Answered step by step

Verified Expert Solution

Question

1 Approved Answer

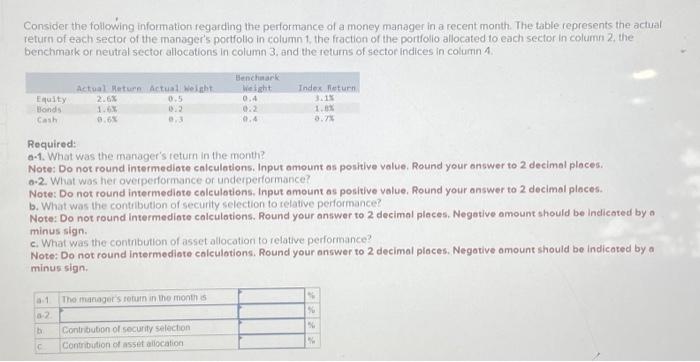

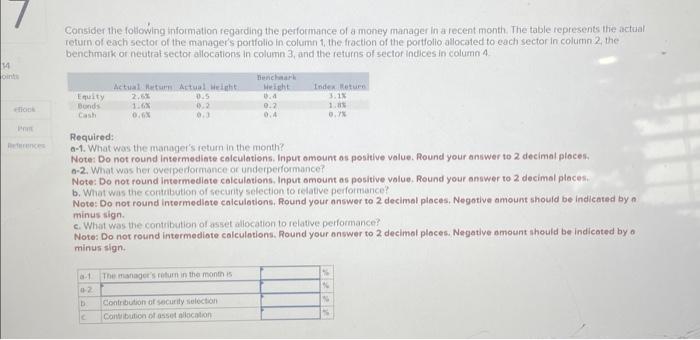

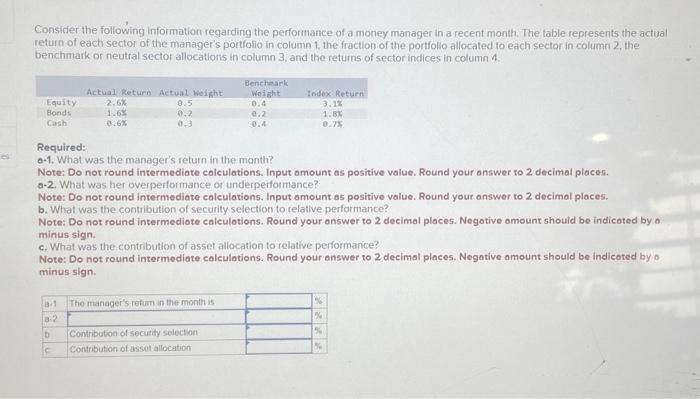

Consider the following information regarding the performance of a money manager in a recent month. The table represents the actual return of each sector of

Consider the following information regarding the performance of a money manager in a recent month. The table represents the actual return of each sector of the manager's portfolio in column 1, the fraction of the portfolio allocated to each sector in column 2, the benchmark or neutral sector allocations in column 3, and the returns of sector indices in column 4. Equity Bonds Cash Actual Return Actual Weight 0.5 0.2 0.3 a-1. a-2. b. 2.6% 1.6% 0.6% C Required: a-1. What was the manager's return in the month? Note: Do not round intermediate calculations. Input amount as positive value. Round your answer to 2 decimal places. a-2. What was her overperformance or underperformance? Note: Do not round intermediate calculations. Input amount as positive value. Round your answer to 2 decimal places. b. What was the contribution of security selection to relative performance? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign. c. What was the contribution of asset allocation to relative performance? Benchmark Weight 0.4 0.2 0.4 Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign. The manager's return in the month is Index Return Contribution of security selection Contribution of asset allocation 3.1% 1.8% 0.7% % % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started