Answered step by step

Verified Expert Solution

Question

1 Approved Answer

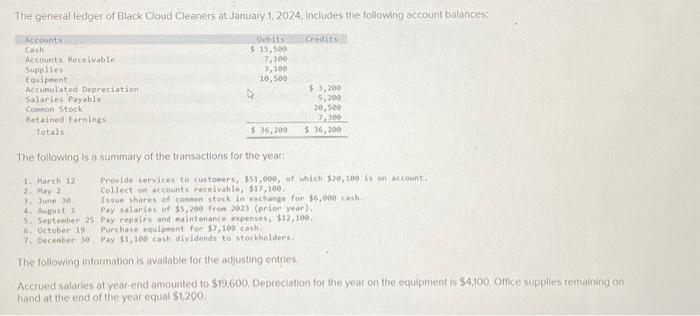

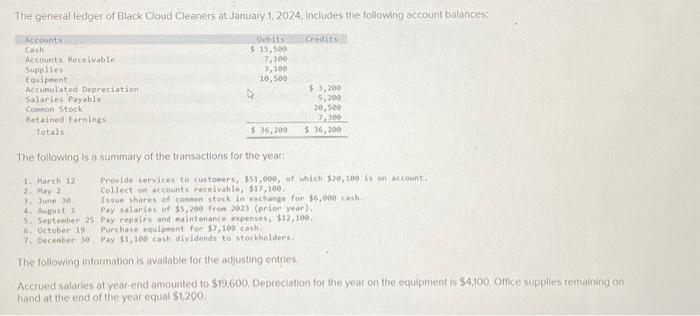

Complete Requirments for 1-6 The general ledger of Black Cloud Cleaners at January 1,2024, includes the following account balances: The following is a summary of

Complete Requirments for 1-6

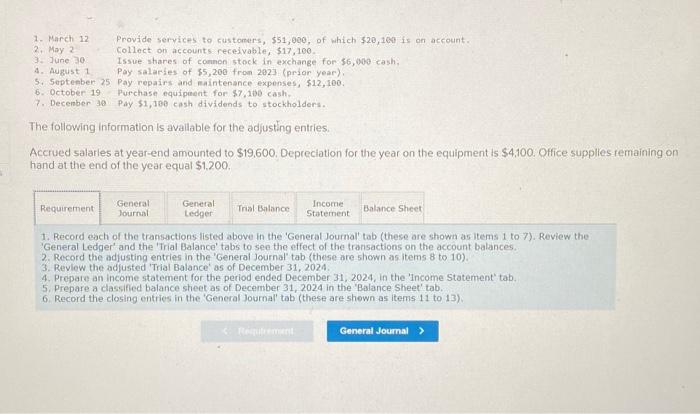

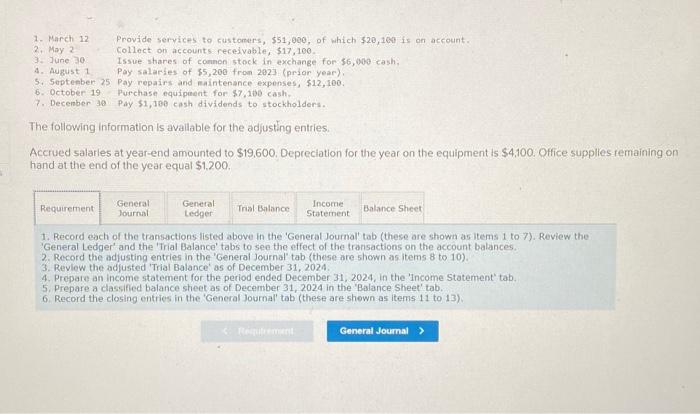

The general ledger of Black Cloud Cleaners at January 1,2024, includes the following account balances: The following is a summary of the transoctions for the year: 1. March 12 Prowide services to custoeers, 351,000 , of which $20,100 is on account. 2. Hay 2 callect on accounts recelvable, $17,100 3. Jurne 30 tsave shares of comeon stock in exchange for $6,000 cash. 4. Aofust 1 pley saleries of $5,200 froe 2023 (prior year). 5. Septenber 25 . Pay resairs and saintenance axpenses, $12;100. 6. Detaber 19 punchais equipeent for $7,100 cash. 7. Decenben 30 Pay $1,200 kash dividands to steckholders. The following information is avalable for the adjusting entries: Accrued salarles at yoar-end amounted to $19,600. Depreciation for the year on the equipnent is $4,100. Office supplies remaining on hand at the end of the year equal $1,200. 1. March 12 Provide services to customers, $51,000, of which $20,160 is on account. 2. May 2 Collect on accounts receivable, $17,100. 3. June 30 Issue shares of comnon stock in exchange for 56,000 cash, 4. August 1 Pay salaries of $5,200 from 2023 (prior year). 5. Septenber 25 Pay repairs and maintenance expenses, $12,100. 6. October 19 Purchase equipaent for $7,105 cash. 7. Decenber 30 Pay $1,100 eash dividends to stockholders. The following information is avallable for the adjusting entries. Accrued salarles at year-end amounted to $19,600. Depreciation for the year on the equipment is $4,100. Office supplies temaining on hand at the end of the year equal $1,200. 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7 ). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are 5 hown as items 8 to 10 ). 3. Revlew the adjusted 'Trial Balance' as of December 31, 2024. 4. Propare an income statement for the period ended December 31, 2024, in the 'Income Statement' tab. 5. Prepare a classifled balance sheet as of Decermber 31, 2024 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shewn as items 11 to 13 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started