Question

Conservatory Lumber sells rough and finished lumber for building products. At one of the Company mills in the Northwest, it processes only one type of

Conservatory Lumber sells rough and finished lumber for building products. At one of the Company mills in the Northwest, it processes only one type of wood into two products: rough-cut lumber (sold for further processing) and dimensional lumber (for paneling and so on). The company has one particular cutting machine on which it can produce either of two types of lumber: rough-cut or dimensional. Sales demand for both products is such that the machine could operate at full capacity on either of the products. Regardless of what is produced, demand is such that Conservatory Lumber can sell all the output it produces at current prices. One unit of rough cut lumber requires 0.6 hours of machine time, and one unit of the dimensional lumber requires four hours of machine time. Each unit consists of 1,040 board-feet.

Following are the costs per unit for the lumber:

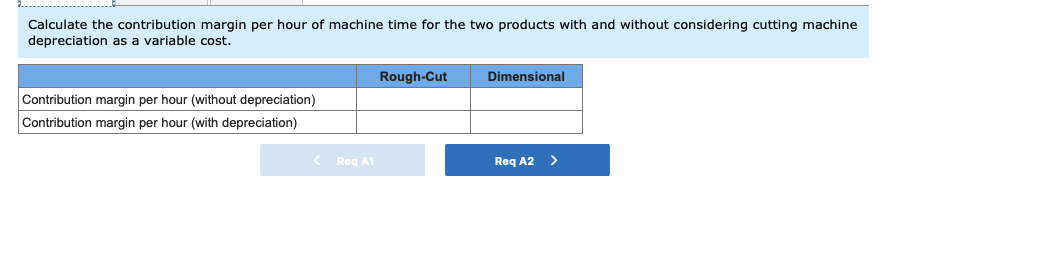

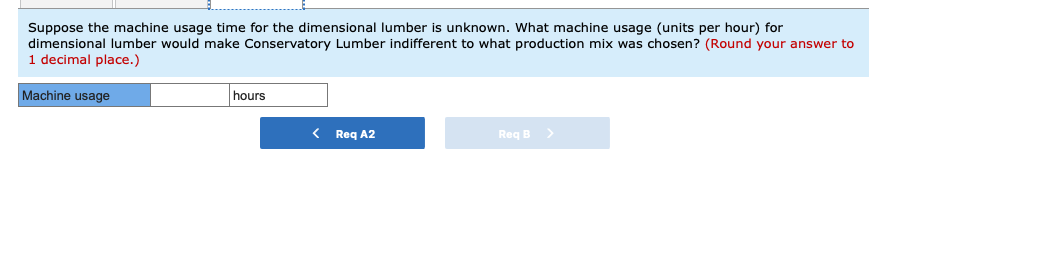

Calculate the contribution margin per hour of machine time for the two products with and without considering cutting machine depreciation as a variable cost. Suppose the machine usage time for the dimensional lumber is unknown. What machine usage (units per hour) for dimensional lumber would make Conservatory Lumber indifferent to what production mix was chosen? (Round your answer to 1 decimal place.) Should Conservatory Lumber produce rough-cut or dimensional lumber, or both? Should Conservatory Lumber produce rough-cut or dimensional lumber, or both

Calculate the contribution margin per hour of machine time for the two products with and without considering cutting machine depreciation as a variable cost. Suppose the machine usage time for the dimensional lumber is unknown. What machine usage (units per hour) for dimensional lumber would make Conservatory Lumber indifferent to what production mix was chosen? (Round your answer to 1 decimal place.) Should Conservatory Lumber produce rough-cut or dimensional lumber, or both? Should Conservatory Lumber produce rough-cut or dimensional lumber, or both Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started