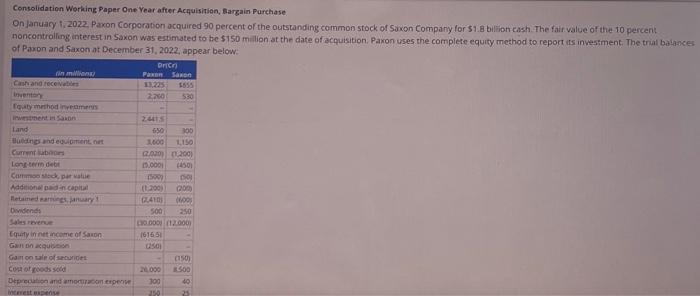

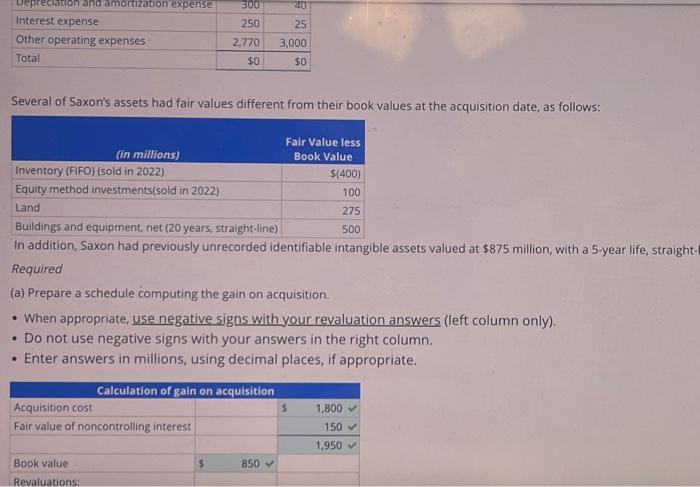

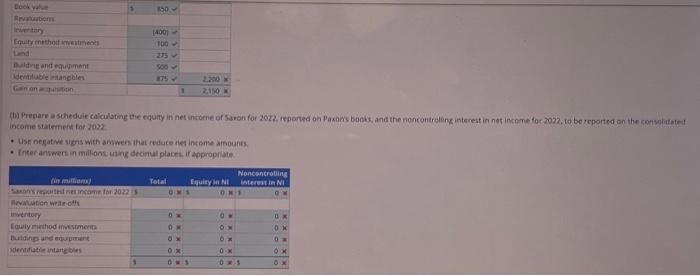

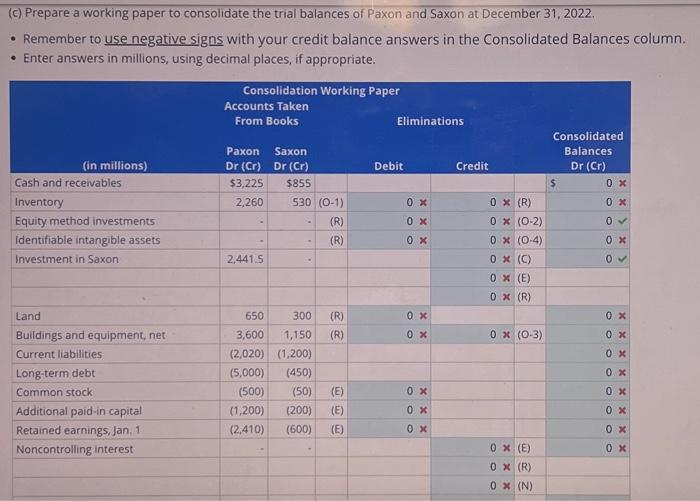

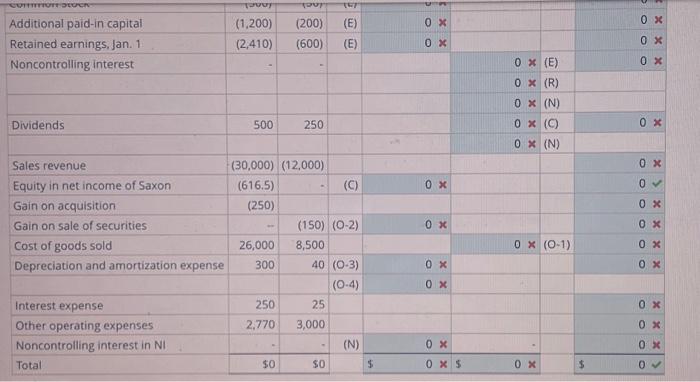

Consolidation Working Paper One Vear after Acnuisition, Eargain Purchase of Paron and Saxon at December 31, 2022, appear below: Several of Saxon's assets had fair values different from their book values at the acquisition date, as follows: In addition, Saxon had previously unrecorded identifiable intangible assets valued at $875 million, with a 5-year life, straight Required (a) Prepare a schedule computing the gain on acquisition. - When appropriate, use negative signs with your revaluation answers (left column only). - Do not use negative signs with your answers in the right column. - Enter answers in millions, using decimal places, if appropriate. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & 1.0007 & 1000 & (W) & & & & & & & \\ \hline Additional paid-in capital & (1,200) & (200) & (E) & 0 & x & . & & & & x \\ \hline Retained earnings, Jan. 1 & (2,410) & (600) & (E) & 0 & x & & & & 0 & x \\ \hline Noncontrolling interest & - & = & & & & & x & (E) & 0 & x \\ \hline & & & & & & & x & (R) & & \\ \hline & & & & & & 0 & x & (N) & & \\ \hline Dividends & 500 & 250 & & & & 0 & x & (C) & 0 & x \\ \hline & & & & m & & 0 & & (N) & & \\ \hline Sales revenue & (30,000) & (12,000) & & & & & & & 0 & x \\ \hline Equity in net income of Saxon & (616.5) & & (C) & 0 & x & & & & 0 & \\ \hline Gain on acquisition & (250) & & & & & & & & 0 & x \\ \hline Gain on sale of securities & - & (150) & (02) & 0 & x & & & & 0 & x \\ \hline Cost of goods sold & 26,000 & 8,500 & & & & 0 & x & (01) & 0x & x \\ \hline Depreciation and amortization expense & 300 & 40 & (03) & 0 & x & & & & 0 & x \\ \hline & & & (0.4) & 0 & x & 4 & & & & \\ \hline Interest expense & 250 & 25 & & & & & & & 0x & x \\ \hline Other operating expenses & 2,770 & 3,000 & & & & & & & 0 & x \\ \hline Noncontrolling interest in NI & & - & (N) & 0 & x & & & & 0 & x \\ \hline Total & $0 & $0 & & 0 & x & 0 & x & & 0 & \\ \hline \end{tabular} (c) Prepare a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2022. - Remember to use negative signs with your credit balance answers in the Consolidated Balances column - Enter answers in millions, using decimal places, if aporopriate. income staternert for 2022 - Ush negatwe ugers wich