Answered step by step

Verified Expert Solution

Question

1 Approved Answer

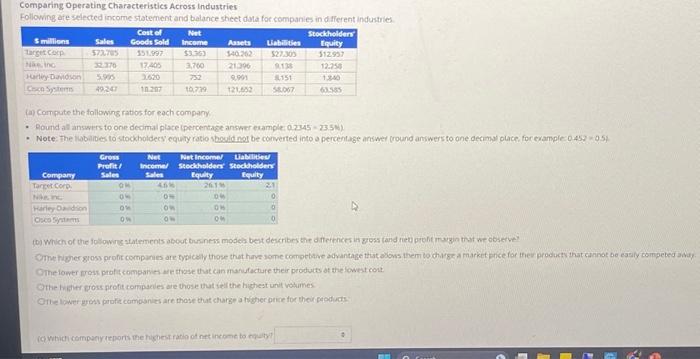

Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries. $ millions Target Corp. Nike, Inc.

Comparing Operating Characteristics Across Industries Following are selected income statement and balance sheet data for companies in different industries. $ millions Target Corp. Nike, Inc. Harley-Davidson Cisco Systems B Sales $73,785 32,376 5,995 49,247 Company Target Corp. Nike, Inc. Harley-Davidson Cisco Systems Cost of Goods Sold $51.997 17,405 3.620 18,287 Gross Profit/ Sales (a) Compute the following ratios for each company. Round all answers to one decimal place (percentage answer example: 0.2345 = 23.5%). Note: The liabilities to stockholders' equity ratio should not be converted into a percentage answer (round answers to one decimal place, for example: 0.452 = 0.5). 096 0% 0% 0% Net Income $3,363 3,760 752 10,739 Net Net Income/ Income/ Stockholders' Sales Equity 4.6% 096 096 0% Assets Liabilities $27,305 $40,262 21.396 9,138 9,991 8,151 121,652 58,067 26.1.96 096 0% 0% Liabilities/ Stockholders' Equity 2.1 0 0 0 Stockholders' Equity $12,957 12,258 1,840 63,585 (b) Which of the following statements about business models best describes the differences in gross (and net) profit margin that we observe? OThe higher gross profit companies are typically those that have some competitive advantage that allows them to charge a market price for their products that cannot be easily competed away. OThe lower gross profit companies are those that can manufacture their products at the lowest cost. OThe higher gross profit companies are those that sell the highest unit volumes. OThe lower gross profit companies are those that charge a higher price for their products. (c) Which company reports the highest ratio of net income to equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started