Question

Consider the production function with physical and labor ( and ) respectively, where the level of technology is assumed to be constant, A: = ^1/2

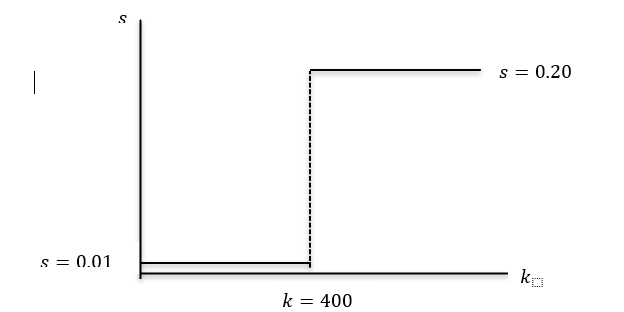

Consider the production function with physical and labor ( and ) respectively, where the level of technology is assumed to be constant, A: = ^1/2 ^1/2 (1) Does this production exhibit constant returns to scale? Does it exhibit constant returns to physical capital, ? Does it exhibit constant returns to labor, ? Please use math to justify your answers. (2) Assume labor and population are identical. If is total GDP, write down income per capita, = /, as a function of capital per person and = / . Physical capital is assumed to depreciate at rate population grows at a constant rate . Households are assumed to save a fraction of their income, s, that depends on capital per person, , in the following way. For capital stocks below = 400, the savings rate is the constant = 0.01 (that is, 1%). For capital stocks above = 400, the savings rate is = 0.20 (that is, 20%). Graphically, the savings rate looks as follows:

(3) Use the fundamental equation of Solow-Swan to write the growth rate of capital as a function of A, s, , and using the production function and the savings rate described above. (4) Graph the savings and depreciation lines as a function of . Are they upward sloping? Downward sloping? Horizontal? (5) Is there a steady state? Is it unique? Is it stable? Imagine that = 100, = 0.09 and = 0.01. (6) Calculate the steady state (or steady states if there are more than one). (7) Imagine that an economy has a capital stock of = 100 and receives aid from the Word Bank in the form of capital by the amount of an additional 100. What is the effect of this policy on the economy in the long run? (8) How would your answer in (7) be different if the amount of aid were 500 instead of 100? (9) The World Bank often recommends the reduction of fertility (and therefore population growth) rates through what they call family planning. What are effects of a family planning program for an economy that has an initial capital stock of = 100? Discuss ALL possible scenarios (that is, discuss the possibility of reductions in n that are small and large).

s s= 0.20 | S= 0.01 ko k = 400 s s= 0.20 | S= 0.01 ko k = 400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started