Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider three investors with significantly different risk profiles. Let us assume that all three investors have total wealth of $1 million. The optimal weight (y)

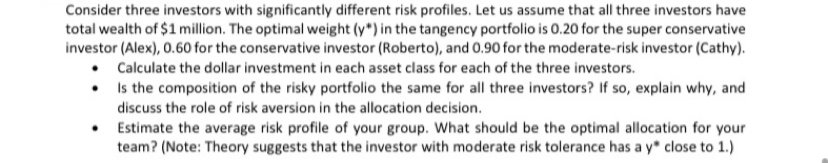

Consider three investors with significantly different risk profiles. Let us assume that all three investors have total wealth of $1 million. The optimal weight (y) in the tangency portfolio is 0.20 for the super conservative investor (Alex), 0.60 for the conservative investor (Roberto), and 0.90 for the moderate-risk investor (Cathy). - Calculate the dollar investment in each asset class for each of the three investors. - Is the composition of the risky portfolio the same for all three investors? If so, explain why, and discuss the role of risk aversion in the allocation decision. - Estimate the average risk profile of your group. What should be the optimal allocation for your team? (Note: Theory suggests that the investor with moderate risk tolerance has a y close to 1. )

Consider three investors with significantly different risk profiles. Let us assume that all three investors have total wealth of $1 million. The optimal weight (y) in the tangency portfolio is 0.20 for the super conservative investor (Alex), 0.60 for the conservative investor (Roberto), and 0.90 for the moderate-risk investor (Cathy). - Calculate the dollar investment in each asset class for each of the three investors. - Is the composition of the risky portfolio the same for all three investors? If so, explain why, and discuss the role of risk aversion in the allocation decision. - Estimate the average risk profile of your group. What should be the optimal allocation for your team? (Note: Theory suggests that the investor with moderate risk tolerance has a y close to 1. ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started