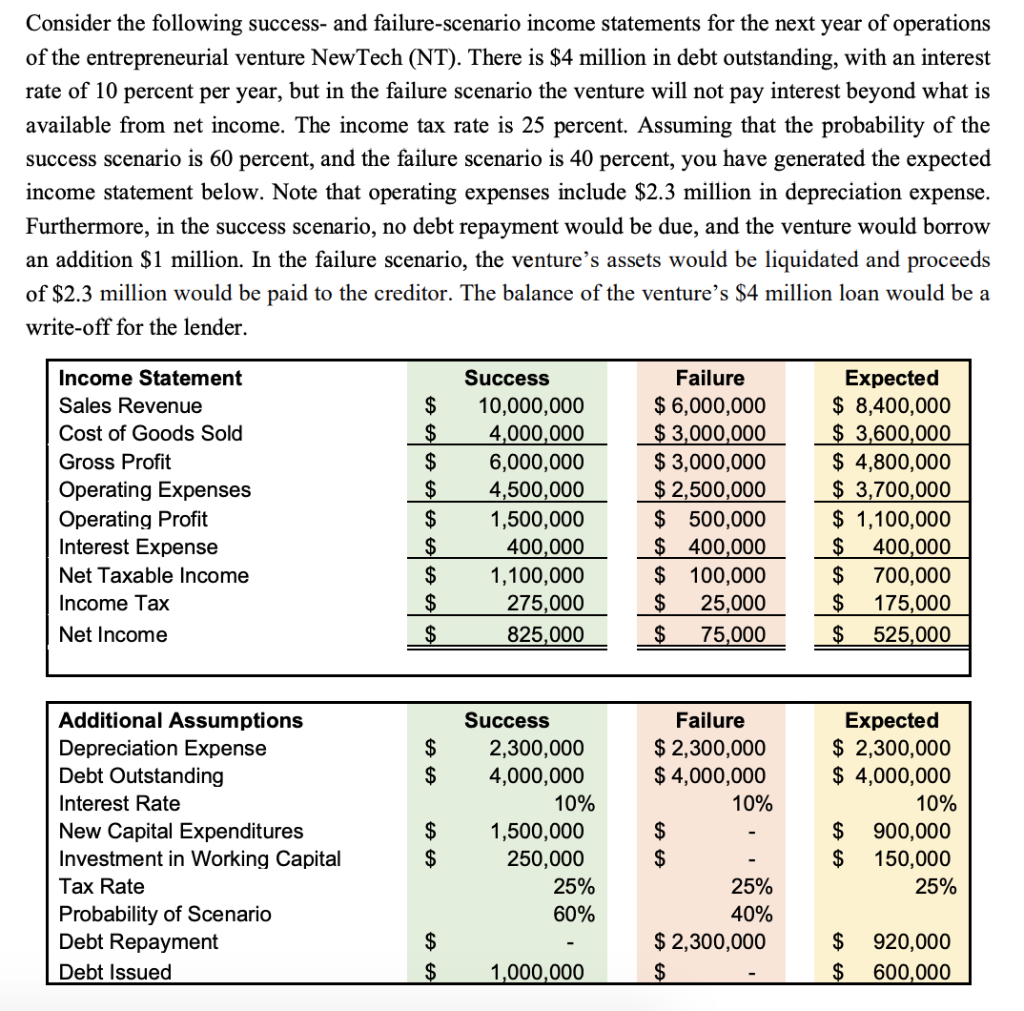

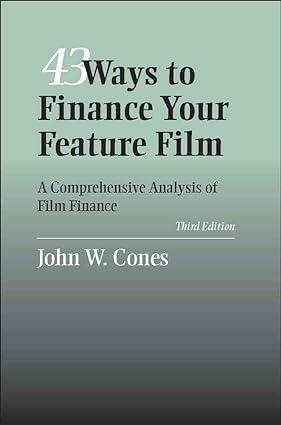

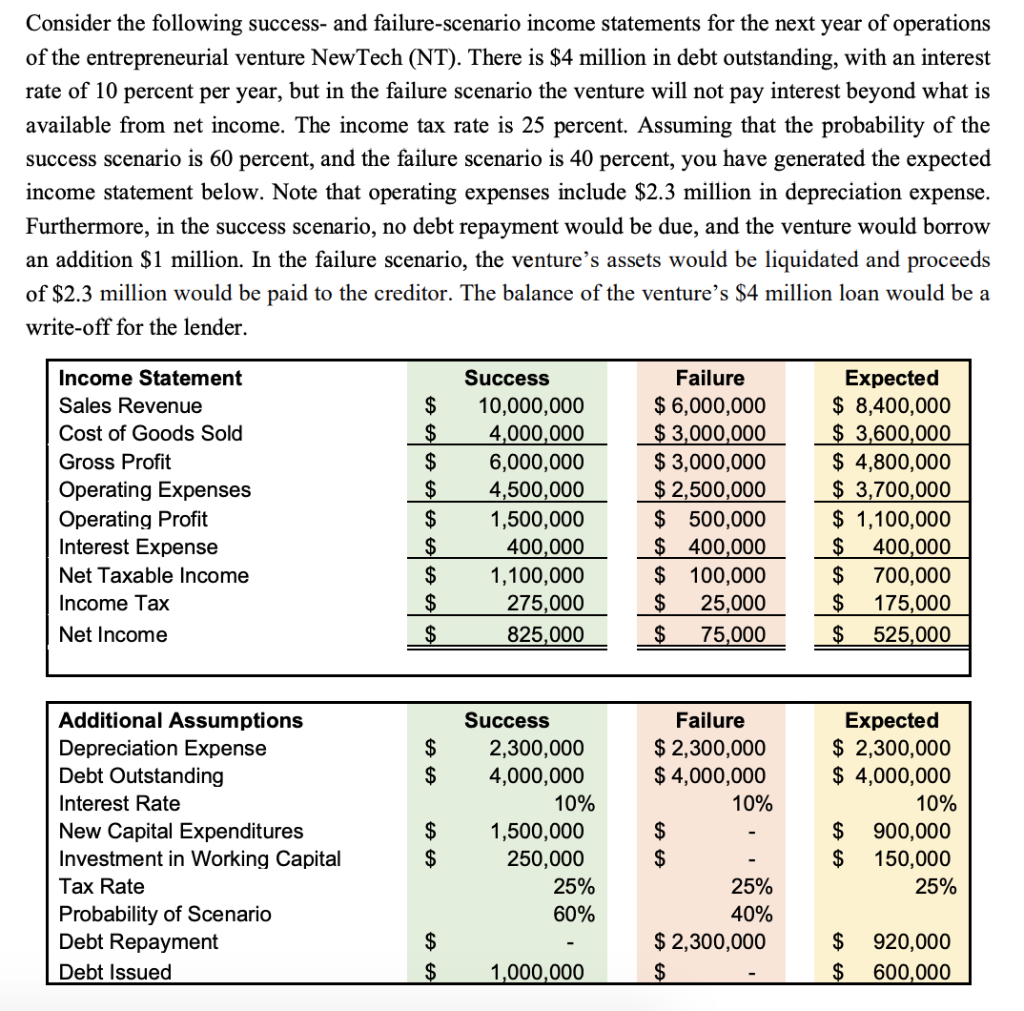

Consider the following success- and failure-scenario income statements for the next year of operations of the entrepreneurial venture NewTech (NT). There is $4 million in debt outstanding, with an interest rate of 10 percent per year, but in the failure scenario the venture will not pay interest beyond what is available from net income. The income tax rate is 25 percent. Assuming that the probability of the success scenario is 60 percent, and the failure scenario is 40 percent, you have generated the expected income statement below. Note that operating expenses include $2.3 million in depreciation expense. Furthermore, in the success scenario, no debt repayment would be due, and the venture would borrow an addition $1 million. In the failure scenario, the venture's assets would be liquidated and proceeds of $2.3 million would be paid to the creditor. The balance of the venture's $4 million loan would be a write-off for the lender. Income Statement Sales Revenue Cost of Goods Sold $ $ $ $ Gross Profit Operating Expenses Operating Profit Interest Expense Net Taxable income Success Failure 10,000,000 $ 6,000,000 4,000,000 $3,000,000 6,000,000 $ 3,000,000 4,500,000 $ 2,500,000 1,500,000 $ 500,000 400,000 $ 400,000 1,100,000 $ 100,000 275,000 $ 25,000 825,000 $ 75,000 Expected $ 8,400,000 $ 3,600,000 $ 4,800,000 $ 3,700,000 $ 1,100,000 $ 400,000 $ 700,000 $ 175,000 $ 525,000 to os es es es Income Tax Net Income Success Additional Assumptions Depreciation Expense Debt Outstanding Interest Rate New Capital Expenditures Investment