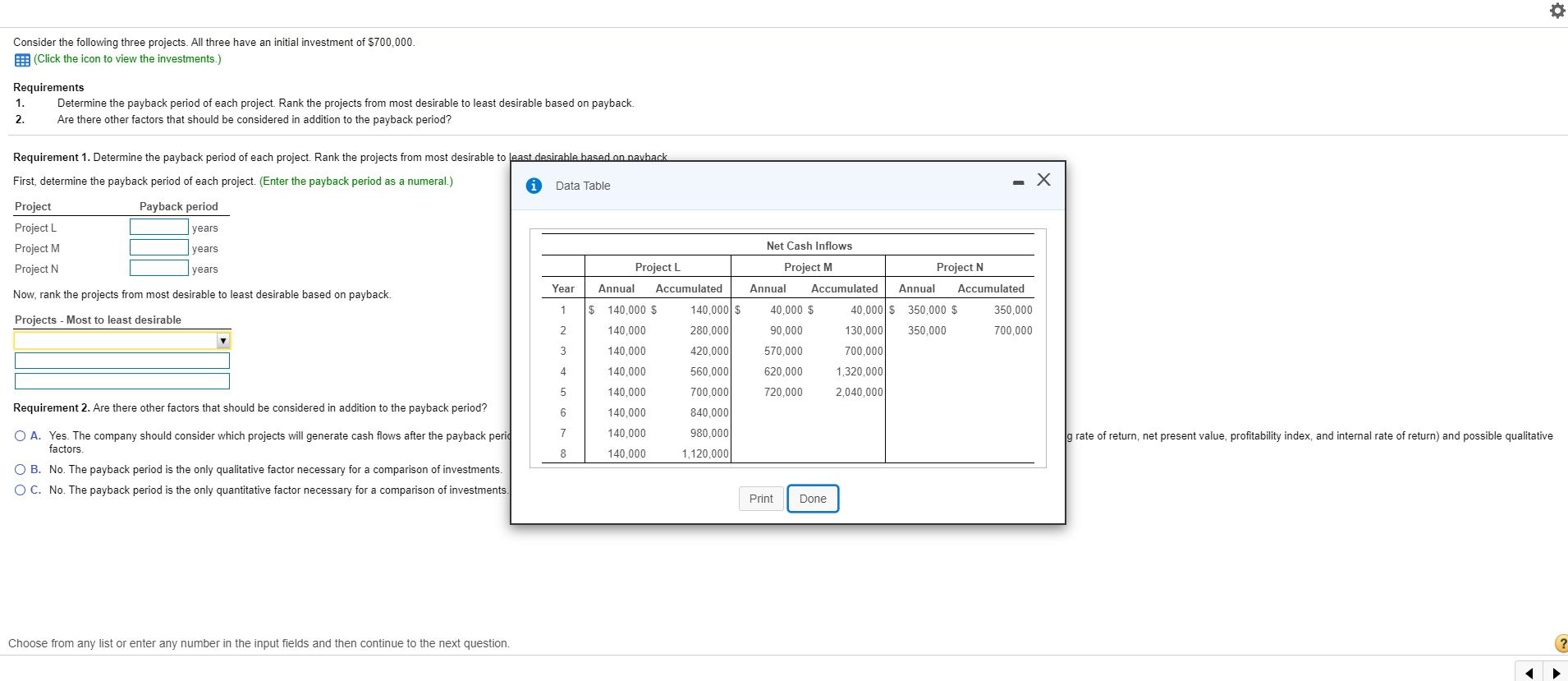

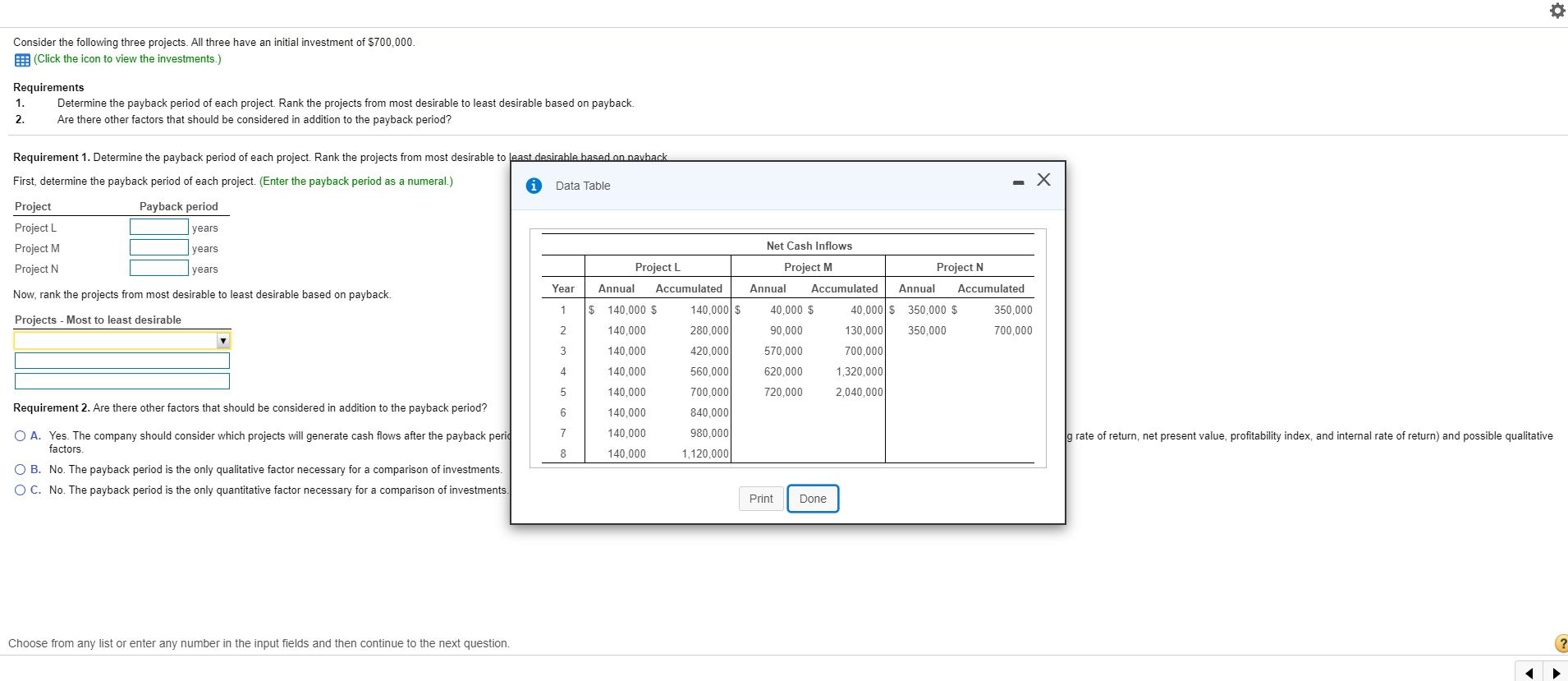

Consider the following three projects. All three have an initial investment of $700,000. E: (Click the icon to view the investments.) Requirements 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. 2. Are there other factors that should be considered in addition to the payback period? Requirement 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. First, determine the payback period of each project. (Enter the payback period as a numeral.) Payback period years Project Project L Project M Project N years years Now, rank the projects from most desirable to least desirable based on payback. Projects - Most to least desirable Requirement 2. Are there other factors that should be considered in addition to the payback period? O A. Yes. The company should consider which projects will generate cash flows after the payback period. In addition, the company should rank the projects based on the results of other evaluation methods (e.g., accounting rate of return, net present value, profitability index, and internal rate of return) and possible qualitative factors O B. No. The payback period is the only qualitative factor necessary for a comparison of investments O C. No. The payback period is the only quantitative factor necessary for a comparison of investments. Choose from any list or enter any number in the input fields and then continue to the next question. Consider the following three projects. All three have an initial investment of $700,000. E: (Click the icon to view the investments.) Requirements 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. 2. Are there other factors that should be considered in addition to the payback period? x Requirement 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on pawback First, determine the payback period of each project. (Enter the payback period as a numeral) Data Table Project Payback period Project L years Project M years Project N years Project L Now, rank the projects from most desirable to least desirable based on payback. Year Annual Accumulated 1 $ 140,000 $ Projects - Most to least desirable 140,000 $ 2 140,000 280,000 Net Cash Inflows Project M Project N Annual Accumulated Annual Accumulated 40,000 $ 40,000 $ 350,000 $ 350,000 90,000 130,000 350,000 700,000 570,000 700,000 3 140.000 420,000 4 620,000 140,000 140.000 560,000 700,000 1,320,000 2,040,000 5 720.000 Requirement 2. Are there other factors that should be considered in addition to the payback period? 