Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a portfolio with two foreign currencies: the Canadian dollar (CAD) and the euro (EUR). These currencies are correlated with and have a volatility

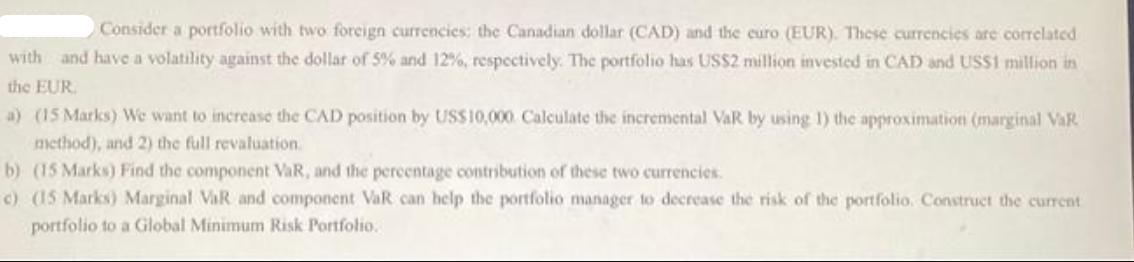

Consider a portfolio with two foreign currencies: the Canadian dollar (CAD) and the euro (EUR). These currencies are correlated with and have a volatility against the dollar of 5% and 12 %, respectively. The portfolio has US$2 million invested in CAD and US$1 million in the EUR a) (15 Marks) We want to increase the CAD position by US$10,000 Calculate the incremental VaR by using 1) the approximation (marginal VaR method), and 2) the full revaluation. b) (15 Marks) Find the component VaR, and the percentage contribution of these two currencies. c) (15 Marks) Marginal VaR and component VaR can help the portfolio manager to decrease the risk of the portfolio. Construct the current portfolio to a Global Minimum Risk Portfolio.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the incremental VaR using the marginal VaR method we need to consider the volatilities and correlations of the currencies involved Given CAD volatility 5 EUR volatility 12 CAD in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started