Question

On October 19, 2000, The Globe and Mail reported on Imperial Oil Ltd.'s earnings for the third quarter ended on September 30, 2000, released on

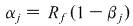

On October 19, 2000, The Globe and Mail reported on Imperial Oil Ltd.'s earnings for the third quarter ended on September 30, 2000, released on October 18. Net income was a record $374 million, up from $191 million for the same quarter of the previous year. Return on equity was 25.7% up from 10.1% a year earlier. Earnings for the quarter included a $60 million gain on Imperial's sale of its Cynthia pipeline and other assets. Cash flow for the quarter was $433 million, up from $270 million in the previous year's third quarter. The reported profit of $374 million was in line with analysts' expectations. On October 18, the TSE oil and gas index rose by 0.6%, as the market anticipated higher prices for oil and gas. Yet, Imperial's share price fell on the day by $1.25, to close at $37.35. The Globe and Mail also reported analysts' comments about a widening discount for heavy crude oil, relative to light crude. Imperial is Canada's biggest producer of heavy crude. Also, Imperial's production from its oil sands projects declined in the quarter, due to maintenance and temporary production problems. Use the market model to calculate the abnormal return, relative to the TSE oiland gas index, on Imperial's Oil's shares for October 18, 2000. Imperial Oil's beta is approximately 0.65. The risk-free interest rate at this time was approximately 0.0002 per day. Note the theoretical relationship .

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started