in Working Capital Tax Rate Probability of Scenario Debt Repayment Debt Issued 2,300,000 4,000,000 10% 1,500,000 250,000 25% 60% $ $ Expected $ 2,300,000 $ 4,000,000 10% $ 900,000 $ 150,000 25% Failure $ 2,300,000 $ 4,000,000 10% $ $ 25% 40% $ 2,300,000 $ s $ $ $ 920,000 600,000 $ 1,000,000 A. Calculate NT's operating cash flow, and total capital cash flow under the failure scenario for the year. (2 marks) B. Calculate NT's expected debt cash flow for the year. (2 marks) C. Calculate NT's equity cash flow under the success scenario for the year. (1 mark) D. Calculate NT's contractual cash flow to creditors under the failure scenario for the year. (1 mark) E. Calculate NT's theoretical taxes as unlevered under the failure scenario for the year. (1 mark) F. Calculate NT's expected unlevered free cash flow for the year. (1.5 marks) G. Calculate NT's expected EBITDA for the year. (1.5 marks) Consider the following success- and failure-scenario income statements for the next year of operations of the entrepreneurial venture NewTech (NT). There is $4 million in debt outstanding, with an interest rate of 10 percent per year, but in the failure scenario the venture will not pay interest beyond what is available from net income. The income tax rate is 25 percent. Assuming that the probability of the success scenario is 60 percent, and the failure scenario is 40 percent, you have generated the expected income statement below. Note that operating expenses include $2.3 million in depreciation expense. Furthermore, in the success scenario, no debt repayment would be due, and the venture would borrow an addition $1 million. In the failure scenario, the venture's