Answered step by step

Verified Expert Solution

Question

1 Approved Answer

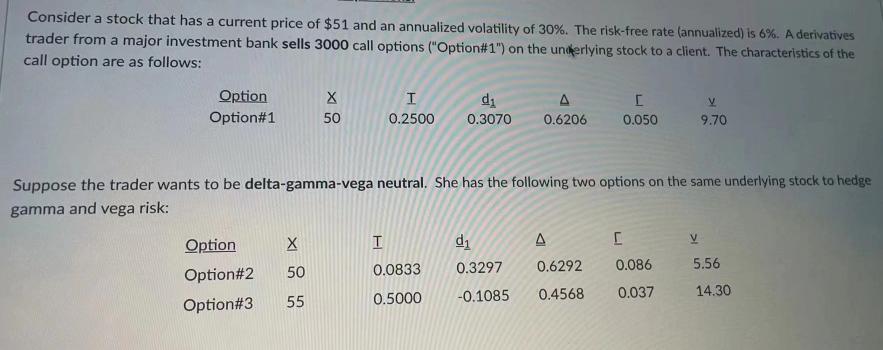

Consider a stock that has a current price of $51 and an annualized volatility of 30%. The risk-free rate (annualized) is 6%. A derivatives

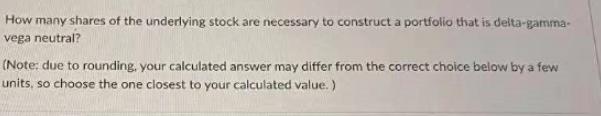

Consider a stock that has a current price of $51 and an annualized volatility of 30%. The risk-free rate (annualized) is 6%. A derivatives trader from a major investment bank sells 3000 call options ("Option#1") on the underlying stock to a client. The characteristics of the call option are as follows: Option Option#1 X 50 Option X Option#2 50 Option#3 55 A I d 0.2500 0.3070 0.6206 Suppose the trader wants to be delta-gamma-vega neutral. She has the following two options on the same underlying stock to hedge gamma and vega risk: T 0.0833 0.5000 A [ 0.050 d 0.3297 0.6292 -0.1085 0.4568 V 9.70 [ 0.086 0.037 5.56 14.30 How many shares of the underlying stock are necessary to construct a portfolio that is delta-gamma- vega neutral? (Note: due to rounding, your calculated answer may differ from the correct choice below by a few. units, so choose the one closest to your calculated value.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To construct a portfolio that is vega neutral using Option 1 and Option 2 we can use the following s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started