Question

Complete an Income Approach to value, using both DCF and Direct Capitalization techniques. (relevant information provided in pictures, first 2 info, last table is comparable

Complete an Income Approach to value, using both DCF and Direct Capitalization techniques. (relevant information provided in pictures, first 2 info, last table is comparable properties).

a. Assume a five-year holding period for your analysis, and a 1.75% cost of sales.

b. Determine an appropriate capitalization rate from the comparables provided. Make sure to substantiate your capitalization rate selection process. Assume a 0.5% risk increase in your discount rate, and a further 0.5% increase in your terminal cap rate over your going-in cap rate.

Please round to nearest dollar and state assumptions. Show the work for each step.

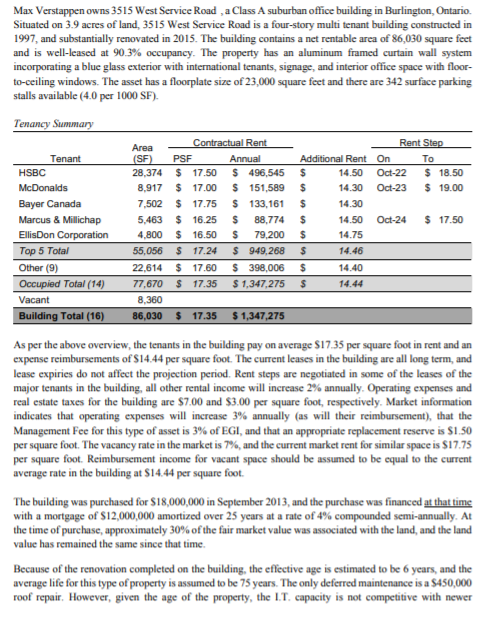

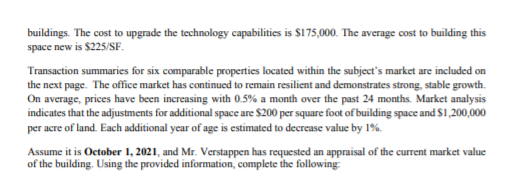

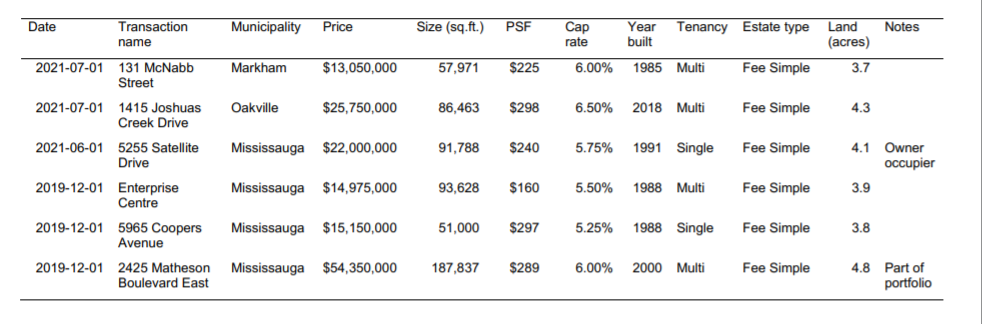

Max Verstappen owns 3515 West Service Road , a Class A suburban office building in Burlington, Ontario Situated on 3.9 acres of land, 3515 West Service Road is a four-story multi tenant building constructed in 1997, and substantially renovated in 2015. The building contains a net rentable area of 86,030 square feet and is well-leased at 90.3% occupancy. The property has an aluminum framed curtain wall system incorporating a blue glass exterior with international tenants, signage, and interior office space with floor- to-ceiling windows. The asset has a floorplate size of 23,000 square feet and there are 342 surface parking stalls available (4.0 per 1000 SF). Tenancy Summary Contractual Rent Area Rent Step Tenant (SF) PSF Annual Additional Rent On HSBC 28,374 $ 17.50 $ 496,545 $ 14.50 Oct-22 $ 18.50 McDonalds 8,917 $ 17.00 $ 151,589 14.30 Oct-23 $ 19.00 Bayer Canada 7,502 $ 17.75 $ 133,161 $ 14.30 Marcus & Millichap 5.463 $ 16.25 S 88,774 $ 14.50 $17.50 EllisDon Corporation 4,800 $ 16.50 $ 79,200 $ 14.75 Top 5 Total 55,056 $ 17.24 $ 949,268 $ 14.46 Other (9) 22.614 $ 17.60 $ 398,006 Occupied Total (14) 77,670 $ 17.35 $ 1,347,275 $ 14.44 Vacant 8,360 Building Total (16) 86,030 $ 17.35 $ 1,347,275 $ Oct-24 $ 14.40 As per the above overview, the tenants in the building pay on average $17.35 per square foot in rent and an expense reimbursements of $14.44 per square foot. The current leases in the building are all long term, and lease expiries do not affect the projection period. Rent steps are negotiated in some of the leases of the major tenants in the building, all other rental income will increase 2% annually. Operating expenses and real estate taxes for the building are $7.00 and $3.00 per square foot, respectively. Market information indicates that operating expenses will increase 3% annually (as will their reimbursement), that the Management Fee for this type of asset is 3% of EGI, and that an appropriate replacement reserve is $1.50 per square foot. The vacancy rate in the market is 7%, and the current market rent for similar space is $17.75 per square foot. Reimbursement income for vacant space should be assumed to be equal to the current average rate in the building at $14.44 per square foot. The building was purchased for $18,000,000 in September 2013, and the purchase was financed at that time with a mortgage of $12,000,000 amortized over 25 years at a rate of 4% compounded semi-annually. At the time of purchase, approximately 30% of the fair market value was associated with the land, and the land value has remained the same since that time. Because of the renovation completed on the building, the effective age is estimated to be 6 years, and the average life for this type of property is assumed to be 75 years. The only deferred maintenance is a $450,000 roof repair. However, given the age of the property, the IT. capacity is not competitive with newer buildings. The cost to upgrade the technology capabilities is $175,000. The average cost to building this space new is $225/SF Transaction summaries for six comparable properties located within the subject's market are included on the next page. The office market has continued to remain resilient and demonstrates strong, stable growth. On average, prices have been increasing with 0.5% a month over the past 24 months. Market analysis indicates that the adjustments for additional space are $200 per square foot of building space and $1,200,000 per acre of land. Each additional year of age is estimated to decrease value by 1%. Assume it is October 1, 2021, and Mr. Verstappen has requested an appraisal of the current market value of the building. Using the provided information, complete the following Date Municipality Price Transaction name Size (sq.ft.) PSF Notes Cap rate Year built Tenancy Estate type Land (acres) 2021-07-01 Markham $13,050,000 57,971 $225 6.00% 131 McNabb Street 1985 Multi Fee Simple 3.7 Oakville $25,750,000 86,463 $298 6.50% 2018 Multi Fee Simple 4.3 2021-07-01 1415 Joshuas Creek Drive 2021-06-01 5255 Satellite Drive Mississauga $22,000,000 91,788 $240 5.75% 1991 Single Fee Simple 4.1 Owner occupier 3.9 Mississauga $14.975,000 93,628 $160 5.50% 1988 Multi 2019-12-01 Enterprise Centre Fee Simple Mississauga $15,150,000 51,000 $297 5.25% 1988 Single Fee Simple 3.8 2019-12-01 5965 Coopers Avenue 2019-12-01 2425 Matheson Boulevard East Mississauga $54,350,000 187,837 $289 6.00% 2000 Multi Fee Simple 4.8 Part of portfolio Max Verstappen owns 3515 West Service Road , a Class A suburban office building in Burlington, Ontario Situated on 3.9 acres of land, 3515 West Service Road is a four-story multi tenant building constructed in 1997, and substantially renovated in 2015. The building contains a net rentable area of 86,030 square feet and is well-leased at 90.3% occupancy. The property has an aluminum framed curtain wall system incorporating a blue glass exterior with international tenants, signage, and interior office space with floor- to-ceiling windows. The asset has a floorplate size of 23,000 square feet and there are 342 surface parking stalls available (4.0 per 1000 SF). Tenancy Summary Contractual Rent Area Rent Step Tenant (SF) PSF Annual Additional Rent On HSBC 28,374 $ 17.50 $ 496,545 $ 14.50 Oct-22 $ 18.50 McDonalds 8,917 $ 17.00 $ 151,589 14.30 Oct-23 $ 19.00 Bayer Canada 7,502 $ 17.75 $ 133,161 $ 14.30 Marcus & Millichap 5.463 $ 16.25 S 88,774 $ 14.50 $17.50 EllisDon Corporation 4,800 $ 16.50 $ 79,200 $ 14.75 Top 5 Total 55,056 $ 17.24 $ 949,268 $ 14.46 Other (9) 22.614 $ 17.60 $ 398,006 Occupied Total (14) 77,670 $ 17.35 $ 1,347,275 $ 14.44 Vacant 8,360 Building Total (16) 86,030 $ 17.35 $ 