Answered step by step

Verified Expert Solution

Question

1 Approved Answer

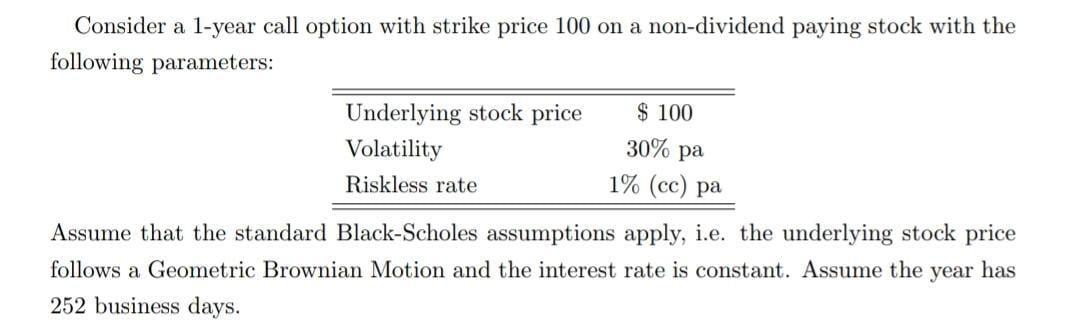

Consider a 1-year call option with strike price 100 on a non-dividend paying stock with the following parameters: Underlying stock price Volatility Riskless rate

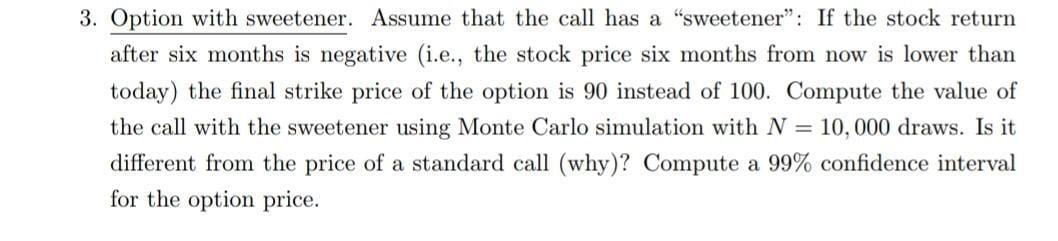

Consider a 1-year call option with strike price 100 on a non-dividend paying stock with the following parameters: Underlying stock price Volatility Riskless rate $100 30% pa 1% (cc) pa Assume that the standard Black-Scholes assumptions apply, i.e. the underlying stock price follows a Geometric Brownian Motion and the interest rate is constant. Assume the year has 252 business days. 3. Option with sweetener. Assume that the call has a "sweetener": If the stock return after six months is negative (i.e., the stock price six months from now is lower than today) the final strike price of the option is 90 instead of 100. Compute the value of the call with the sweetener using Monte Carlo simulation with N = 10, 000 draws. Is it different from the price of a standard call (why)? Compute a 99% confidence interval for the option price.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that the standard BlackScholes assumptions apply the stock price six months from now would be lower than today if the stock return after six months is negative In this case the final strike p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started