Answered step by step

Verified Expert Solution

Question

1 Approved Answer

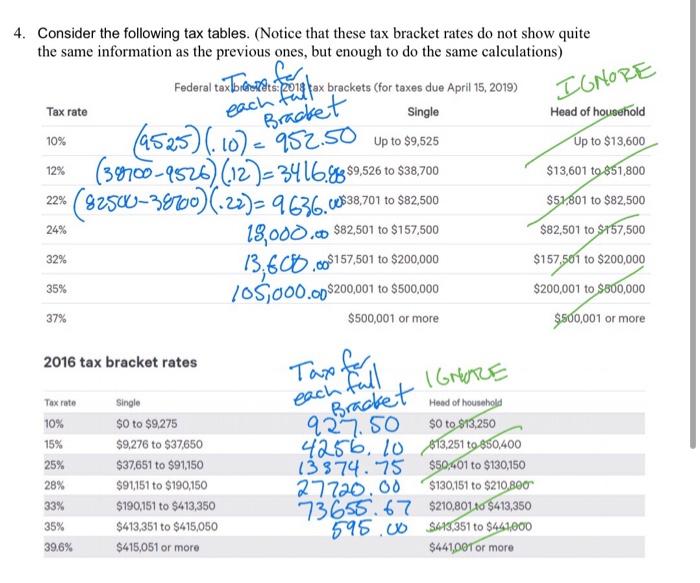

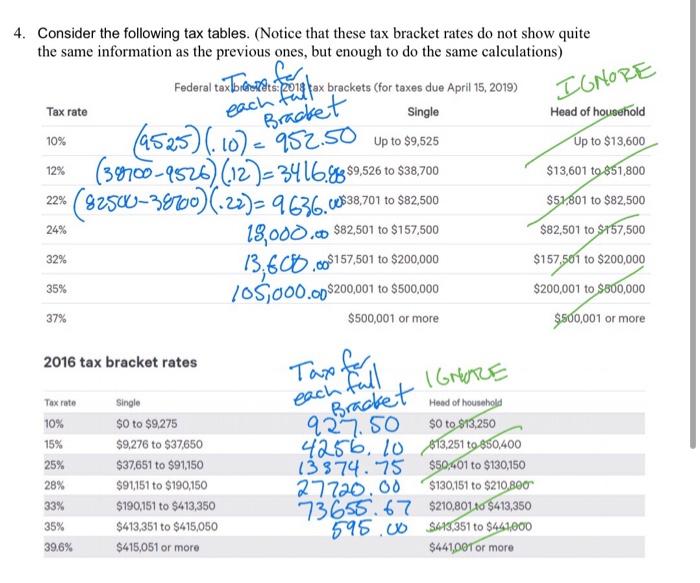

comparing tax rates need help i will thumbs up thankyou!! IGNORE each ta Bracket 12% 4. Consider the following tax tables. (Notice that these tax

