Question

Consider the money market. In conducting monetary policy the Bank of Canada arranges the purchase and sale of Government of Canada securities with the chartered

Consider the money market. In conducting monetary policy the Bank of Canada arranges the purchase and sale of Government of Canada securities with the chartered banks.

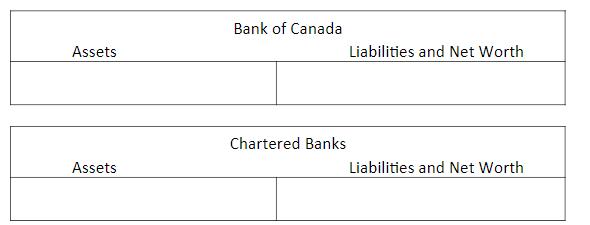

a. Show changes (with a + or - sign) to the assets and liabilities of the Bank of Canada and the Chartered Banks if the Bank of Canada sells $50 million in securities to the chartered banks.

b. Briefly explain in words (1-2 sentences and with no diagram) whether this is an example of expansionary or contractionary monetary policy AND how this sale of securities in a) will change the money supply and the equilibrium interest rate.

c. Briefly explain in words (1-2 sentences with no diagram) what type of short-run "gap” the sale of securities would be used to eliminate AND what the impact of this monetary policy would be on the equilibrium real GDP and the price level.

d. Assuming this is an open economy with international capital mobility, briefly explain (1-2 sentences with no diagram) the second part to the monetary transmission mechanism as a result of the monetary policy described in b) above.

Bank of Canada Assets Liabilities and Net Worth Chartered Banks Assets Liabilities and Net Worth

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a BANK OF CANADA Assets Liabilities Net worth CHARTERED BANKS Assets Liabilities Net worth Securitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started