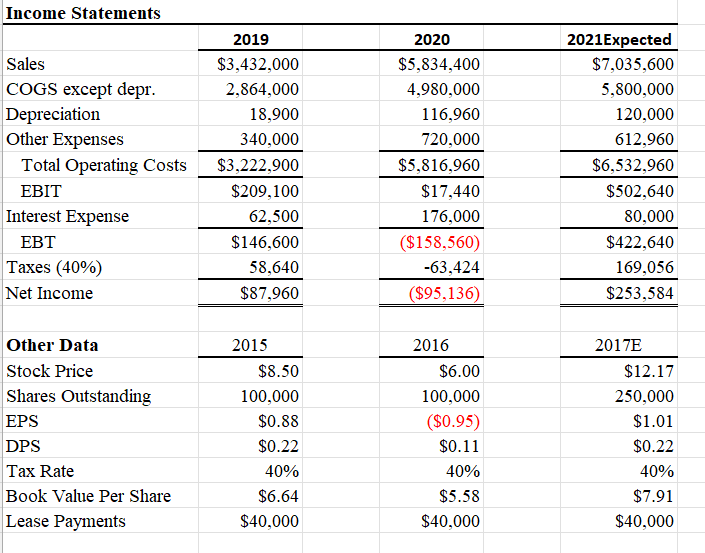

Conduct common size analysis for the balance sheet and income statement. Discuss the firm's financial situation based on your findings.