anwers that reduce riet income artoounes. - Inter anwwers in militons usirg decimul places. ir apprapriate Consolidation Working Paper One Vear after Acnuisition, Eargain Purchase of Paron and Saxon at December 31, 2022, appear below: Several of Saxon's assets had fair values different from their book values at the acquisition date, as follows: In addition, Saxon had previously unrecorded identifiable intangible assets valued at $875 million, with a 5-year life, straight Required (a) Prepare a schedule computing the gain on acquisition. - When appropriate, use negative signs with your revaluation answers (left column only). - Do not use negative signs with your answers in the right column. - Enter answers in millions, using decimal places, if appropriate. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & 1.0007 & 1000 & (W) & & & & & & & \\ \hline Additional paid-in capital & (1,200) & (200) & (E) & 0 & x & . & & & & x \\ \hline Retained earnings, Jan. 1 & (2,410) & (600) & (E) & 0 & x & & & & 0 & x \\ \hline Noncontrolling interest & - & = & & & & & x & (E) & 0 & x \\ \hline & & & & & & & x & (R) & & \\ \hline & & & & & & 0 & x & (N) & & \\ \hline Dividends & 500 & 250 & & & & 0 & x & (C) & 0 & x \\ \hline & & & & m & & 0 & & (N) & & \\ \hline Sales revenue & (30,000) & (12,000) & & & & & & & 0 & x \\ \hline Equity in net income of Saxon & (616.5) & & (C) & 0 & x & & & & 0 & \\ \hline Gain on acquisition & (250) & & & & & & & & 0 & x \\ \hline Gain on sale of securities & - & (150) & (02) & 0 & x & & & & 0 & x \\ \hline Cost of goods sold & 26,000 & 8,500 & & & & 0 & x & (01) & 0x & x \\ \hline Depreciation and amortization expense & 300 & 40 & (03) & 0 & x & & & & 0 & x \\ \hline & & & (0.4) & 0 & x & 4 & & & & \\ \hline Interest expense & 250 & 25 & & & & & & & 0x & x \\ \hline Other operating expenses & 2,770 & 3,000 & & & & & & & 0 & x \\ \hline Noncontrolling interest in NI & & - & (N) & 0 & x & & & & 0 & x \\ \hline Total & $0 & $0 & & 0 & x & 0 & x & & 0 & \\ \hline \end{tabular} (c) Prepare a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2022. - Remember to use negative signs with your credit balance answers in the Consolidated Balances column - Enter answers in millions, using decimal places, if aporopriate. income staternert for 2022 - Ush negatwe ugers wich anwers that reduce riet income artoounes. - Inter anwwers in militons usirg decimul places. ir apprapriate