assets would be liquidated and proceeds of $2.3 million would be paid to the creditor. The balance of the venture's $4 million loan would be a write-off for the lender. Income Statement Sales Revenue Cost of Goods Sold $ $ $ $ Gross Profit Operating Expenses Operating Profit Interest Expense Net Taxable income Success Failure 10,000,000 $ 6,000,000 4,000,000 $3,000,000 6,000,000 $ 3,000,000 4,500,000 $ 2,500,000 1,500,000 $ 500,000 400,000 $ 400,000 1,100,000 $ 100,000 275,000 $ 25,000 825,000 $ 75,000 Expected $ 8,400,000 $ 3,600,000 $ 4,800,000 $ 3,700,000 $ 1,100,000 $ 400,000 $ 700,000 $ 175,000 $ 525,000 to os es es es Income Tax Net Income Success Additional Assumptions Depreciation Expense Debt Outstanding Interest Rate New Capital Expenditures Investment in Working Capital Tax Rate Probability of Scenario Debt Repayment Debt Issued 2,300,000 4,000,000 10% 1,500,000 250,000 25% 60% $ $ Expected $ 2,300,000 $ 4,000,000 10% $ 900,000 $ 150,000 25% Failure $ 2,300,000 $ 4,000,000 10% $ $ 25% 40% $ 2,300,000 $ s $ $ $ 920,000 600,000 $ 1,000,000 A. Calculate NT's operating cash flow, and total capital cash flow under the failure scenario for the year. (2 marks) B. Calculate NT's expected debt cash flow for the year. (2 marks) C. Calculate NT's equity cash flow under the success scenario for the year. (1 mark) D. Calculate NT's contractual cash flow to creditors under the failure scenario for the year. (1 mark) E. Calculate NT's theoretical taxes as unlevered under the failure scenario for the year. (1 mark) F. Calculate NT's expected unlevered free cash flow for the year. (1.5 marks) G. Calculate NT's expected EBITDA for the year. (1.5 marks)