Answered step by step

Verified Expert Solution

Question

1 Approved Answer

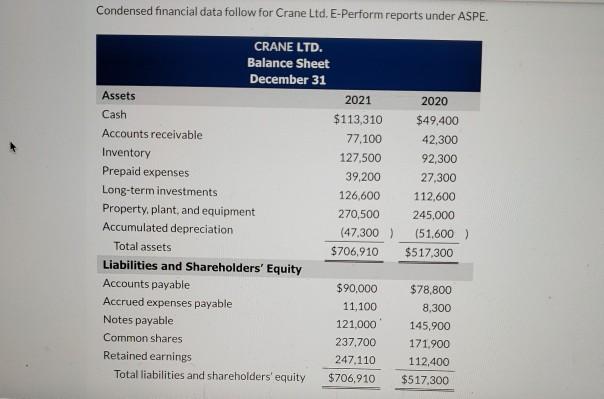

Condensed financial data follow for Crane Ltd. E-Perform reports under ASPE. CRANE LTD. Balance Sheet December 31 Assets 2021 Cash $113,310 Accounts receivable 77.100 Inventory

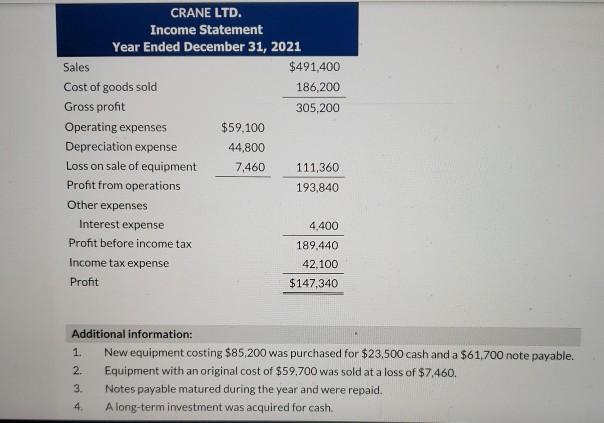

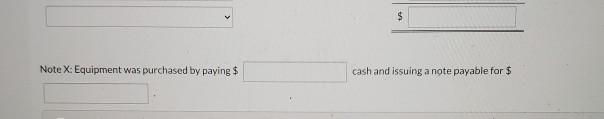

Condensed financial data follow for Crane Ltd. E-Perform reports under ASPE. CRANE LTD. Balance Sheet December 31 Assets 2021 Cash $113,310 Accounts receivable 77.100 Inventory 127,500 Prepaid expenses 39,200 Long-term investments 126,600 Property, plant, and equipment 270,500 Accumulated depreciation (47.300) Total assets $706,910 Liabilities and Shareholders' Equity Accounts payable $90,000 Accrued expenses payable 11,100 Notes payable 121,000 Common shares 237,700 Retained earnings 247.110 Total liabilities and shareholders' equity $706,910 2020 $49,400 42,300 92,300 27.300 112,600 245.000 (51,600) $517,300 $78,800 8,300 145,900 171.900 112,400 $517.300 CRANE LTD. Income Statement Year Ended December 31, 2021 Sales $491,400 Cost of goods sold 186,200 Gross profit 305,200 Operating expenses $59,100 Depreciation expense 44,800 Loss on sale of equipment 7,460 111,360 Profit from operations 193.840 Other expenses Interest expense 4.400 Profit before income tax 189.440 Income tax expense 42.100 Profit $147.340 Additional information: 1. New equipment costing $85,200 was purchased for $23,500 cash and a $61.700 note payable. 2. Equipment with an original cost of $59,700 was sold at a loss of $7,460. Notes payable matured during the year and were repaid. 4. A long-term investment was acquired for cash. 3 CRANE LTD. Cash Flow Statement-Indirect Method $ Adjustments to Reconcile Profit to v $ S > > . > $ Note X: Equipment was purchased by paying $ cash and issuing a note payable for $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started