Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the returns for three portfolios: An equal weighted portfolio of the three ETFs A low-volatility portfolio whose weight in each ETF is related to

Compute the returns for three portfolios:

- An equal weighted portfolio of the three ETFs

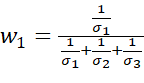

- A low-volatility portfolio whose weight in each ETF is related to the inverse of the ETFs standard deviation. To derive these weights, you first need to compute the total period standard deviation for each ETF. For example, the weight of ETF 1, would be

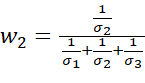

, the weight of the second one is

, the weight of the second one is  , and so on.)

, and so on.) - Create the last portfolio following this rule of thumb: 20% of your money in foreign stocks, (your age)% in a bond portfolio, and the rest in US stock. This is your third portfolio.

- Now that you have the time-series of the above three portfolios, create and complete a table such as the one below in the same worksheet:

| Equal weighted | Low Volatility | Rule of thumb | |

| Mean (Annualized) | |||

| SD (Annualized) | |||

| Mean/SD (Annualized) |

w1=11+21+3111 w2=11+21+3121

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started