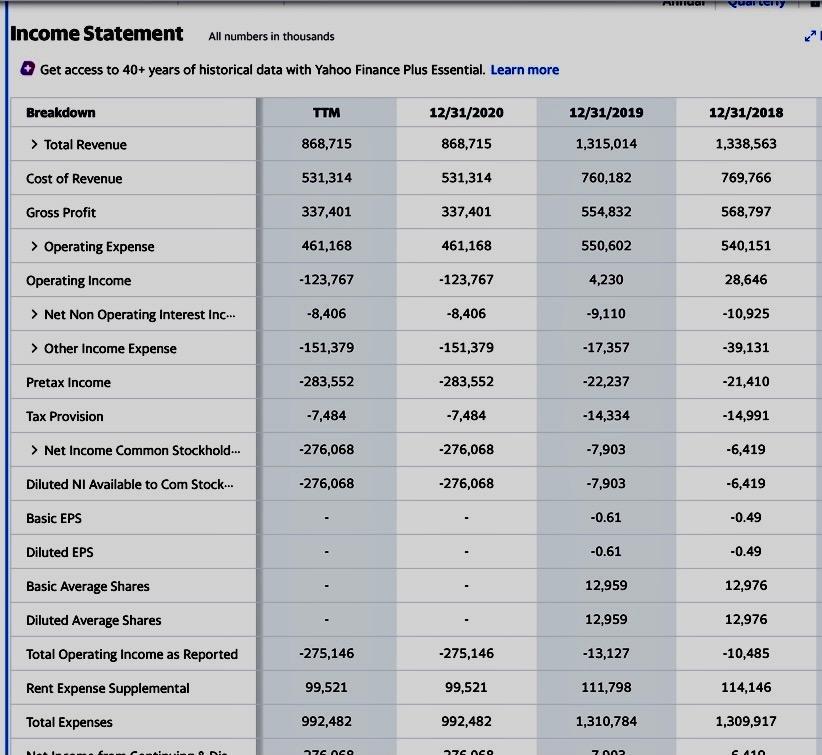

Compute the following ratios for Red Robin Gourmet Burger Financial Statement for two consecutive years such as 2018 and 2019.

