \\ \hline 52321 Payroll expense- sales commission & $ & 256,858 \\ \hline 52325 Employee benefits - sales & $ & 8,000 \\ \hline 53010 Supply expense- office & $ & 200 \\ \hline 53030 Supplies used- factory & $ & 6,000 \\ \hline 53110 Utilities - office & $ & 150 \\ \hline 53130 Utilities - factory & $ & 8,000 \\ \hline 55010 Insurance expense- office & $ & 450 \\ \hline 55030 Insurance expense - factory & $ & 2,000 \\ \hline 55020 Insurance expense- selling & $ & 500 \\ \hline 56010 Maintenance and repair expense- office & $ & 250 \\ \hline 56030 maintenance expense and repair-factory & $ & 5,000 \\ \hline 57010 Rent- office & $ & 1,000 \\ \hline 57020 Rent - sales & $ & 1,200 \\ \hline 57030 Rent- factory & $ & 80,000 \\ \hline 60020 Advertising & $ & 1,000 \\ \hline 61010 Travel- office/CEO & $ & 2,000 \\ \hline 61020 Travel- sales & $ & 5,000 \\ \hline 62010 Professional fees - office & 2,000 \\ \hline 66010 Depreciation- office equipment & 250 \\ \hline 66020 Depreciation- selling equipment & 167 \\ \hline 66030 Depreciation- factory equipment & $ & \\ \hline \end{tabular} Accounting policies Best Computer Company INC DATA SORTING Multi step Income Statement