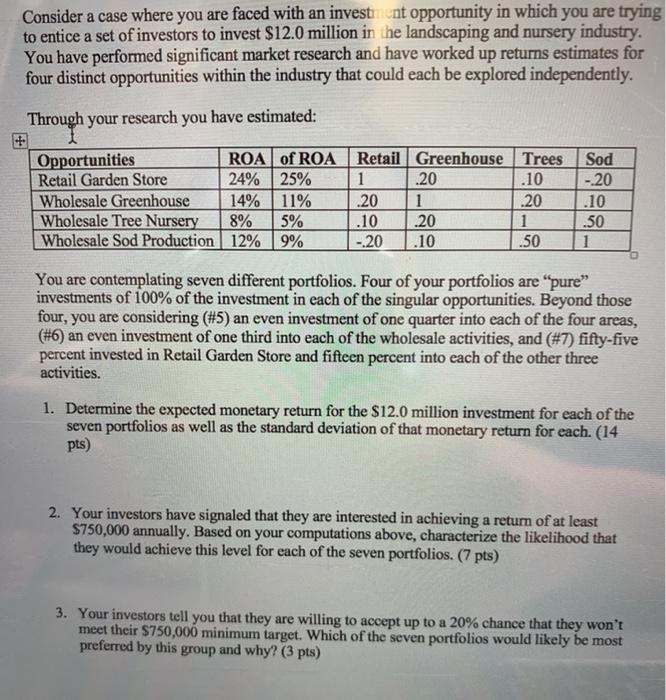

Consider a case where you are faced with an investr unt opportunity in which you are trying to entice a set of investors to invest $12.0 million in he landscaping and nursery industry. You have performed significant market research and have worked up returns estimates for four distinct opportunities within the industry that could each be explored independently. Through your research you have estimated: Opportunities ROA of ROA Retail Greenhouse Trees Retail Garden Store 24% 25% 1 .20 .10 Wholesale Greenhouse 14% 11% .20 1 .20 Wholesale Tree Nursery 8% 5% .10 .20 1 Wholesale Sod Production 12% 9% -.20 .10 .50 Sod - 20 .10 .50 1 You are contemplating seven different portfolios. Four of your portfolios are "pure" investments of 100% of the investment in each of the singular opportunities. Beyond those four, you are considering (#5) an even investment of one quarter into each of the four areas, (#6) an even investment of one third into each of the wholesale activities, and (#7) fifty-five percent invested in Retail Garden Store and fifteen percent into each of the other three activities. 1. Determine the expected monetary return for the $12.0 million investment for each of the seven portfolios as well as the standard deviation of that monetary return for each. (14 pts) 2. Your investors have signaled that they are interested in achieving a return of at least $750,000 annually. Based on your computations above, characterize the likelihood that they would achieve this level for each of the seven portfolios. (7 pts) 3. Your investors tell you that they are willing to accept up to a 20% chance that they won't meet their $750,000 minimum target. Which of the seven portfolios would likely be most preferred by this group and why? (3 pts) Consider a case where you are faced with an investr unt opportunity in which you are trying to entice a set of investors to invest $12.0 million in he landscaping and nursery industry. You have performed significant market research and have worked up returns estimates for four distinct opportunities within the industry that could each be explored independently. Through your research you have estimated: Opportunities ROA of ROA Retail Greenhouse Trees Retail Garden Store 24% 25% 1 .20 .10 Wholesale Greenhouse 14% 11% .20 1 .20 Wholesale Tree Nursery 8% 5% .10 .20 1 Wholesale Sod Production 12% 9% -.20 .10 .50 Sod - 20 .10 .50 1 You are contemplating seven different portfolios. Four of your portfolios are "pure" investments of 100% of the investment in each of the singular opportunities. Beyond those four, you are considering (#5) an even investment of one quarter into each of the four areas, (#6) an even investment of one third into each of the wholesale activities, and (#7) fifty-five percent invested in Retail Garden Store and fifteen percent into each of the other three activities. 1. Determine the expected monetary return for the $12.0 million investment for each of the seven portfolios as well as the standard deviation of that monetary return for each. (14 pts) 2. Your investors have signaled that they are interested in achieving a return of at least $750,000 annually. Based on your computations above, characterize the likelihood that they would achieve this level for each of the seven portfolios. (7 pts) 3. Your investors tell you that they are willing to accept up to a 20% chance that they won't meet their $750,000 minimum target. Which of the seven portfolios would likely be most preferred by this group and why? (3 pts)