6 140,000 840,000 7 140,000 O A. Yes. The company should consider which projects will generate cash flows after the payback perid factors g rate of return, net present value, profitability index, and internal rate of return) and possible qualitative 980,000 1,120,000 8 140.000 OB. No. The payback period is the only qualitative factor necessary for a comparison of investments. OC. No. The payback period is the only quantitative factor necessary for a comparison of investments. Print Done Choose from any list or enter any number in the input fields and then continue to the next question. ? Consider the following three projects. All three have an initial investment of $700,000. (Click the icon to view the investments.) Requirements 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. 2. Are there other factors that should be considered in addition to the payback period? Requirement 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. First, determine the payback period of each project. (Enter the payback period as a numeral.) Payback period years Project Project L Project M Project N years years Now, rank the projects from most desirable to least desirable based on payback. Projects - Most to least desirable Project L Project M Project N hould be considered in addition to the payback period? O A. Yes. The company should consider which projects will generate cash flows after the payback period. In addition, the company should rank the projects based on the results of other evaluation methods (e.g., accounting rate of return, net present value, profitability index, and internal rate of return) and possible qualitative factors. O B. No. The payback period is the only qualitative factor necessary for a comparison of investments O C. No. The payback period is the only quantitative factor necessary for a comparison of investments Choose from any list or enter any number in the input fields and then continue to the next