5. Profit Margin

6. Return on Equity

7. Return on Assets

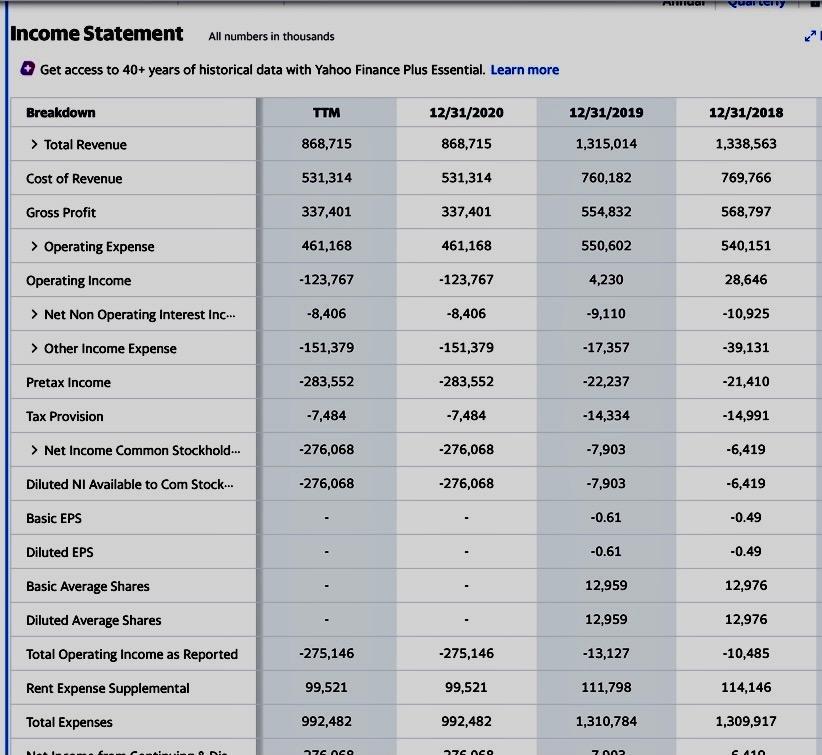

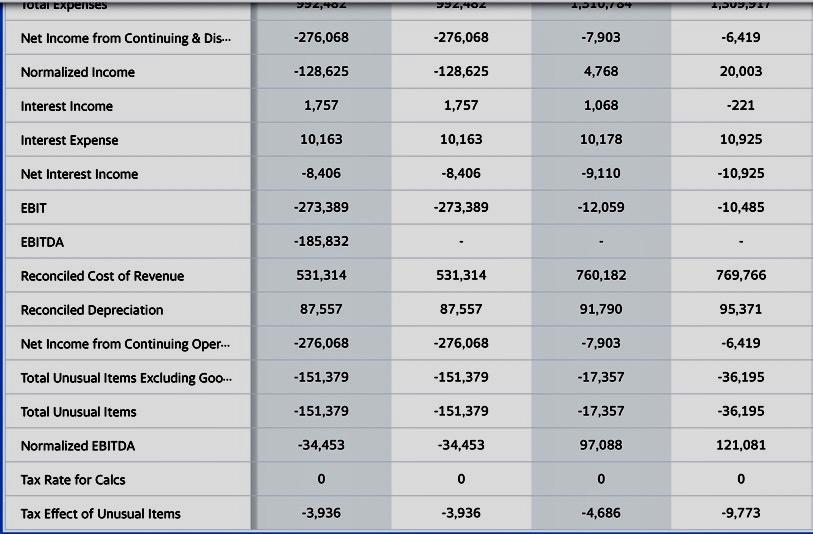

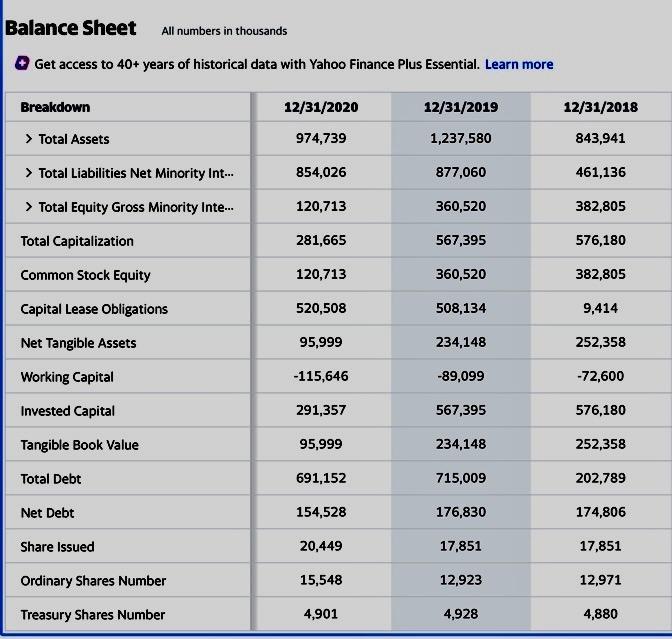

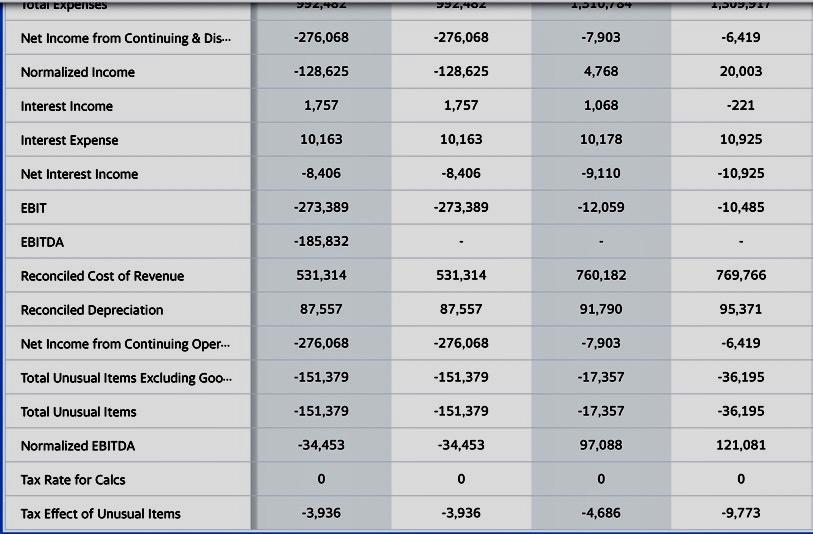

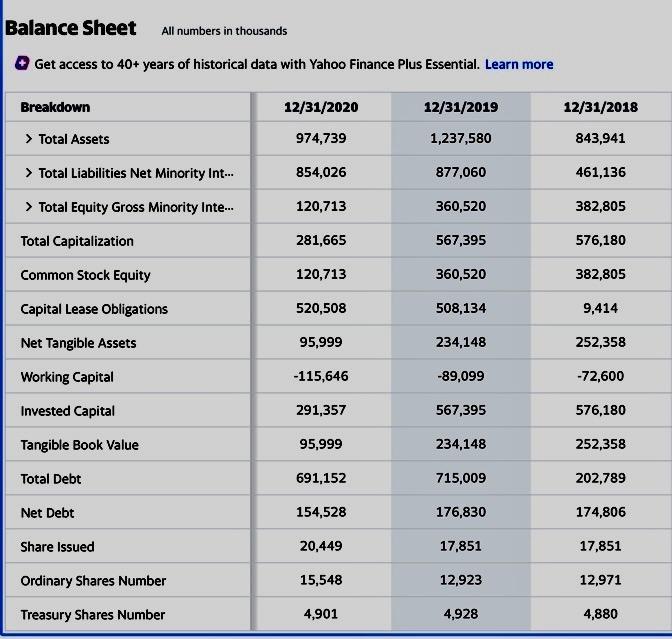

UGCHY Income Statement All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown TTM 12/31/2020 12/31/2019 12/31/2018 > Total Revenue 868,715 868,715 1,315,014 1,338,563 Cost of Revenue 531,314 531,314 760,182 769,766 Gross Profit 337,401 337,401 554,832 568,797 > Operating Expense 461,168 461,168 550,602 540,151 -123,767 -123,767 4,230 28,646 Operating Income > Net Non Operating Interest Inc... -8,406 -8,406 -9,110 -10,925 > Other Income Expense -151,379 -151,379 -17,357 -39,131 Pretax Income -283,552 -283,552 -22,237 -21,410 Tax Provision -7,484 -7,484 -14,334 -14,991 > Net Income Common Stockhold... -276,068 -276,068 -7,903 -6,419 Diluted NI Available to Com Stock... -276,068 -276,068 -7,903 -6,419 Basic EPS -0.61 -0.49 Diluted EPS -0.61 -0.49 12,959 12,976 Basic Average Shares Diluted Average Shares Total Operating Income as Reported 12,959 12,976 -275,146 -275,146 -13,127 -10,485 Rent Expense Supplemental 99,521 99,521 111,798 114,146 Total Expenses 992,482 992,482 1,310,784 1,309,917 Coco 70 OCO 702 ca Total expenses 9747402 992,"TOZ DIVO ,, -276,068 -276,068 -7,903 -6,419 Net Income from Continuing & Dis... Normalized Income -128,625 -128,625 4,768 20,003 Interest Income 1,757 1,757 1,068 -221 Interest Expense 10,163 10,163 10,178 10,925 Net Interest Income -8,406 -8,406 -9,110 -10,925 EBIT -273,389 -273,389 -12,059 -10,485 EBITDA -185,832 Reconciled Cost of Revenue 531,314 531,314 760,182 769,766 Reconciled Depreciation 87,557 87,557 91,790 95,371 Net Income from Continuing Oper... -276,068 -276,068 -7,903 -6,419 -151,379 -151,379 -17,357 -36,195 Total Unusual Items Excluding Goo... Total Unusual Items -151,379 -151,379 -17,357 -36,195 Normalized EBITDA -34,453 -34,453 97,088 121,081 Tax Rate for Calcs 0 0 0 0 Tax Effect of Unusual Items -3,936 -3,936 -4,686 -9,773 Balance Sheet All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown 12/31/2020 12/31/2018 12/31/2019 1,237,580 > Total Assets 974,739 843,941 > Total Liabilities Net Minority Int... 854,026 877,060 461,136 > Total Equity Gross Minority Inte... 120,713 360,520 382,805 Total Capitalization 281,665 567,395 576,180 Common Stock Equity 120,713 360,520 382,805 520,508 508,134 9,414 Capital Lease Obligations Net Tangible Assets 95,999 234,148 252,358 -115,646 -89,099 -72,600 Working Capital Invested Capital 291,357 567,395 576,180 Tangible Book Value 95,999 234,148 252,358 Total Debt 691,152 715,009 202.789 Net Debt 154,528 176,830 174,806 Share Issued 20,449 17,851 17,851 Ordinary Shares Number 15,548 12,923 12,971 Treasury Shares Number 4,901 4,928 4,880