Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an IS-LM model where aggregate private spending depends on current variables as well as their expected values in the future period. People expect

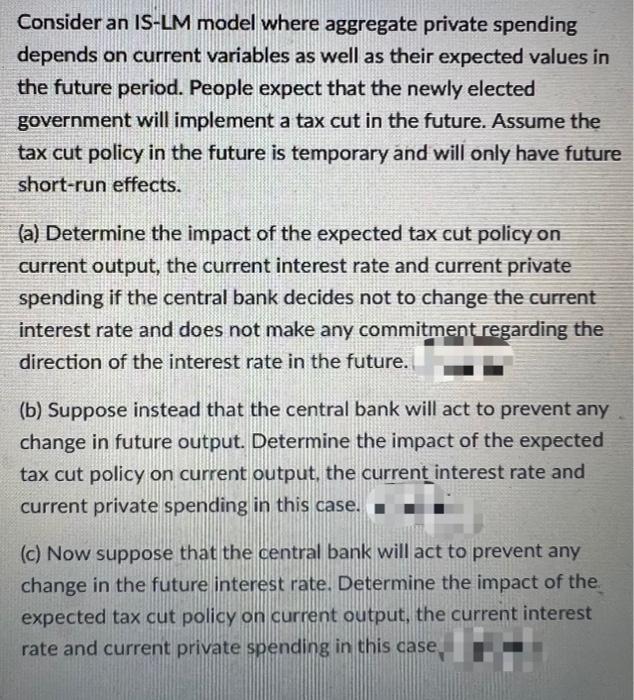

Consider an IS-LM model where aggregate private spending depends on current variables as well as their expected values in the future period. People expect that the newly elected government will implement a tax cut in the future. Assume the tax cut policy in the future is temporary and will only have future short-run effects. (a) Determine the impact of the expected tax cut policy on current output, the current interest rate and current private spending if the central bank decides not to change the current interest rate and does not make any commitment regarding the direction of the interest rate in the future. (b) Suppose instead that the central bank will act to prevent any change in future output. Determine the impact of the expected tax cut policy on current output, the current interest rate and current private spending in this case. (c) Now suppose that the central bank will act to prevent any change in the future interest rate. Determine the impact of the expected tax cut policy on current output, the current interest rate and current private spending in this case

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started