Answered step by step

Verified Expert Solution

Question

1 Approved Answer

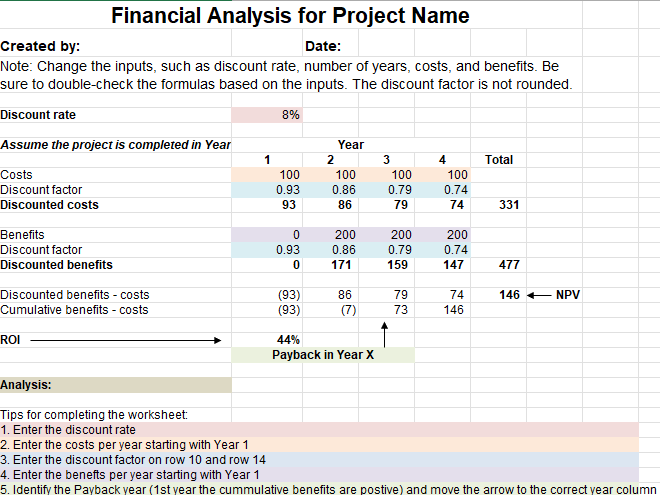

Complete Exercise 2 . 1 - Perform a financial analysis for a project using the format provided in Figure 2 - 5 . Assume the

Complete Exercise Perform a financial analysis for a project using the format provided in Figure Assume the projected costs and benefits for this project are spread over years as follows:

Estimated costs are $ in Year and $ each year in Years and Hint: Just change the years in the template you will use below from and to and The discount factors will automatically be recalculated. Estimated benefits are $ in Year and $ each year in Years and Use an discount rate. Use the Financial Analysis Business Case Financials template linked in this assignment to calculate and clearly display the NPV ROI, the year in which payback occurs, and assumptions. In addition, write a paragraph explaining whether you would recommend investing in this project based on your financial analysis.

Tips for completing the worksheet below

Enter the discount rate

Enter the costs per year starting with Year

Enter the discount factor on row and row

Enter the benefts per year starting with Year

Identify the Payback year st year the cummulative benefits are postive and move the arrow to the correct year column.

Type up the analysis by answering the question in the instructions.

Please answer in the same format as worksheet provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started