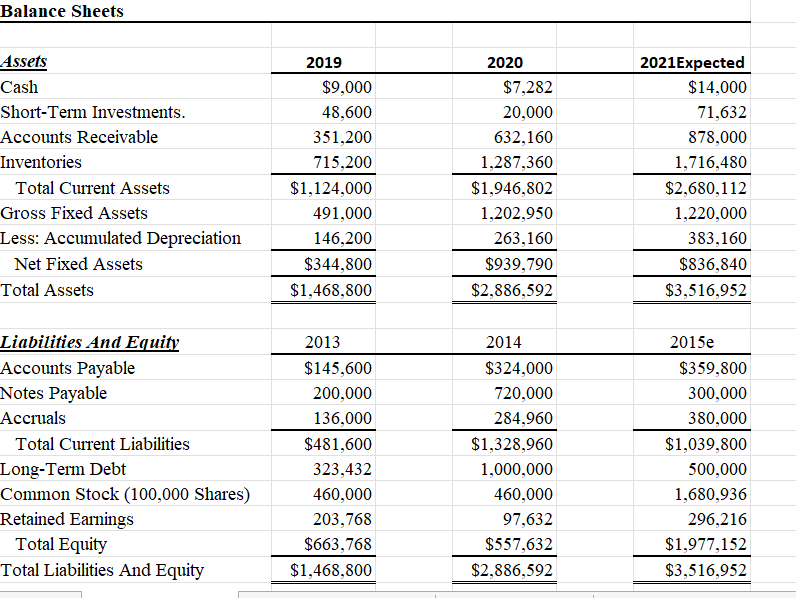

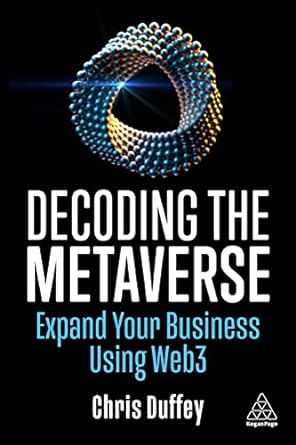

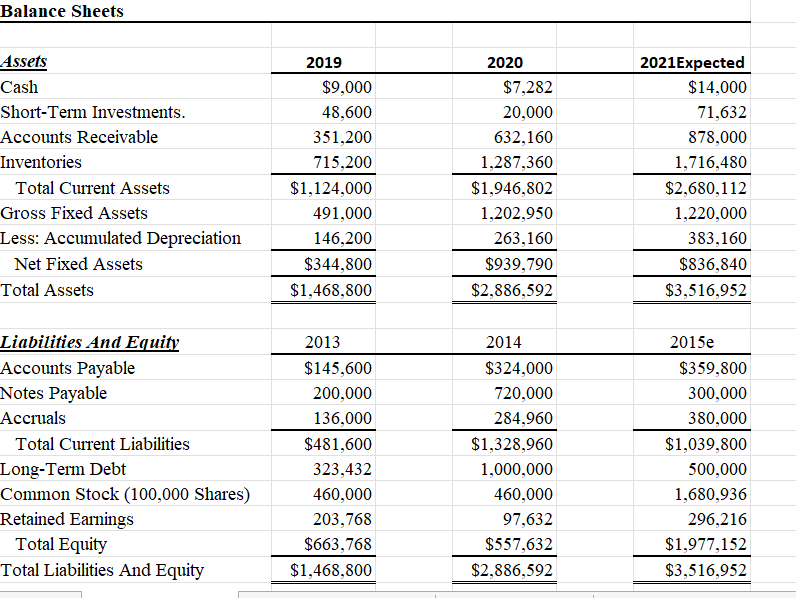

Balance Sheets 2019 Assets Cash Short-Term Investments. Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets $9,000 48,600 351,200 715,200 $1,124,000 491,000 146,200 $344.800 $1,468,800 2020 $7,282 20,000 632,160 1,287,360 $1,946,802 1,202,950 263,160 $939,790 $2.886,592 2021Expected $14,000 71,632 878,000 1,716,480 $2,680,112 1,220,000 383,160 $836,840 $3,516,952 Liabilities And Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Debt Common Stock (100,000 Shares) Retained Earnings Total Equity Total Liabilities And Equity 2013 $145,600 200,000 136,000 $481,600 323,432 460,000 203,768 $663,768 $1,468,800 2014 $324,000 720,000 284,960 $1,328,960 1,000,000 460,000 97,632 $557,632 $2.886,592 2015e $359,800 300,000 380,000 $1,039,800 500,000 1,680,936 296,216 $1,977,152 $3,516,952 Income Statements Sales COGS except depr. Depreciation Other Expenses Total Operating Costs EBIT Interest Expense EBT Taxes (40%) Net Income 2019 $3,432,000 2,864,000 18,900 340,000 $3,222,900 $209,100 62,500 $146,600 58,640 $87,960 2020 $5,834,400 4,980,000 116,960 720,000 $5,816,960 $17,440 176,000 ($158,560) -63,424 ($95,136) 2021Expected $7,035,600 5,800,000 120,000 612,960 $6,532,960 $502,640 80,000 $422,640 169,056 $253,584 Other Data Stock Price Shares Outstanding EPS DPS Tax Rate Book Value Per Share Lease Payments 2015 $8.50 100,000 $0.88 $0.22 40% $6.64 $40,000 2016 $6.00 100,000 ($0.95) $0.11 40% $5.58 $40,000 2017E $12.17 250,000 $1.01 $0.22 40% $7.91 $40,000 Balance Sheets 2019 Assets Cash Short-Term Investments. Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets $9,000 48,600 351,200 715,200 $1,124,000 491,000 146,200 $344.800 $1,468,800 2020 $7,282 20,000 632,160 1,287,360 $1,946,802 1,202,950 263,160 $939,790 $2.886,592 2021Expected $14,000 71,632 878,000 1,716,480 $2,680,112 1,220,000 383,160 $836,840 $3,516,952 Liabilities And Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Debt Common Stock (100,000 Shares) Retained Earnings Total Equity Total Liabilities And Equity 2013 $145,600 200,000 136,000 $481,600 323,432 460,000 203,768 $663,768 $1,468,800 2014 $324,000 720,000 284,960 $1,328,960 1,000,000 460,000 97,632 $557,632 $2.886,592 2015e $359,800 300,000 380,000 $1,039,800 500,000 1,680,936 296,216 $1,977,152 $3,516,952 Income Statements Sales COGS except depr. Depreciation Other Expenses Total Operating Costs EBIT Interest Expense EBT Taxes (40%) Net Income 2019 $3,432,000 2,864,000 18,900 340,000 $3,222,900 $209,100 62,500 $146,600 58,640 $87,960 2020 $5,834,400 4,980,000 116,960 720,000 $5,816,960 $17,440 176,000 ($158,560) -63,424 ($95,136) 2021Expected $7,035,600 5,800,000 120,000 612,960 $6,532,960 $502,640 80,000 $422,640 169,056 $253,584 Other Data Stock Price Shares Outstanding EPS DPS Tax Rate Book Value Per Share Lease Payments 2015 $8.50 100,000 $0.88 $0.22 40% $6.64 $40,000 2016 $6.00 100,000 ($0.95) $0.11 40% $5.58 $40,000 2017E $12.17 250,000 $1.01 $0.22 40% $7.91 $40,000