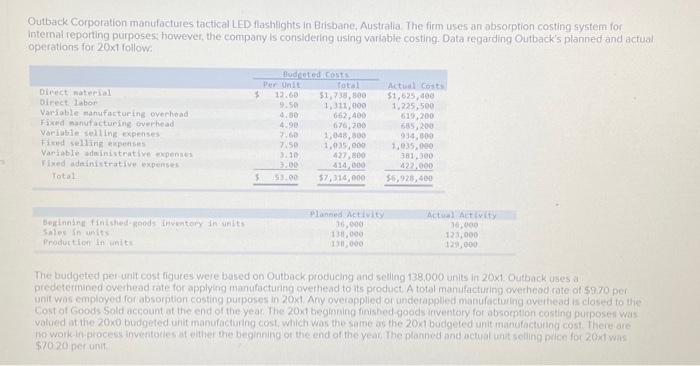

Complete this question by entering your answers in the tabs below. Compute the value of Outback Corporation's 201 ending finished-goods inventory under variable costing. (Do not round itermediate calculations, ) Outback Corporation manufactures tactical LED flashlights in Brisbane, Australla. The firm uses an absorption costing system for internal reporting purposes; however, the company is considering using vardable costing. Data regarding Outback's planned and actual operations for 201 follow: The budgeted per-unit cost figures were based on Outback producing and seling 138.000 units in 201. Outback uses a piedeterinined overhead tate for applying manufacturing overhend to its product A total manufacturing overheod rate of $9.70 per unit was employed for absorption costing purposes in 20xt. Any overapplied or underapplied manufacturing overbead is clased to the Cost of Goods Sold account at the end of the yeak. The 20xt beginning finished-goods inventory for absorption costing purposer was valued at the 200 budgeted unit manufacturing cost, which was the same as the 20x bodgeted unit manufacturing cost. Ihere are no work-li-process inventoties at either the beginning on the end of the year. The planned and actual unit seling price for 20xdwis $7020 per unit. Compute the difference between Outback Corporation's 201 reported operoting income calculated under absorption costing and calculated under variable costing. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Compute the value of Outback Corporation's 20xi ending finished goods inventory under absotption costing. (Do not round intermediate calculations,) Required: Was Outback's 201 operating income higher under absorption costing or variable costing? Also: compute the following: 1. The value of Outback Corporation's 201 ending finished-goods inventory under absorption costing. 2. The value of Outback Corporation's 201 ending finished-goods inventory under variable costing. 3. The difference between Outback Corporation's 201 reported operating income calculated under absorption costing and calculated under variable costing. Complete this question by entering your answers in the tabs below. Was outback's 201 operating income higher under absorption costing or variable costing