1,347,275 $ Oct-24 $ 14.40 As per the above overview, the tenants in the building pay on average $17.35 per square foot in rent and an expense reimbursements of $14.44 per square foot. The current leases in the building are all long term, and lease expiries do not affect the projection period. Rent steps are negotiated in some of the leases of the major tenants in the building, all other rental income will increase 2% annually. Operating expenses and real estate taxes for the building are $7.00 and $3.00 per square foot, respectively. Market information indicates that operating expenses will increase 3% annually (as will their reimbursement), that the Management Fee for this type of asset is 3% of EGI, and that an appropriate replacement reserve is $1.50 per square foot. The vacancy rate in the market is 7%, and the current market rent for similar space is $17.75 per square foot. Reimbursement income for vacant space should be assumed to be equal to the current average rate in the building at $14.44 per square foot. The building was purchased for $18,000,000 in September 2013, and the purchase was financed at that time with a mortgage of $12,000,000 amortized over 25 years at a rate of 4% compounded semi-annually. At the time of purchase, approximately 30% of the fair market value was associated with the land, and the land value has remained the same since that time. Because of the renovation completed on the building, the effective age is estimated to be 6 years, and the average life for this type of property is assumed to be 75 years. The only deferred maintenance is a $450,000 roof repair. However, given the age of the property, the IT. capacity is not competitive with newer buildings. The cost to upgrade the technology capabilities is $175,000. The average cost to building this space new is $225/SF Transaction summaries for six comparable properties located within the subject's market are included on the next page. The office market has continued to remain resilient and demonstrates strong, stable growth. On average, prices have been increasing with 0.5% a month over the past 24 months. Market analysis indicates that the adjustments for additional space are $200 per square foot of building space and $1,200,000 per acre of land. Each additional year of age is estimated to decrease value by 1%. Assume it is October 1, 2021, and Mr. Verstappen has requested an appraisal of the current market value of the building. Using the provided information, complete the following Date Municipality Price Transaction name Size (sq.ft.) PSF Notes Cap rate Year built Tenancy Estate type Land (acres) 2021-07-01 Markham $13,050,000 57,971 $225 6.00% 131 McNabb Street 1985 Multi Fee Simple 3.7 Oakville $25,750,000 86,463 $298 6.50% 2018 Multi Fee Simple 4.3 2021-07-01 1415 Joshuas Creek Drive 2021-06-01 5255 Satellite Drive Mississauga $22,000,000 91,788 $240 5.75% 1991 Single Fee Simple 4.1 Owner occupier 3.9 Mississauga $14.975,000 93,628 $160 5.50% 1988 Multi 2019-12-01 Enterprise Centre Fee Simple Mississauga $15,150,000 51,000 $297 5.25% 1988 Single Fee Simple 3.8 2019-12-01 5965 Coopers Avenue 2019-12-01 2425 Matheson Boulevard East Mississauga $54,350,000 187,837 $289 6.00% 2000 Multi Fee Simple 4.8 Part of portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started