comparing tax rates need help

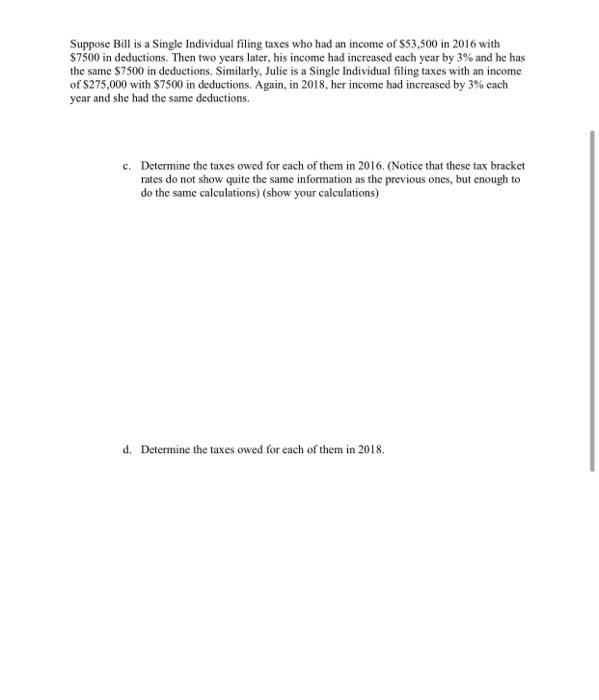

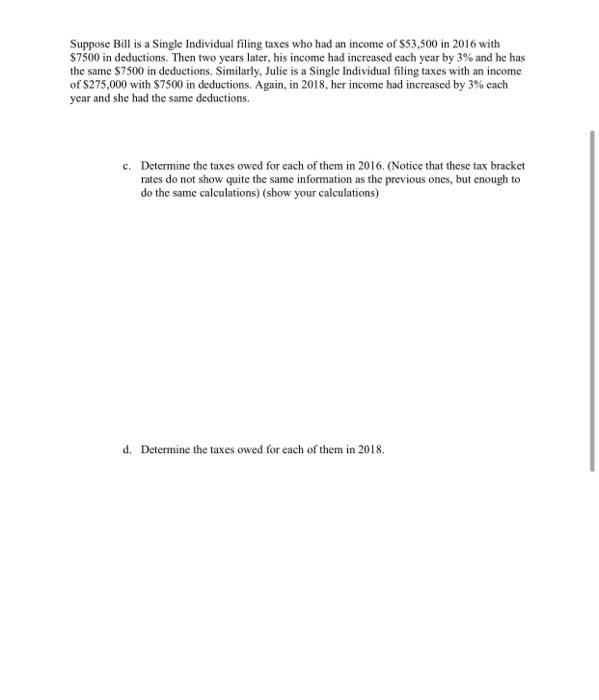

IGNORE each ta Bracket 12% 4. Consider the following tax tables. (Notice that these tax bracket rates do not show quite the same information as the previous ones, but enough to do the same calculations) Federal tax boieraksts pouq|ax brackets (for taxes due April 15, 2019) Tax rate Single Head of household 10% (95255) (.10) - 952.50 Up to $9525 Up to $13,600 (39700-9526) (12)-3416.4%959,526 to $38,700 $13,601 to 851,800 (8250-3000)(.22)=9636.ce838,701 to $62.500 $57,801 to $82,500 18,000.co $82,501 to $157,500 $82,501 to $157,500 $157,501 to $200,000 105,000.00$200,001 to $500.000 $200,001 to $800,000 37% $500,001 or more $500,001 or more 22% 24% 32% 13,600,00$157,501 to $200,000 35% 2016 tax bracket rates IGNORE each full Tax for Bracket Tax rate 10% 15% 25% 28% 33% 35% Single $0 to $9.275 $9,276 to $37,650 $37,651 to $91,150 $91,151 to $190,150 $190,151 to $413,350 $413,351 to $415,050 $415,051 or more Head of household 927.50 $0 to $13,250 4256.10 $13,251 to $50,400 13374.75 $50,401 to $130,150 27720.00 $130,151 to $210,800 73655.67 $210,80140 $413,350 595.00 $443,351 to $441000 $441,001 or more 39.6% Suppose Bill is a Single Individual filing taxes who had an income of $53,500 in 2016 with $7500 in deductions. Then two years later, his income had increased each year by 3% and he has the same $7500 in deductions. Similarly, Julic is a Single Individual filing taxes with an income of S275,000 with S7500 in deductions. Again, in 2018, her income had increased by 3% each year and she had the same deductions, c. Determine the taxes owed for cach of them in 2016. (Notice that these tax bracket rates do not show quite the same information as the previous ones, but enough to do the same calculations) (show your calculations) d. Determine the taxes owed for each of them in 2018. e. In a few full sentences, compare the taxes paid and the effective tax rates for both of the individuals in both years i will thumbs up thankyou!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started